-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 W-8 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLogisticsSimplify your trucking and logistics paperwork with our ready-to-use transportation and freight templates.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out a 1040-X Form: Tips for Beginners

Liza Zdrazhevska

With this guide, you will quickly learn how to fill out a 1040-X form. It is dedicated to a less known but still important form also known as an amended tax return. In case you made a mistake in your tax return forms and realized it after filing the document to the IRS, tax amendment would be your only option. Learn how to file the form and where and when to send it.

What Is an Amended Tax Return

The mistakes in Form 1040 might happen when you expect them the least. It might be a valuable credit or tax deduction. It can also be an error in a number you find irrelevant at first. Yet, the IRS requires exact data so that you wouldn’t underpay or overpay your taxes. Right after you discover your mistake, download the 1040-X form and refile taxes. You can add more information, correct, or delete the already existing one in form 1040.

The form can also be filed if you receive forms 1099 or W-2 with the income you’ve forgotten or missed. Sometimes this form is used by a divorced couple when one of the parties decides to claim a common child as a dependent. Though it is not complicated to refile federal tax, you have to do it before the deadline. The longer you wait, the more serious consequences you will face. If you want to find out more about how to get form 1040-X, read another article on this website.

1040-X Form 65cb6b37911ce9829a00d11a

How to Fill Out a 1040-X Form

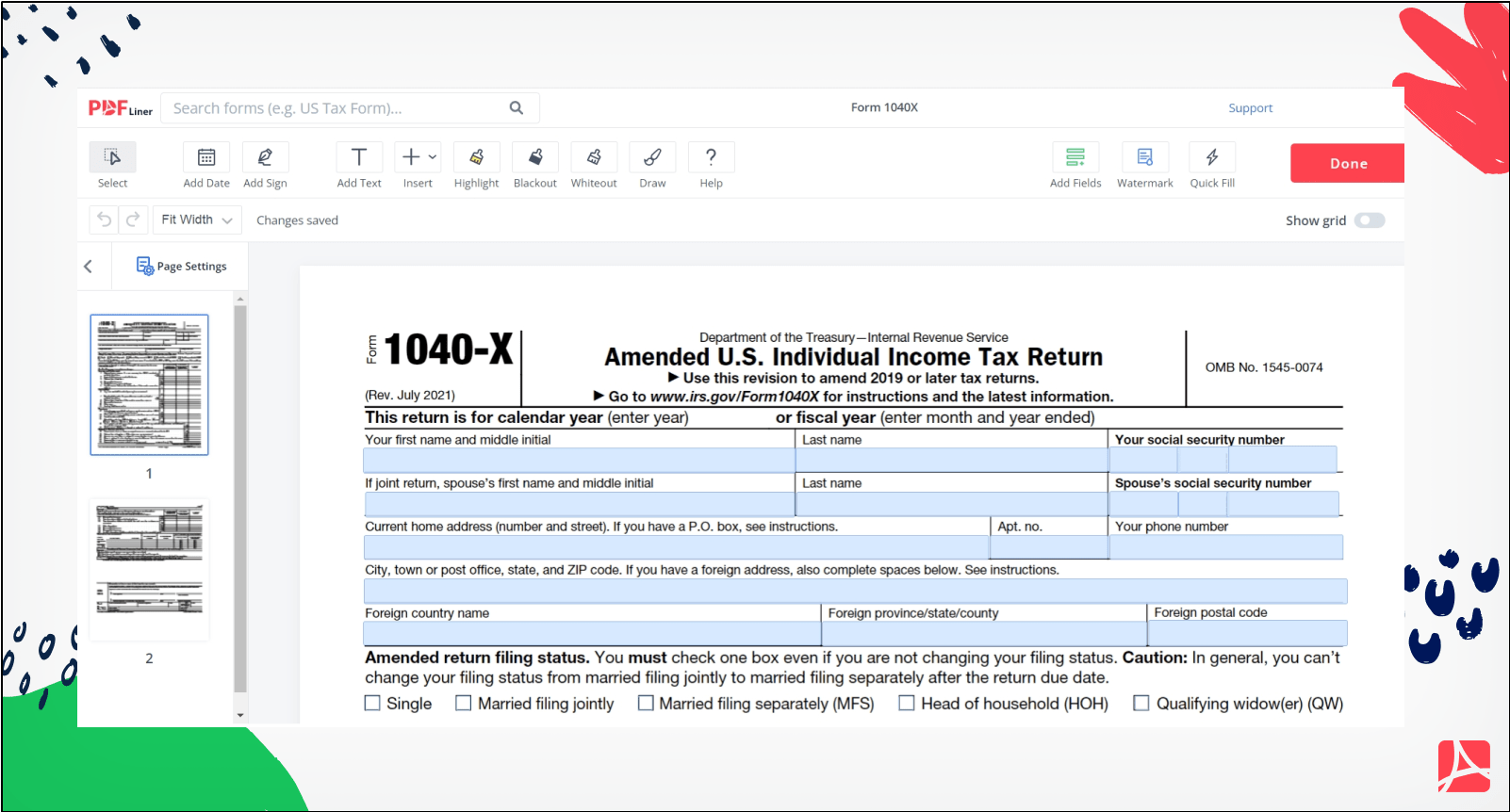

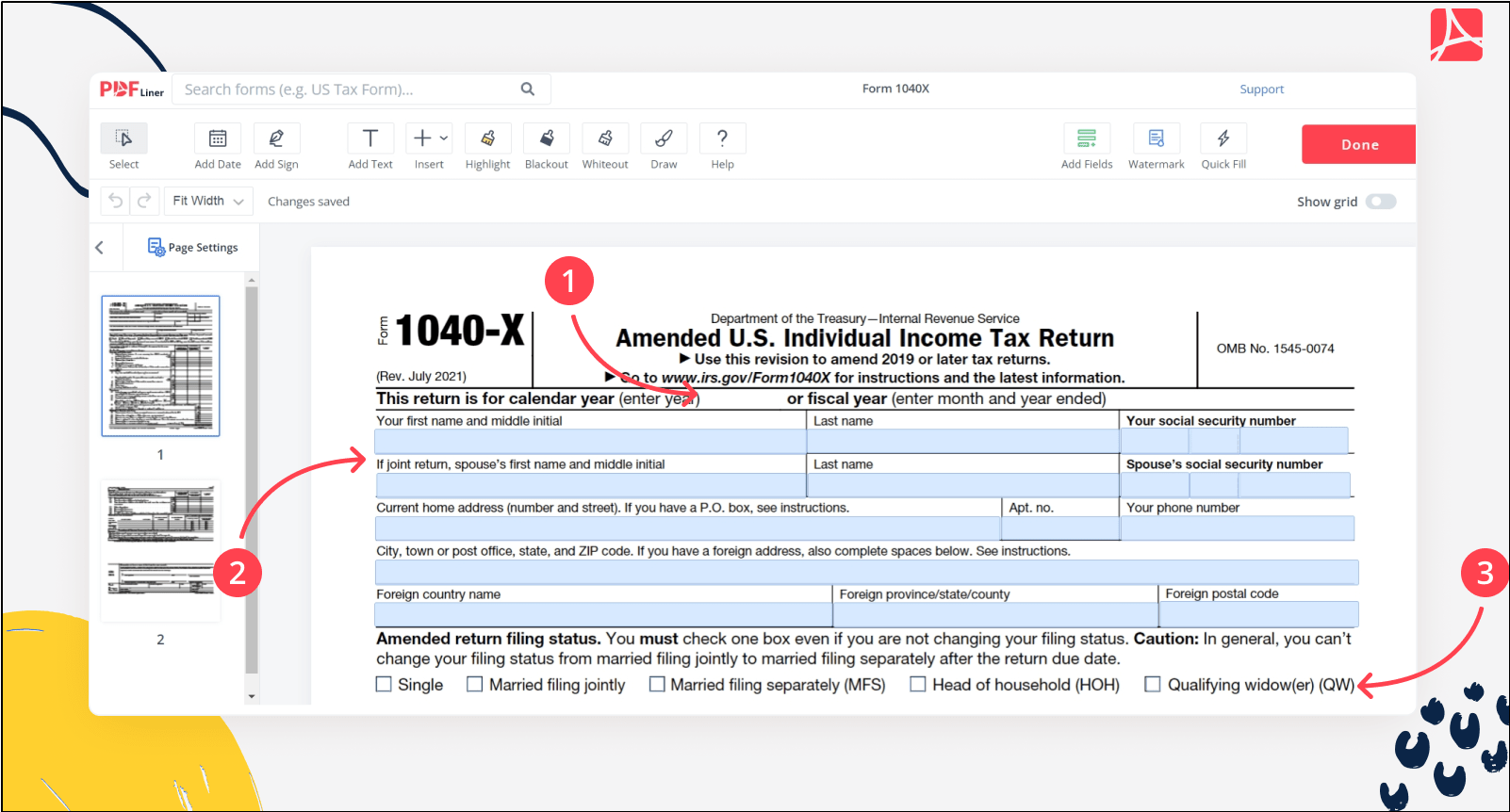

To understand how to amend taxes, follow the next instructions. You have to start either by going to the IRS website or using PDFLiner. Open the form 1040-X. Make sure that you have your original incorrect tax reform nearby. The form is only 3 pages long, and there are brief IRS form 1040-X instructions on the first page. You have to fill in only two next pages.

Both PDFLiner and IRS allow you to fill out 1040-X online. Yet, PDFLiner is simple to use and contains extra tools, including the ability to create eSignature online. If you write down something wrong or put a tick in the irrelevant box, there is a possibility to fix it even if you saved the document. The form can be applied for different tax years. If you need to fix information for several years, you should file separate forms for each of them. Include the following data:

Step 1: Tick the proper calendar year for the tax return. If there is no matching box with the year on it, just write it down in the line “Other Year”. You can pick whether you want to add calendar or fiscal year;

Step 2: Provide your personal information including name, address, SSN, the name and SSN of your spouse, phone number;

Step 3: Pick the right box with your marital status;

Step 4: Fill the lines that must be corrected in sections Income and Deduction, Tax Liability, Payments, Refund or Amount You Owe;

Step 5: Fill the information in the Exemptions and Dependents section only in case you need to make changes to the original document;

Step 6: Put a tick in the boxes related to Presidential Election Campaign Fund;

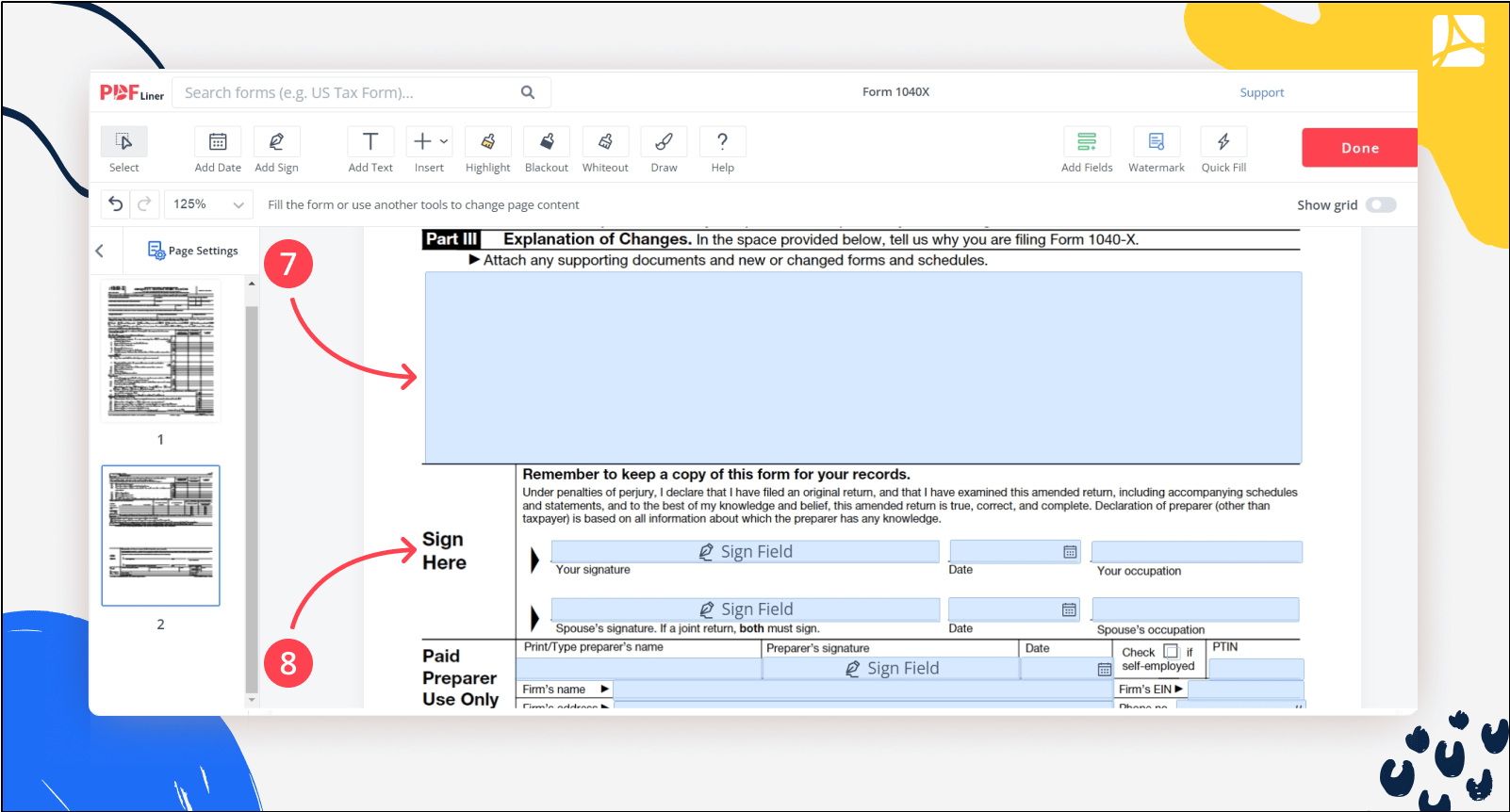

Step 7: You have to write down the reason for the change you’ve made in Part 3 of the document;

Step 8: Sign the document, add the date, your occupation, the signature, and the occupation of your spouse (if you have any).

Fill Out 1040-X Form 65cb6b37911ce9829a00d11a

How to File an Amended Tax Return

There is no strict amended tax return deadline. You have to file it after the IRS processed the original document without corrections. If there are clerical or math errors, the IRS might correct mistakes and send you the bill for the work. Yet, you have to keep in mind that the IRS expects you to send them the form 1040-X in three years after the original file was sent, and no later or in 2 years of paying the tax due.

Now, let’s talk about how to file 1040-X. The procedure is pretty simple. You have to compile the original tax return document, add 1040-X to it, and add forms 1099 or W-2 if you need them. Check out the information on all the documents and make sure you correct everything in the new form. If you need to fix errors in several years, use separate forms.

After that, you can submit them. Since 2019, there is an option to do it electronically if your original tax return is also filed online. If not, check out the list with addresses on the IRS website and find the closest option for you.

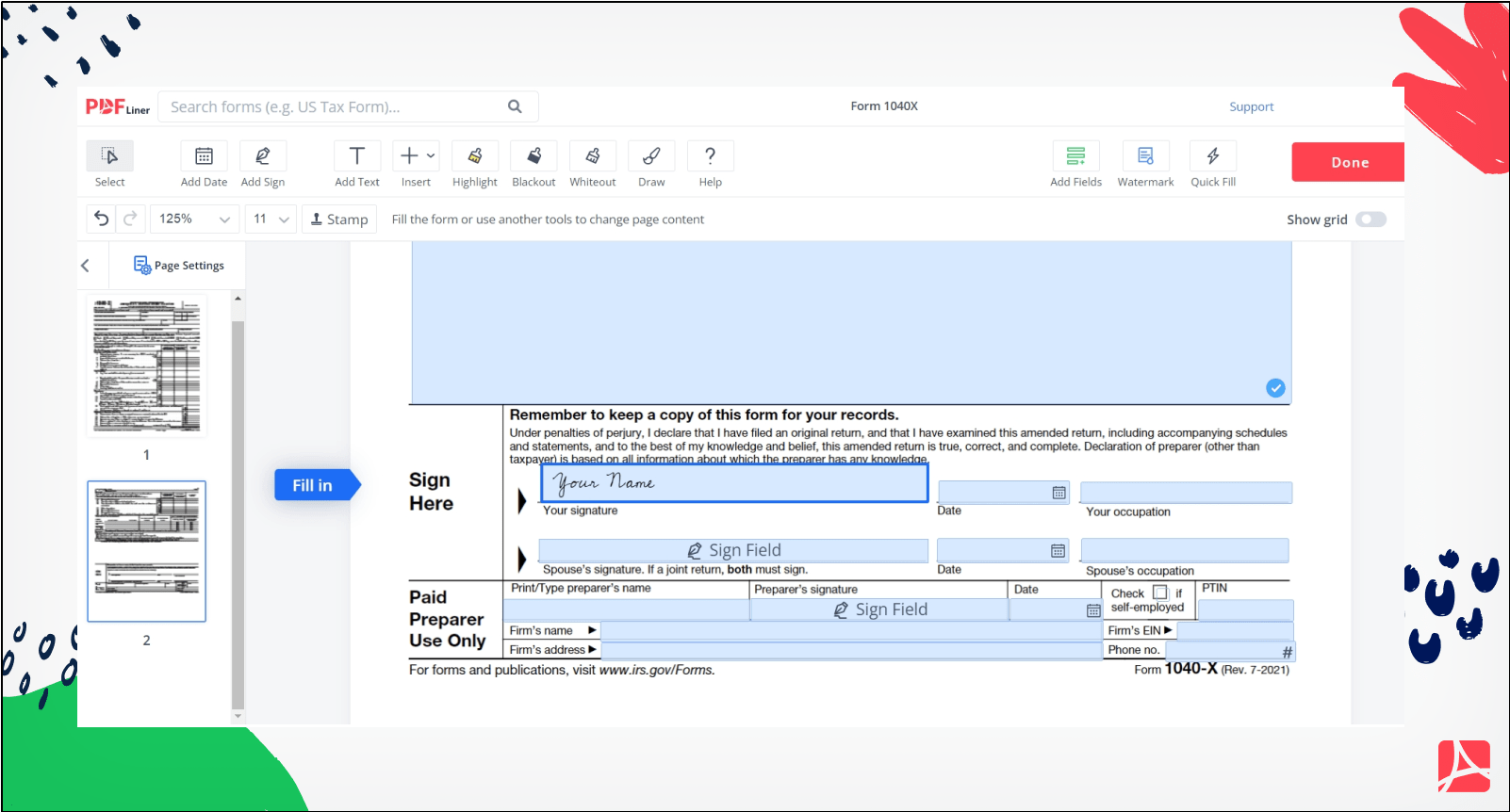

How to Sign a 1040-X Form

This is when you might find PDFLiner extremely helpful. You can create eSignature without having to search for the third parties, right in the form you are completing. It sounds simple, and so it is. This signature is recognized by the IRS. You can pick the style, including hand-writing, the color, size, and place of the signature. By the way, you may also save this signature in storage in case you want to use it on other forms and documents. You will find more details on how to sign the form with PDFLiner in the separate article.

FAQ

After you learned how to fill the 1040-X form, you might still have some questions left. Here is the most frequently asked of them.

When to file an amended tax return?

There is no strict deadline. However, the IRS can force you to pay the fine in case you send the form 1040-X later than 3 years after the original tax return is filed. They also might require it no later than in 2 years while you are paying the tax due for the year if the date is later. Keep in mind that you will not be able to claim the refund if you miss this period of time. The earlier you send form 1040-X after you notice the error left by you and missed by the IRS, the better.

Can you e-file a 1040-X?

You have already learned where to mail form 1040-X and know that from 2019, you can file the amended tax return online. However, it is possible only if your original tax return is sent online as well. If you want to send it by regular mail, you will find a nearby address on the first page of the form.

Should I amend my tax return before I get my refund?

No. If you expect to receive the refund from the original tax return form, you can’t send the amended tax return before. You have to receive a refund and can even cash the refund check from the return. The fastest way, which is online form sending, will take up to 16 weeks for the IRS to process.

How do I know if my tax amendment was accepted?

The simplest way is to use the IRS Amended Tax Return tool called Where’s My Amended Return. You will have to provide your information to check the status of the return. If you don’t want to do this, you can always call the phone number 866-464-2050 and contact the IRS. It must be done not earlier than 3 weeks after you send the form.

What do I mail with 1040X?

Send the original tax return document. If you need to add other forms, like 1099, do it. You may also add several amended returns for separate years.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

Tax Form 1040-X 65cb6b37911ce9829a00d11a