-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other tax forms - page 18

-

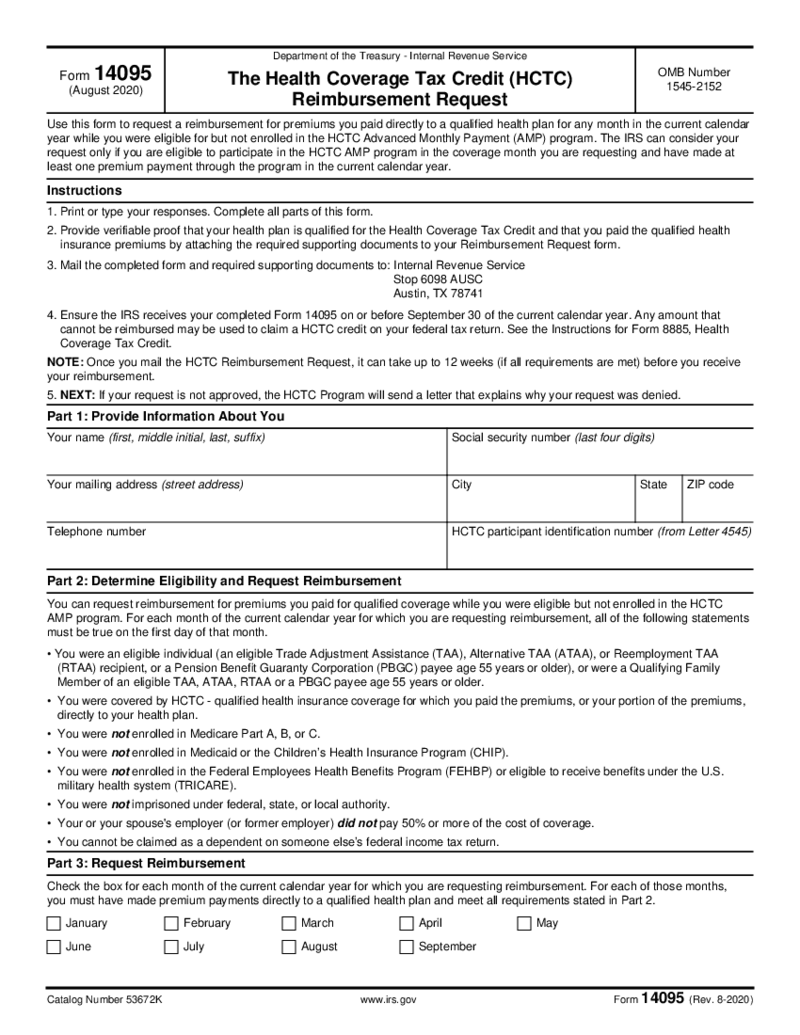

Form 14095

1. What is a 14095 Form?

The fillable Form 14095 (The Health Coverage Tax Credit (HCTC) Reimbursement Request) is a federal tax form by the Internal Revenue Service (IRS) that is designed to let taxpayers request reimbursement for premiums paid

Form 14095

1. What is a 14095 Form?

The fillable Form 14095 (The Health Coverage Tax Credit (HCTC) Reimbursement Request) is a federal tax form by the Internal Revenue Service (IRS) that is designed to let taxpayers request reimbursement for premiums paid

-

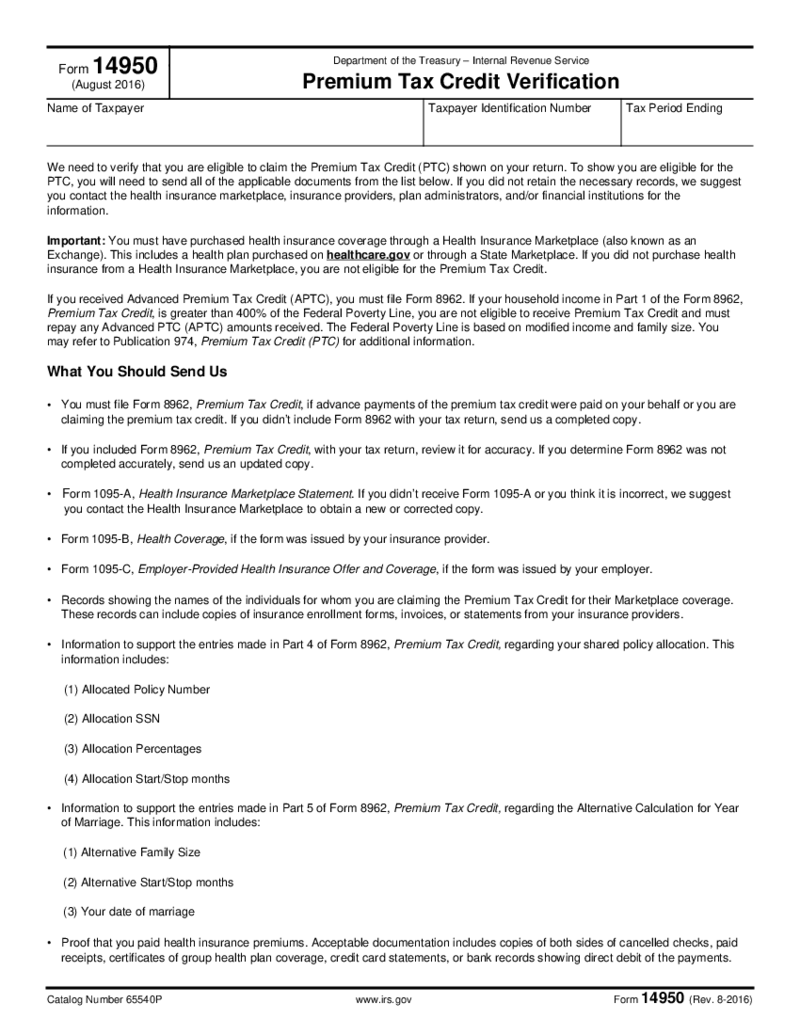

Form 14950

1. What is a 14950 Form?

The fillable Form 14950 is a small official IRS PDF tax form (full title Premium Tax Credit Verification) that is used for verification of taxpayer eligibility to claim the PTC (Premium Tax Credit). The form enlists all the docume

Form 14950

1. What is a 14950 Form?

The fillable Form 14950 is a small official IRS PDF tax form (full title Premium Tax Credit Verification) that is used for verification of taxpayer eligibility to claim the PTC (Premium Tax Credit). The form enlists all the docume

-

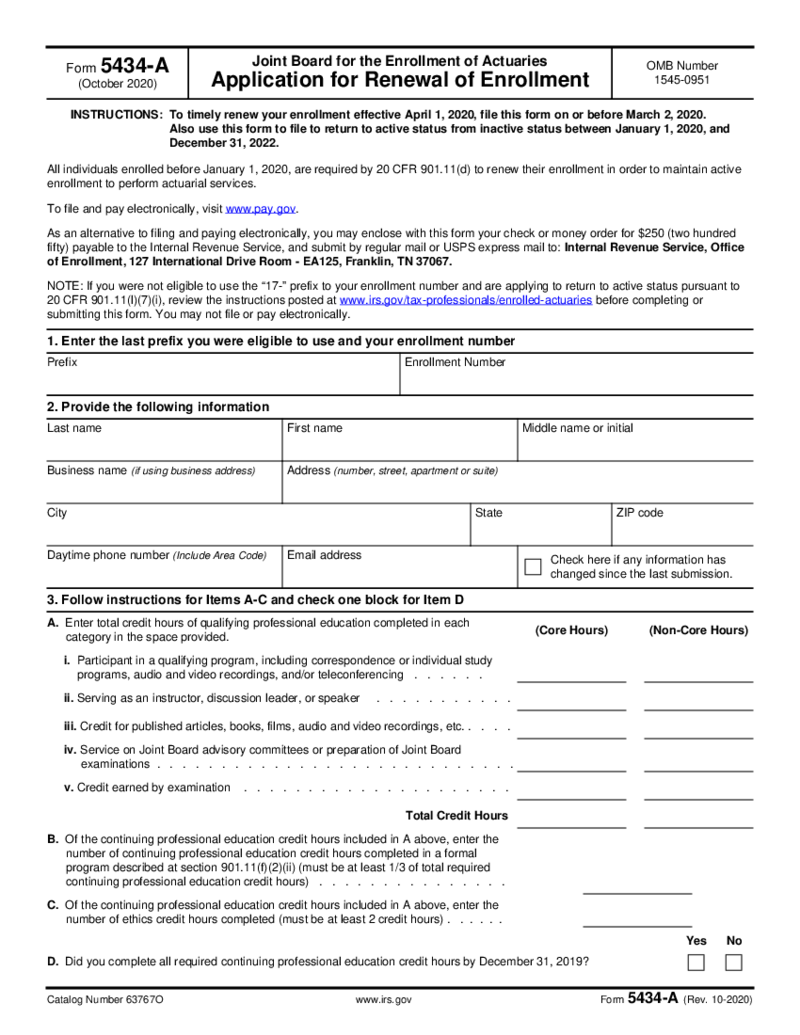

Form 5434-A

What Is Form 5434 A

Form 5434 A, officially titled "Arbitrage Rebate, Yield Reduction and Penalty instead of Arbitrage Rebate," is a tax form used by issuers of tax-exempt bonds or other tax-advantaged bonds. It's a crucial document for gove

Form 5434-A

What Is Form 5434 A

Form 5434 A, officially titled "Arbitrage Rebate, Yield Reduction and Penalty instead of Arbitrage Rebate," is a tax form used by issuers of tax-exempt bonds or other tax-advantaged bonds. It's a crucial document for gove

-

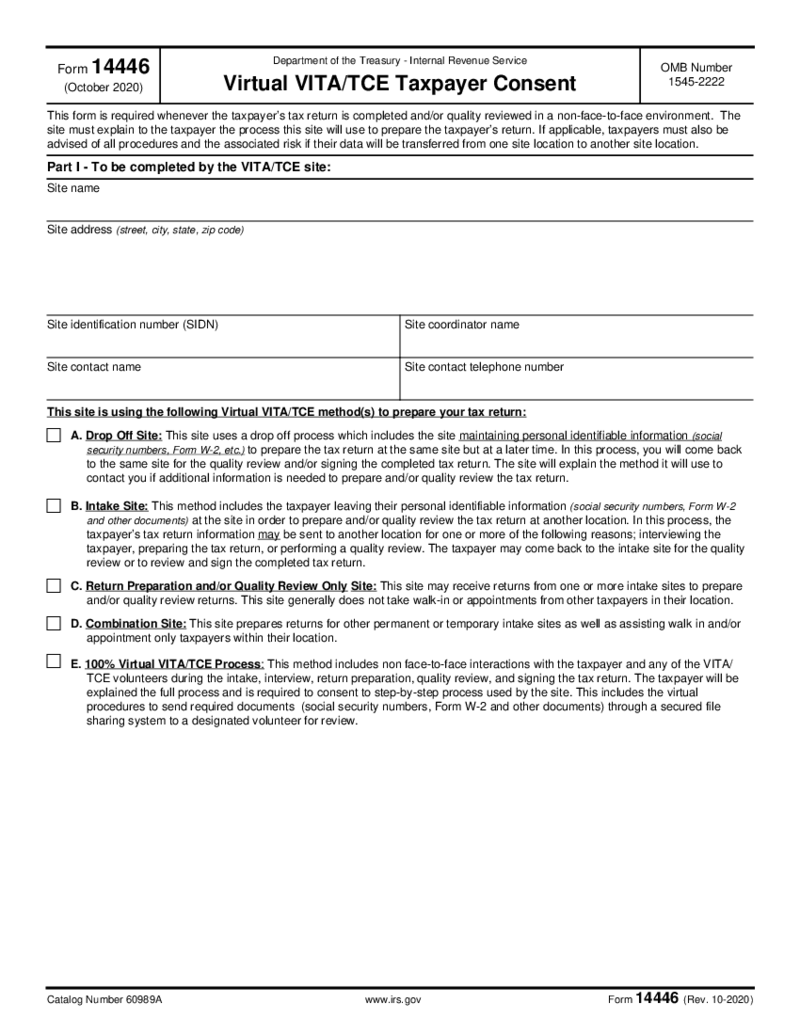

Form 14446

What Is 14446 Form?

Form 14446 is required if a taxpayer applies for free tax calculation assistance from VITA/TCE remotely, via one of the specializing sites. This form is used for getting the taxpayer’s consent to have their data processed di

Form 14446

What Is 14446 Form?

Form 14446 is required if a taxpayer applies for free tax calculation assistance from VITA/TCE remotely, via one of the specializing sites. This form is used for getting the taxpayer’s consent to have their data processed di

-

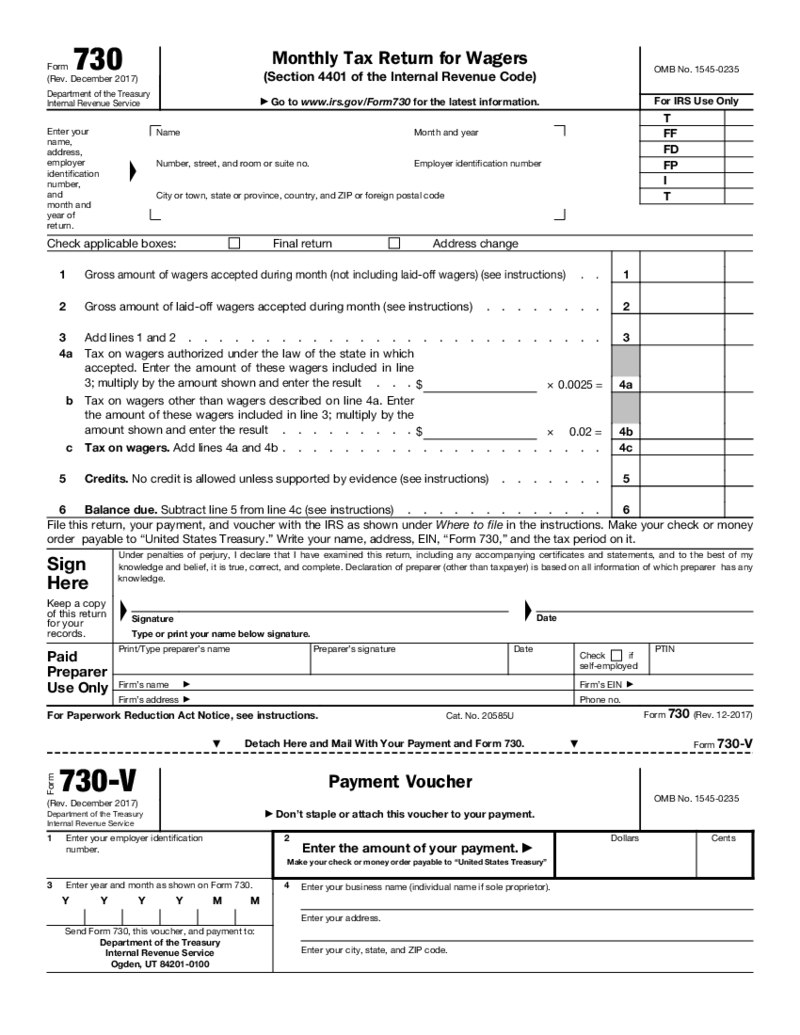

Form 730

What Is Form 730?

Form 730 is the form used for reporting and paying the tax on wagers accepted in the US or placed by an individual who lives in/is a citizen of the US. If you’re in the wagering business (running or participating in profit-based lo

Form 730

What Is Form 730?

Form 730 is the form used for reporting and paying the tax on wagers accepted in the US or placed by an individual who lives in/is a citizen of the US. If you’re in the wagering business (running or participating in profit-based lo

-

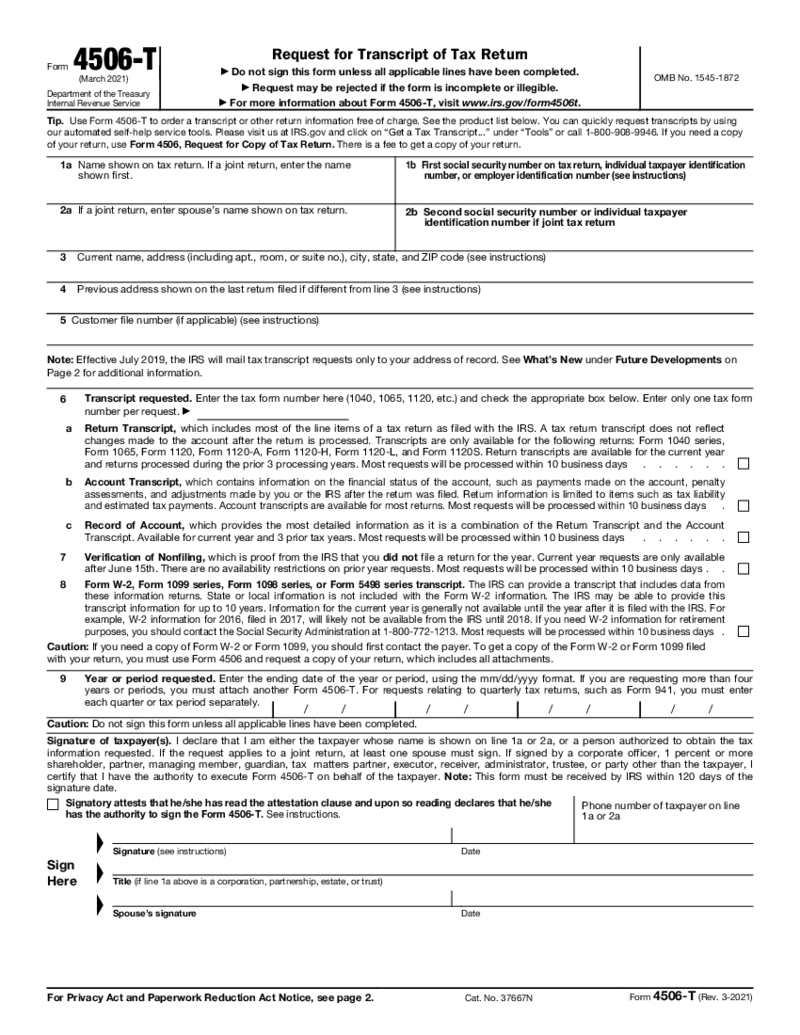

Form 4506-T (March 2021)

What Is 4506 T Form 2021

Form 4506-T, officially known as the Request for Transcript of Tax Return, is an essential document authorized by the Internal Revenue Service (IRS). It allows individuals and businesses to request tax return transcripts, ta

Form 4506-T (March 2021)

What Is 4506 T Form 2021

Form 4506-T, officially known as the Request for Transcript of Tax Return, is an essential document authorized by the Internal Revenue Service (IRS). It allows individuals and businesses to request tax return transcripts, ta

-

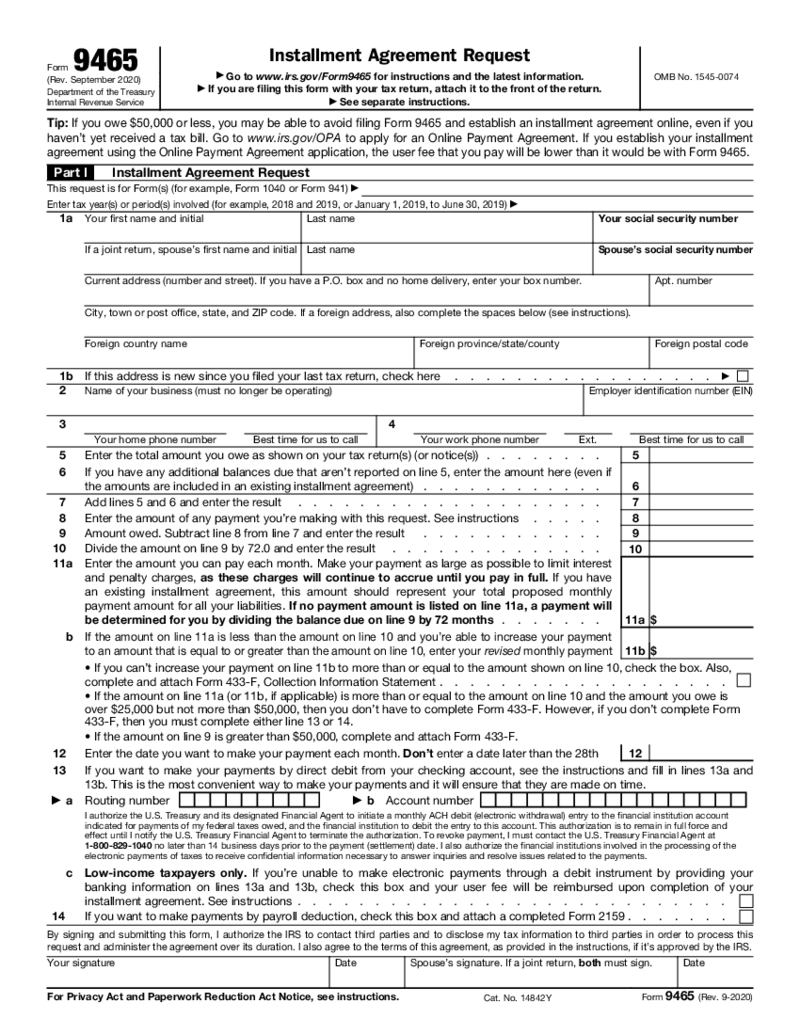

Form 9465

What is Form 9465?

Form 9465 is used to request a monthly installment plan (payment plan) if you cannot pay the full amount indicated in the tax return (or in the notice we sent you). The maximum term for a simplified agreement is 72 months. In certain ci

Form 9465

What is Form 9465?

Form 9465 is used to request a monthly installment plan (payment plan) if you cannot pay the full amount indicated in the tax return (or in the notice we sent you). The maximum term for a simplified agreement is 72 months. In certain ci

-

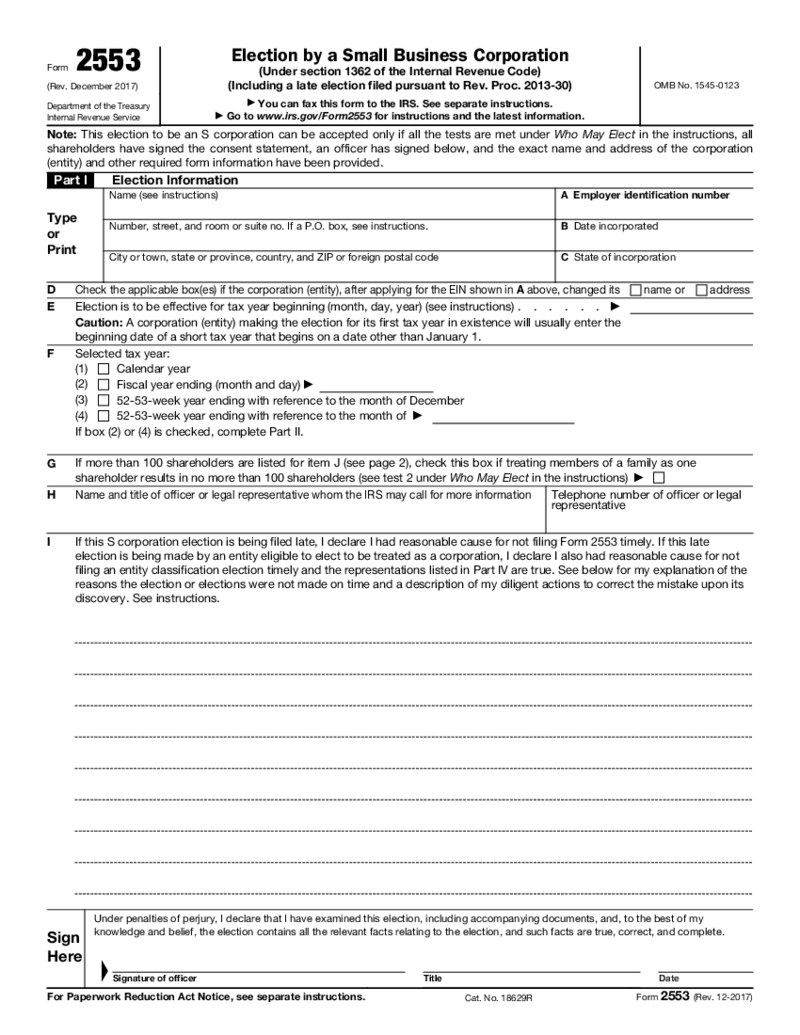

Form 2553

What is the IRS 2553?

If you have a business that is a corporation C type, but you want to switch and file taxes as a corporation S, you need to notify the IRS in advance by submitting the relevant document IRS 2553 Form. Election by a Small Business Corp

Form 2553

What is the IRS 2553?

If you have a business that is a corporation C type, but you want to switch and file taxes as a corporation S, you need to notify the IRS in advance by submitting the relevant document IRS 2553 Form. Election by a Small Business Corp

FAQ

-

What tax forms do I need?

That depends on a wide variety of factors, such as the state you live in, the specificity of your work, the format of your operation, and the like. You can consult a tax expert if you have questions on these nuances.

-

What are allowances on tax forms?

A withholding allowance is an exemption reducing the amount of income tax withheld from an employee’s wages. Upon determining your employees’ withholding allowances, you can easily pinpoint their federal income taxes.

-

When will unemployment send out tax forms?

You’re probably trying to ask us when your state unemployment office will mail you Form 1099-G (the total amount of taxable unemployment payment). The due date in this respect is January 31.

-

Where can I pick up tax forms?

You can head to your local IRS office or a post office, or library that offers tax forms. But why all the fuss if you can download the needed tax templates from our digital library. Give PDFLiner a go and you’ll forget about the alternative (and rather subpar) methods.