-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

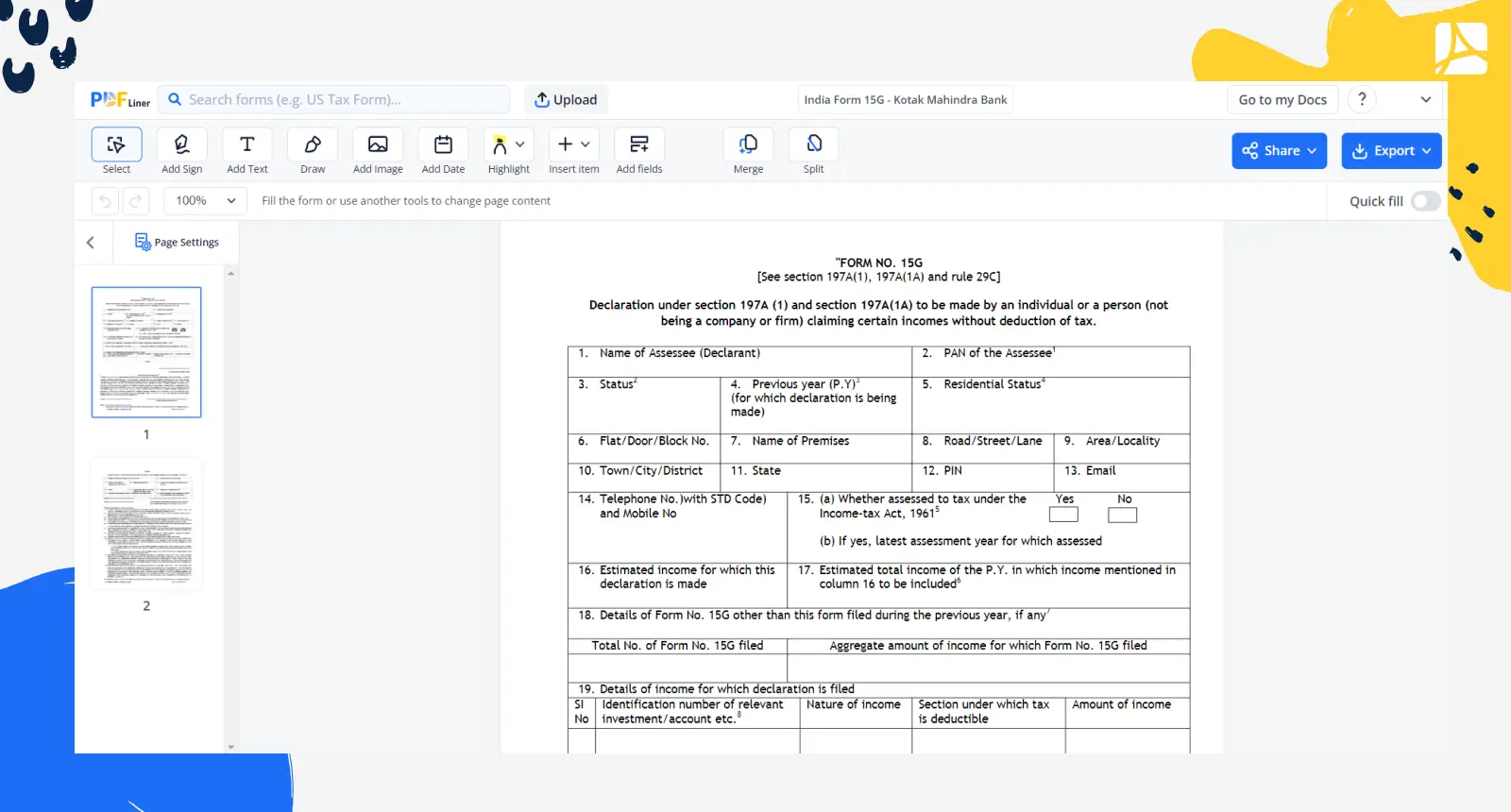

Fillable India Form 15G - Kotak Mahindra Bank

Get your India Form 15G - Kotak Mahindra Bank in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is an India Form 15G?

In India, form 15G plays a crucial role in managing tax deductions. This form is designed for individuals below 60 years of age, who need to request banks not to deduct tax at source (TDS) on interest earned on their investments, provided they fulfill certain conditions.

Importance 15G form India

The 15G form India is a self-declaration form in which an individual certifies that their total income is less than the taxable income. It's mainly used to ensure that TDS is not deducted from the interest income in case it's less than the minimum exempt income.

Kotak Mahindra Bank's role

As one of the leading banks in India, Kotak Mahindra Bank assists its customers by allowing them to download and submit their 15G forms online. It simplifies the process and ensures that customers can easily meet their tax obligations without visiting the branch.

How to Fill Out Bank of India 15G Form

Filling 15G form India can be a bit overwhelming for first-timers. Here's a step-by-step guide:

- Start by writing the 'Name of Assessee (Declarant)'. It is the name of the person who is submitting the form.

- Input your 'PAN of the Assessee'. This is your Permanent Account Number, a unique ten-digit alphanumeric number issued by the Indian Income Tax Department.

- Specify your 'Status'. This could be 'Individual' or 'HUF' (Hindu Undivided Family) etc. Choose the one corresponding to your legal status.

- Enter the 'Previous year (P.Y)'. This is the financial year for which you are filing the form.

- Choose your 'Residential Status' from 'Resident' or 'Non-resident'.

- In the 'Flat/Door/Block No.' field, input your house/flat number.

- Mention the 'Name of Premises', 'Road/Street/Lane', 'Area/Locality', 'Town/City/District', 'State', 'PIN', 'Email', 'Telephone No. with STD Code' and 'Mobile No'. All these details are related to your full permanent address.

- In 'Whether assessed to tax under the Income-tax Act, 1961' field, select 'Yes' or 'No'. If 'Yes', provide the latest assessment year for which assessed.

- Write down your 'Estimated income for which this declaration is made'. It’s the estimated income from sources that are subject to TDS and on which you seek relief.

- In 'Estimated total income of the P.Y.', provide the total income you anticipate receiving during the fiscal year.

- Fill in the 'Details of Form No. 15G other than this form filed during the previous year, if any'.

- Enter the 'Total No. of Form No. 15G filed' and 'Aggregate amount of income for which Form No. 15G filed'

- Provide 'Details of income for which declaration is filed', 'Identification number of relevant investment/account etc.', 'Nature of income Section under which tax is deductible', and 'Amount of income'.

- Finally, sign in the 'Signature of the Declarant' section, enter the 'Place' where you are filling out the form and the 'Date of signing'.

Please remember to be careful while entering all the details in Form 15G. Any mistakes can lead to complications or even penalties. The information you provide must be accurate and truthful to the best of your knowledge. Also, PDFLiner helped to get Kotak Mahindra bank statement form download pdf for free.

Submission of the State Bank of India 15G form

The best time to submit the Kotak Mahindra Bank 15G form is at the beginning of a financial year, which in India starts on the 1st of April and ends on the 31st of March. Being proactive in submitting this form will ensure that the bank does not deduct tax at source (TDS) on any interest earnings you accrue during the year right from the start.

Additionally, every time you open a new Fixed Deposit, it is also advisable to submit a separate Form 15G if your total interest income from all sources is going to be less than the minimum exemption limit.

Finally, bear in mind that the 15G form is valid only for one financial year. This means if you have multiple years where you believe the income is not going to be taxable due to being under the exemption limit, you will need to submit this form at the beginning of each financial year.

Fillable online India Form 15G - Kotak Mahindra Bank