-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Get a 4506-T Form and File It Online

.png)

Dmytro Serhiiev

If you want your mortgage for a small business to be approved, you should confirm that you have an income match for this. In most cases, SBA will ask you to fill out a 4506-T form. It is a request for the tax return transcript and some other forms. If you wonder “Where can I get a 4506-T form,” check out the next Form 4506-T instructions.

Fillable 4506-T 653660fbc74e78c81d004861

How to Get a 4506-T Form?

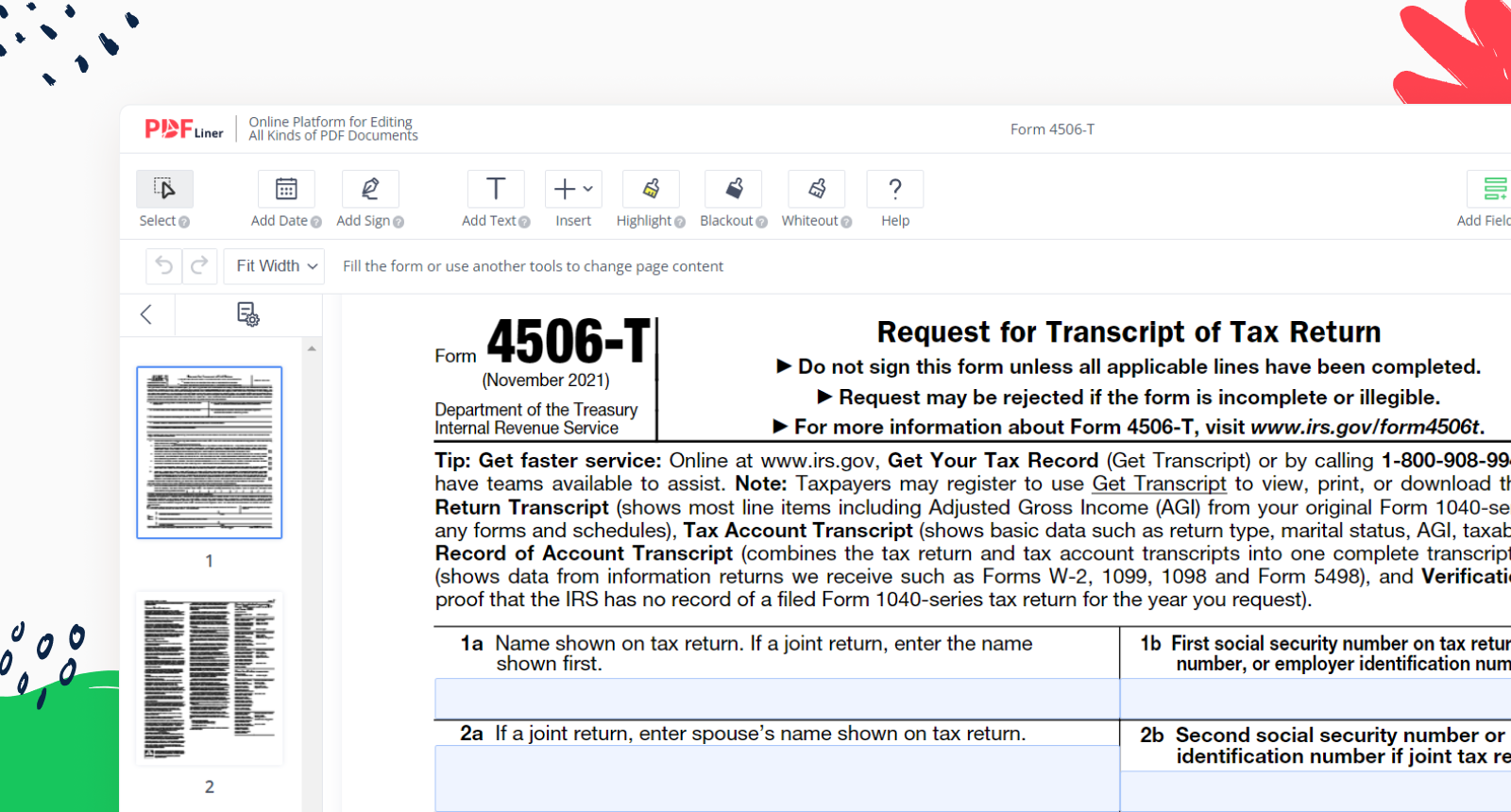

There are two ways you can get Form 4506-T. Since it is an IRS form, this document is available on the official IRS website. You can find and download it there. You will also find information about how and where to file this blank. You can download a 4506-T form using PDFLiner too. What is more, you can fill out this form online on our website.

PDFLiner editor allows you to edit text fields, add your text, images, comments, and much more. You may also share your document with other users so that they can view or edit it in the editor. Besides, PDFLiner provides you with an e-signature service. You may sign Form 4506-T online and print it out if needed. Other parties can also sign the form; you just need to share it with them. By the way, if you’re wondering how to fill out Form 4506-T, there is a comprehensive guide on our website.

Blank 4506-T 653660fbc74e78c81d004861

Frequently Asked Questions

Filling out the IRS Form 4506-T is not a challenging process. However, there are some significant details to know.

Why does SBA need Form 4506-T?

SBA asks you to fill out a 4506-T form to find out whether you are capable of repaying the loan. This form requires a tax return transcript, which you can give to the SBA.

Where to mail Form 4506-T?

You can find all the information about where you should file a 4506-T form on the second page. The address depends on your state or the state where your business is registered.

Can I submit Form 4506-T online?

Yes, you can fill out, sign, and submit your 4506-T form online. You should visit the IRS website for more details.

How long does it take the IRS to process form 4506-T?

Usually, it takes about ten days. However, time depends on the individual case. If you didn’t get an answer from the IRS after two weeks, you should contact them.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Printable 4506-T Form 653660fbc74e78c81d004861