-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other tax forms - page 15

-

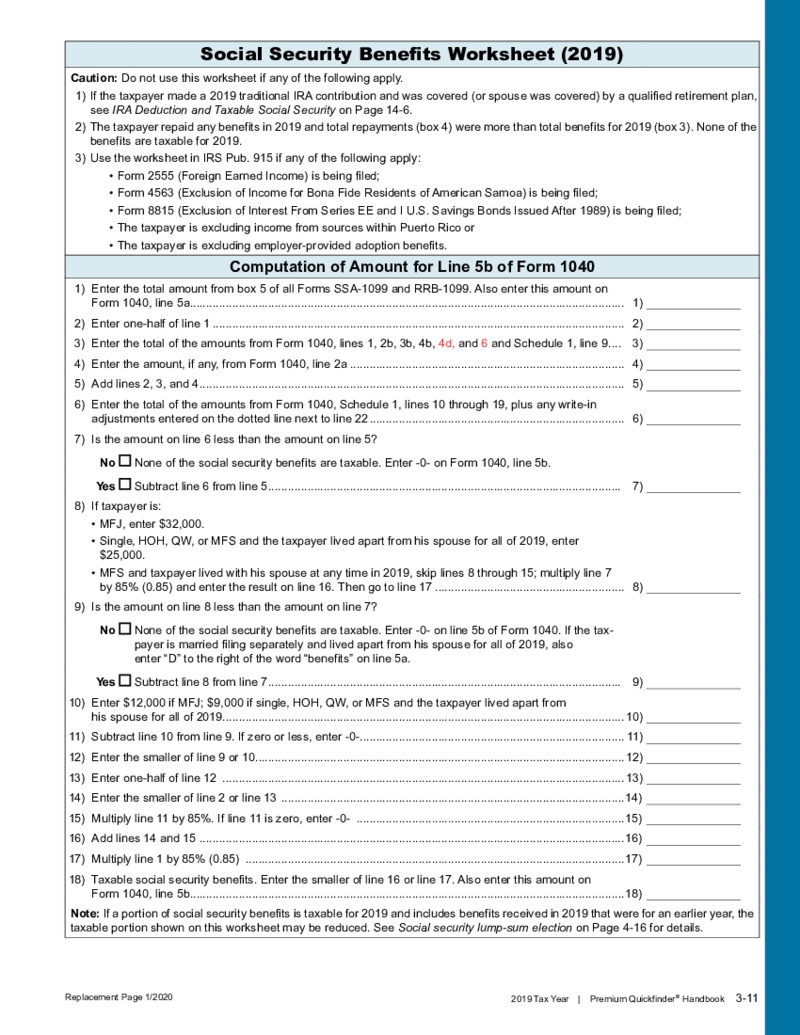

Social Security Benefits Worksheet (2019)

What Is a Worksheet for Social Security Benefits 2019

It’s a document designed by the IRS to calculate the taxable portion of a person's Social Security benefits for the tax year 2019. It helps recipients determine if a portion of their benefits

Social Security Benefits Worksheet (2019)

What Is a Worksheet for Social Security Benefits 2019

It’s a document designed by the IRS to calculate the taxable portion of a person's Social Security benefits for the tax year 2019. It helps recipients determine if a portion of their benefits

-

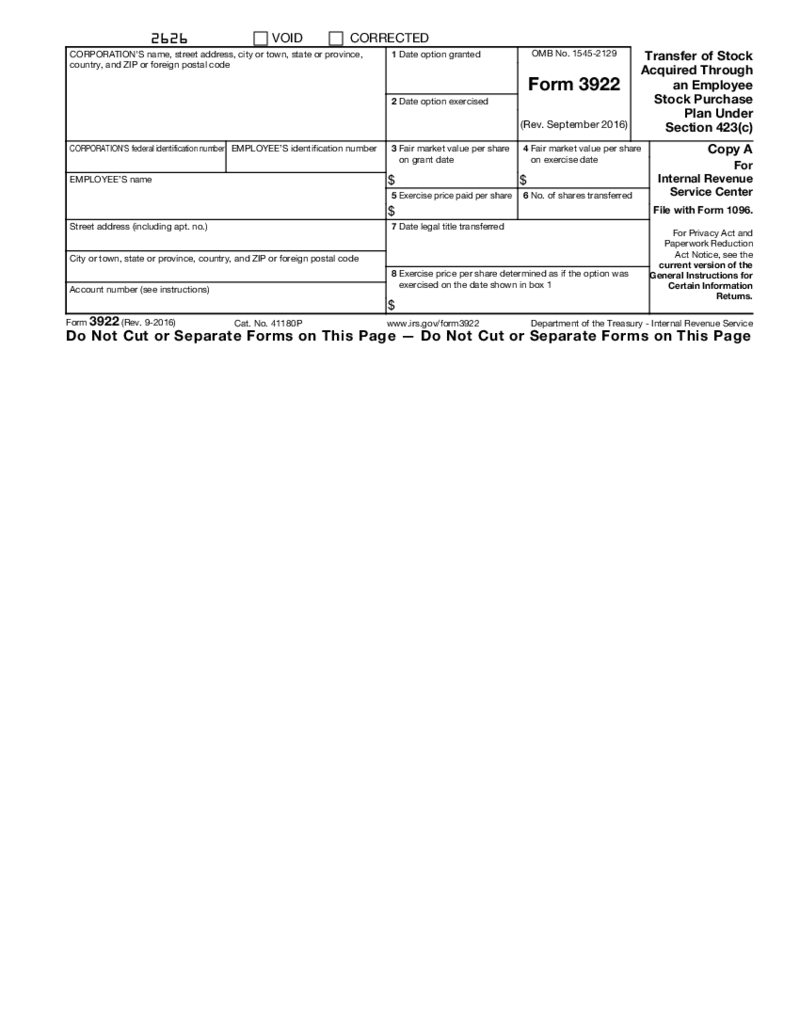

Form 3922

What Is Form 3922?

The 3922 form is also known as the Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c). This is actually not the most common form in the country. If you are wondering what is a form 3922, you may be a

Form 3922

What Is Form 3922?

The 3922 form is also known as the Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c). This is actually not the most common form in the country. If you are wondering what is a form 3922, you may be a

-

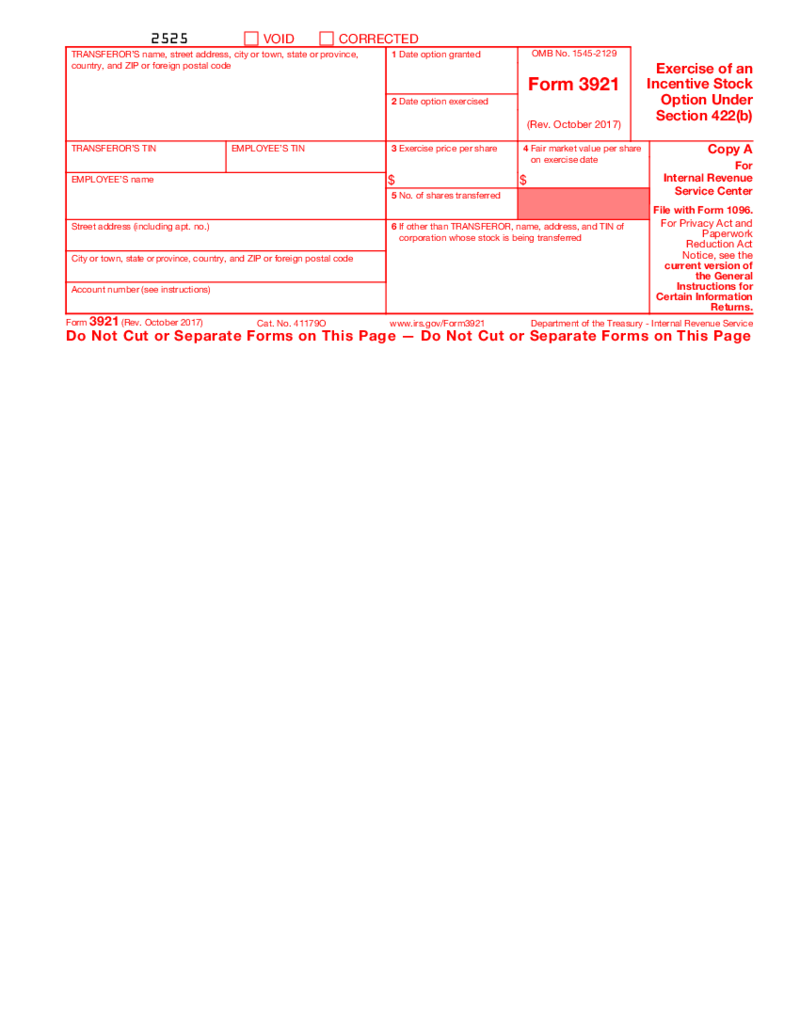

Form 3921

What Is Form 3921?

If you don’t know what is form 3921, you may have never received this report from the corporations. This form is called Exercise of an Incentive Stock Option Under Section 422(b). It is one of the most complicated forms that requi

Form 3921

What Is Form 3921?

If you don’t know what is form 3921, you may have never received this report from the corporations. This form is called Exercise of an Incentive Stock Option Under Section 422(b). It is one of the most complicated forms that requi

-

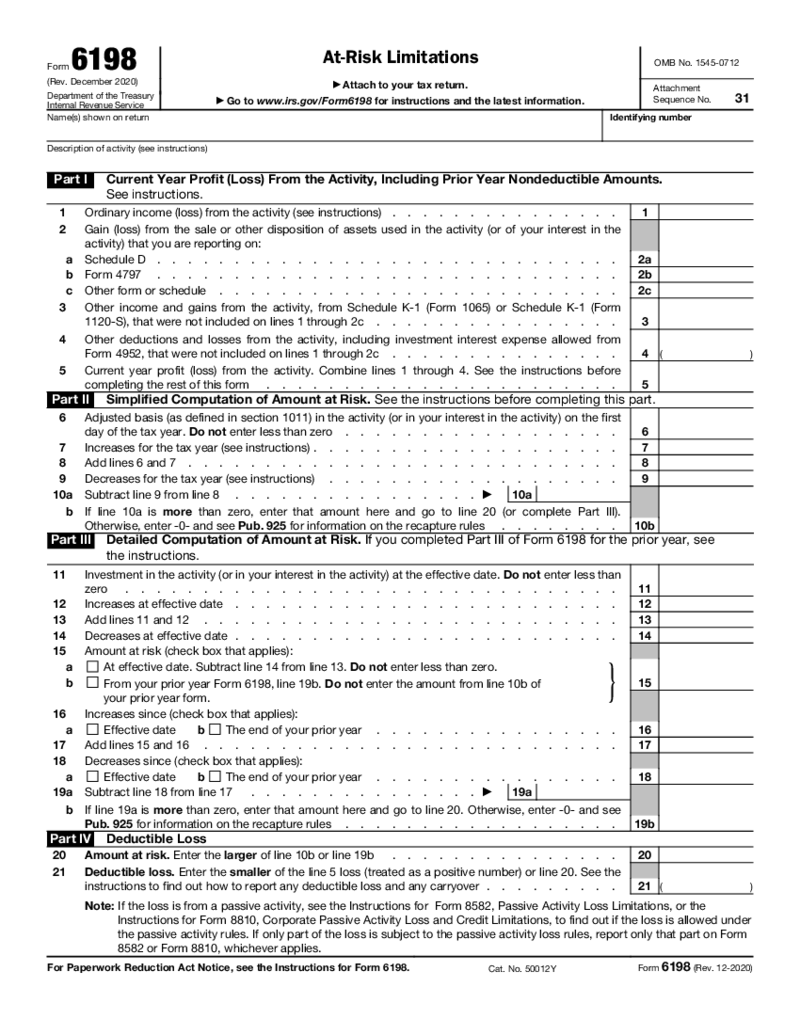

Form 6198

What Is Form 6198?

Form 6198 is called the At-Risk Limitations. It was made and released by the Department of the Treasury Internal Revenue Service, where you need to send the completed blank. You have to attach this form to the yearly tax return you send

Form 6198

What Is Form 6198?

Form 6198 is called the At-Risk Limitations. It was made and released by the Department of the Treasury Internal Revenue Service, where you need to send the completed blank. You have to attach this form to the yearly tax return you send

-

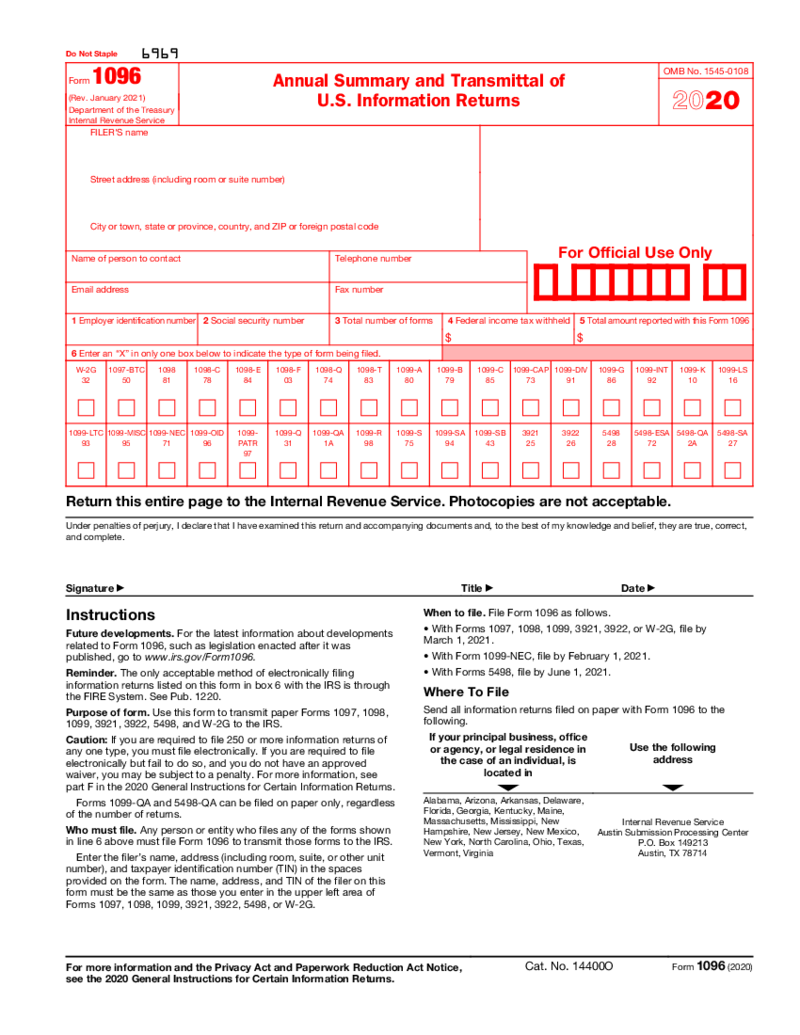

Form 1096 (2020)

What Is 1096 Form 2020?

The 1096 form 2020 serves as a cover sheet to report the totals from information returns, which may include forms such as 1099, 1098, and other tax documents. It is important to note that Form 1096 is utilized when submitting paper

Form 1096 (2020)

What Is 1096 Form 2020?

The 1096 form 2020 serves as a cover sheet to report the totals from information returns, which may include forms such as 1099, 1098, and other tax documents. It is important to note that Form 1096 is utilized when submitting paper

-

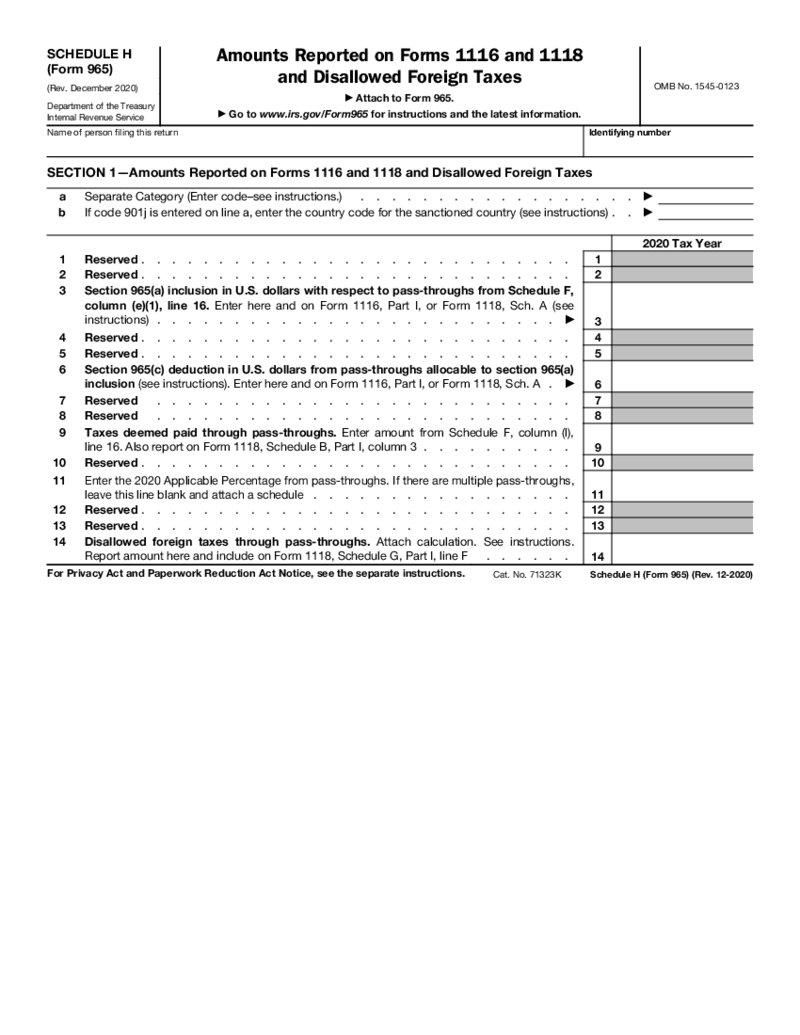

Form 965 (Schedule H)

What Is IRS Form 965 Schedule H

IRS Form 965 Schedule H is a tax form used for reporting the untaxed foreign earnings of U.S. shareholders using accumulated post-1986 deferred foreign income. Essentially, this form is a part of the Transi

Form 965 (Schedule H)

What Is IRS Form 965 Schedule H

IRS Form 965 Schedule H is a tax form used for reporting the untaxed foreign earnings of U.S. shareholders using accumulated post-1986 deferred foreign income. Essentially, this form is a part of the Transi

-

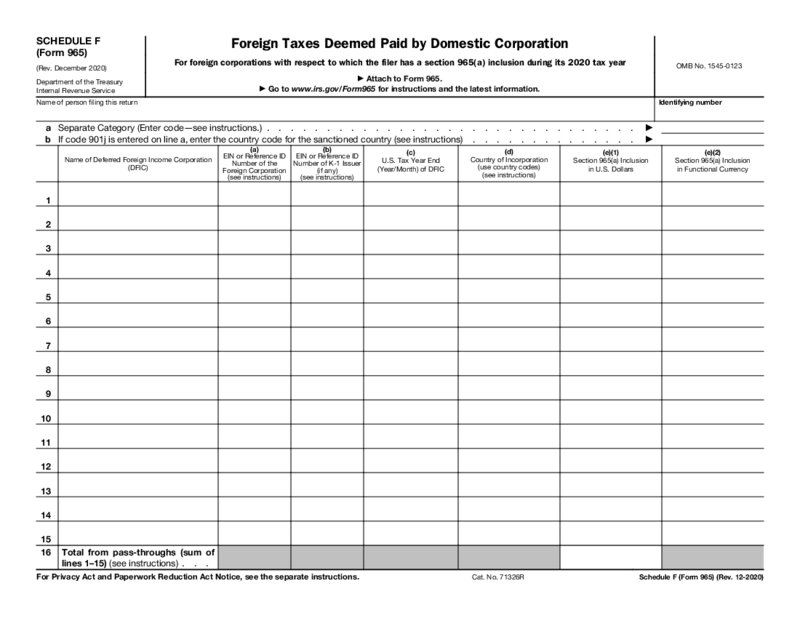

Form 965 (Schedule F)

What Is Form 965

IRS Form 965, officially known as the "Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System," is used to report the transition tax on untaxed foreign earnings of foreign subsidi

Form 965 (Schedule F)

What Is Form 965

IRS Form 965, officially known as the "Inclusion of Deferred Foreign Income Upon Transition to Participation Exemption System," is used to report the transition tax on untaxed foreign earnings of foreign subsidi

-

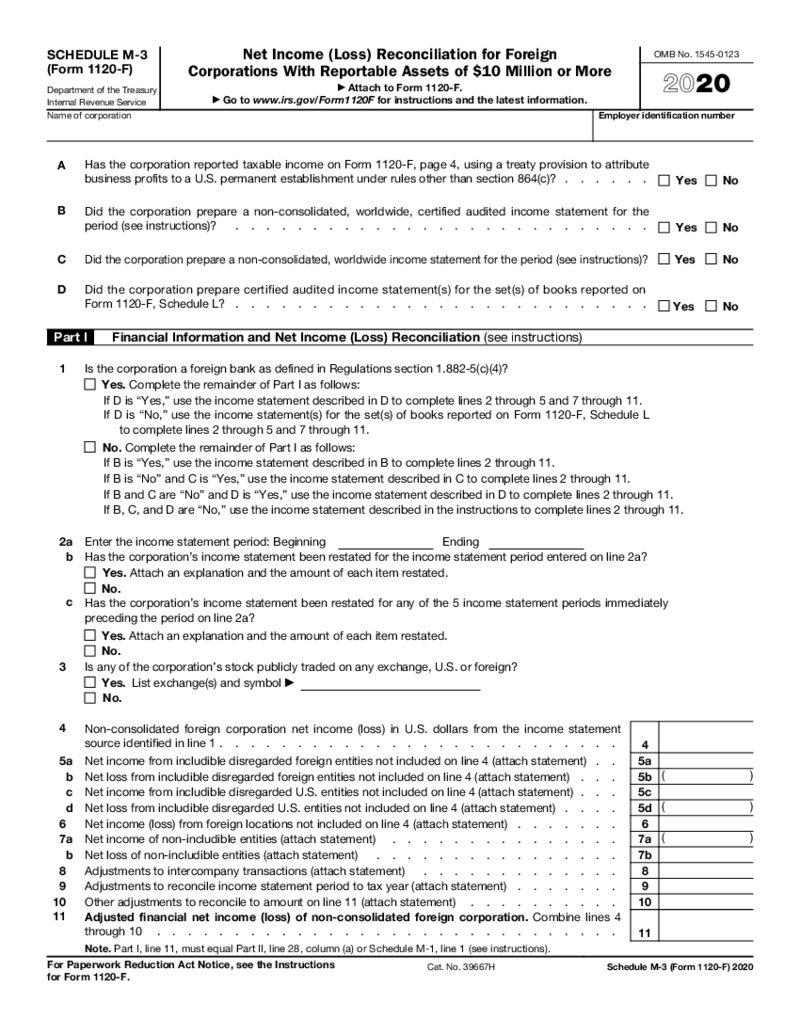

Form 1120-F (Schedule M-3)

What Is A Form 1120 F Schedule M 3

Form 1120-F Schedule M-3 is a financial statement that foreign corporations use to report their income and expenses when filing U.S. federal income tax returns. Specifically tailored for foreign entities

Form 1120-F (Schedule M-3)

What Is A Form 1120 F Schedule M 3

Form 1120-F Schedule M-3 is a financial statement that foreign corporations use to report their income and expenses when filing U.S. federal income tax returns. Specifically tailored for foreign entities

-

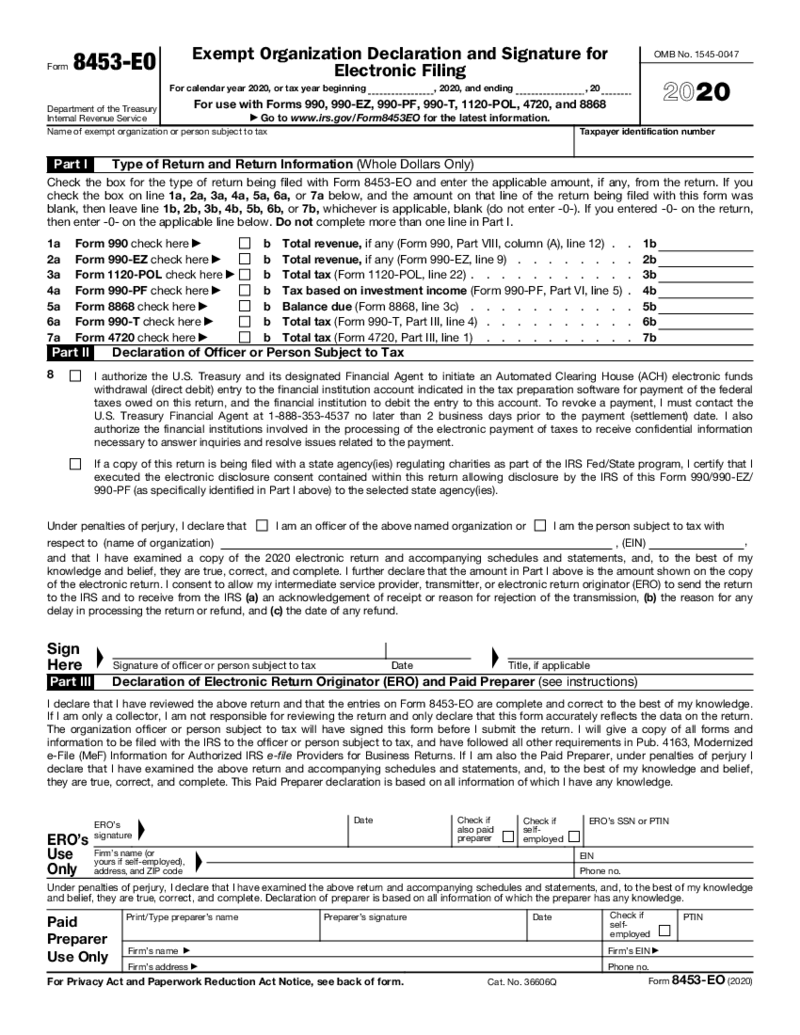

Form 8453-EO

What is Form 8453-EO

IRS Form 8453-EO is an "Exempt Organization Declaration and Signature for Electronic Filing." The form acts as a cover sheet for tax-exempt organizations who electronically file (e-file) their tax returns, including the comm

Form 8453-EO

What is Form 8453-EO

IRS Form 8453-EO is an "Exempt Organization Declaration and Signature for Electronic Filing." The form acts as a cover sheet for tax-exempt organizations who electronically file (e-file) their tax returns, including the comm

-

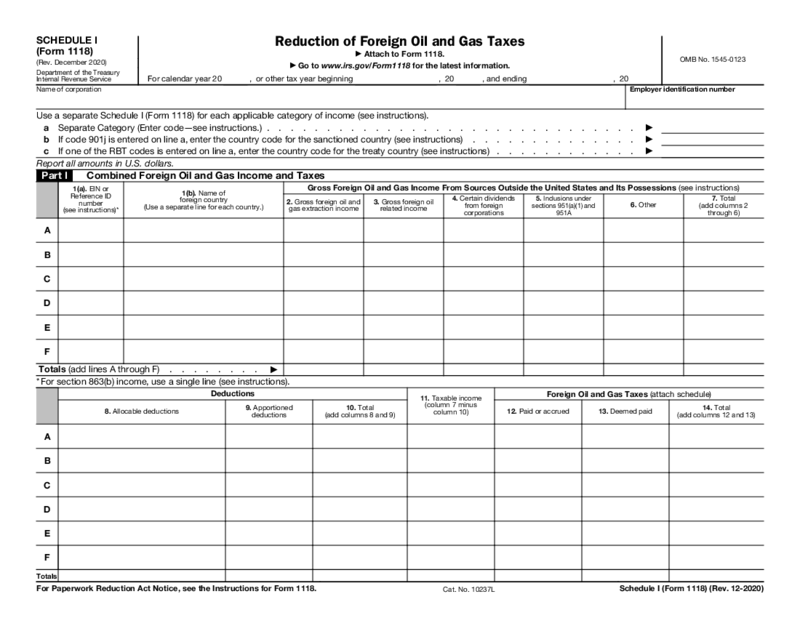

Form 1118 (Schedule I)

What Is A Form 1118 Schedule I

A form 1118 Schedule I is a critical component of the documentation required by corporations that claim foreign tax credits on income earned through their foreign operations. The form is part of the broader

Form 1118 (Schedule I)

What Is A Form 1118 Schedule I

A form 1118 Schedule I is a critical component of the documentation required by corporations that claim foreign tax credits on income earned through their foreign operations. The form is part of the broader

-

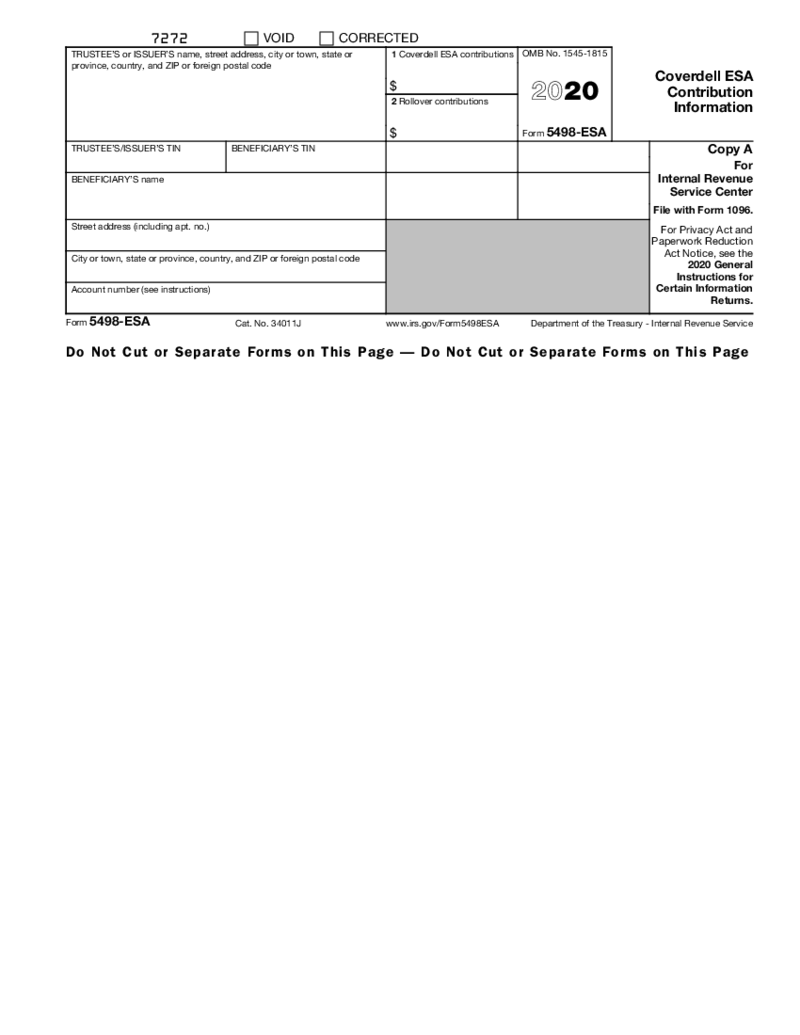

Form 5498-ESA 2020

What Is Form 5498 ESA

Form 5498-ESA, also known as the Coverdell ESA Contribution Information form, is pivotal in the tax world. It's a document used by financial institutions to report contributions and rollovers to a Coverdell Edu

Form 5498-ESA 2020

What Is Form 5498 ESA

Form 5498-ESA, also known as the Coverdell ESA Contribution Information form, is pivotal in the tax world. It's a document used by financial institutions to report contributions and rollovers to a Coverdell Edu

-

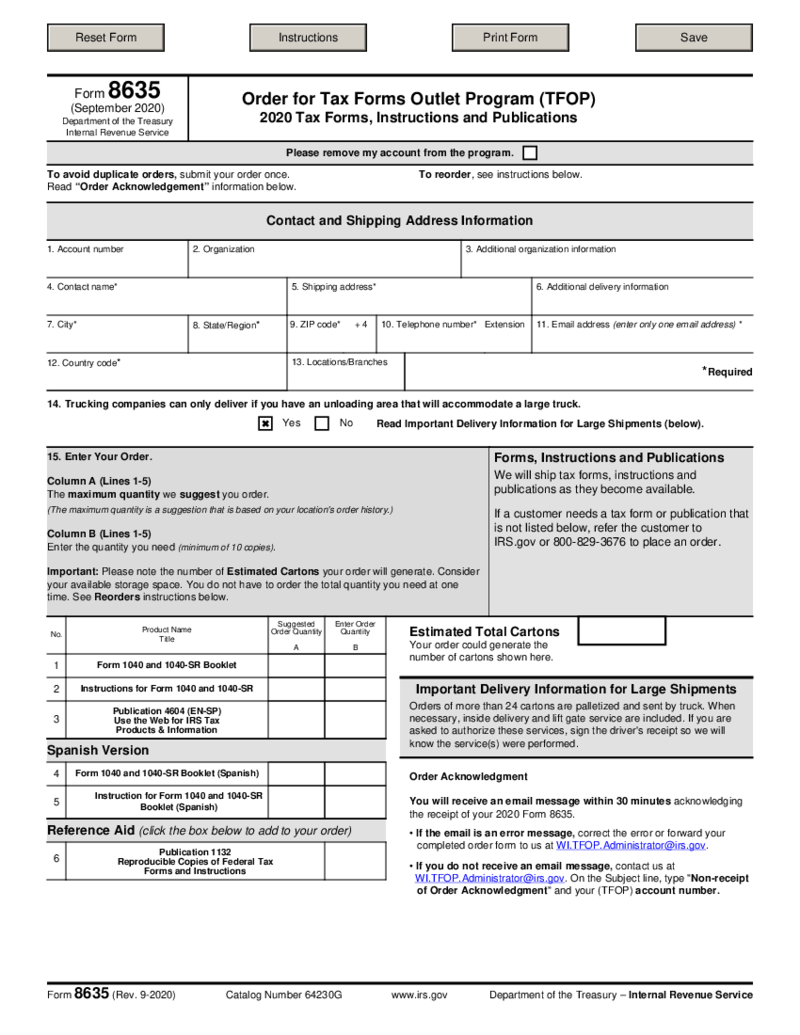

Form 8635

What Is Form 8635?

Form 8635, also known as the Taxpayer Order for Transcript of Tax Return, serves as a request form for those seeking a transcript of their past tax returns. This IRS form enables taxpayers to order multiple transcripts with a single req

Form 8635

What Is Form 8635?

Form 8635, also known as the Taxpayer Order for Transcript of Tax Return, serves as a request form for those seeking a transcript of their past tax returns. This IRS form enables taxpayers to order multiple transcripts with a single req

FAQ

-

What tax forms do I need?

That depends on a wide variety of factors, such as the state you live in, the specificity of your work, the format of your operation, and the like. You can consult a tax expert if you have questions on these nuances.

-

What are allowances on tax forms?

A withholding allowance is an exemption reducing the amount of income tax withheld from an employee’s wages. Upon determining your employees’ withholding allowances, you can easily pinpoint their federal income taxes.

-

When will unemployment send out tax forms?

You’re probably trying to ask us when your state unemployment office will mail you Form 1099-G (the total amount of taxable unemployment payment). The due date in this respect is January 31.

-

Where can I pick up tax forms?

You can head to your local IRS office or a post office, or library that offers tax forms. But why all the fuss if you can download the needed tax templates from our digital library. Give PDFLiner a go and you’ll forget about the alternative (and rather subpar) methods.