-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Duplicate W 2 Form Request

Get your Duplicate W 2 Form Request in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding the Need for a Duplicate W-2 Request

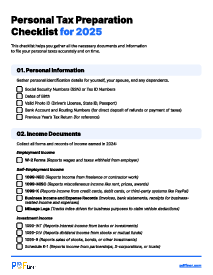

At some point, many taxpayers find themselves in a situation where their original W-2 form—vital for annual tax filing—has gone missing or is incorrect. Whether it's due to accidental disposal, a change of address, or an error on the initial document, obtaining a duplicate becomes essential for meeting IRS requirements and ensuring accurate reporting of wages and taxes withheld. PDFliner offers a streamlined process to request duplicate W 2 forms.

Process to Request for Duplicate W 2 Form

The first step is understanding when and why you might need to request a duplicate W-2. You typically need to take this action if you haven’t received your W-2 by mid-February, if your original W-2 is lost, or if the information reported is incorrect. To initiate a duplicate W 2 request form through PDFliner, you'd start by accessing the platform's repository of tax forms.

How to Fill Out the Form for a Duplicate W-2

Filling out the form properly is critical for avoiding delays. PDFliner’s interface is intuitive, simplifying the process. Here are the steps you need to follow:

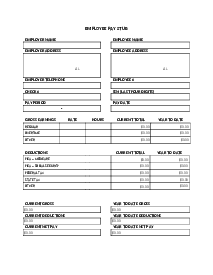

- Identify the specific tax years you need the W-2 forms for and enter them in the designated field labeled "Tax Year(s) Requested."

- Write your full legal name in the space provided to indicate the employee requesting the duplicate W-2.

- Enter either your Red ID Number or the last four digits of your Social Security Number for identification purposes.

- Provide your complete current mailing address, including street number, street name, and apartment number if applicable. Also, fill in your city, state, and zip code in the corresponding areas.

- Include your daytime phone number where you can be reached for any clarifications or questions regarding your request.

- Choose how you want to receive your duplicate W-2 statement by picking it up at the A.S. Business Office or to have it mailed to you. If you prefer mail delivery and the address is different from your current address, specify the complete alternate address.

- The form will indicate that it takes one business day to process all requests. Keep this timeline in mind when awaiting your duplicate W-2.

- In the space allocated, print your name to verify the information you've provided is accurate and for record-keeping purposes.

- Sign the form to authenticate your request and grant permission to generate the duplicate W-2 form(s).

- Date your request by writing the current date next to your signature to complete the process and confirm the timeframe for the duplicate form issuance.

Taking advantage of PDFliner services

Navigating tax documents can be tricky, but PDFliner aims to simplify the plethora of necessary forms, including the process of requesting 2 duplicate form request W. However, the services offered by PDFliner go beyond just downloading forms.

PDFliner provides a complete suite of tools tailored to your tax-filing needs. You can fill in their details, make corrections, and customize their forms within a few clicks. The PDFliner's platform editing tools are specifically designed to handle tax forms with precision and security. Also, here, you may find a large base of different IRS form templates.

Fillable online Duplicate W 2 Form Request