-

Templates

1099 FormsAccurately report 1099 information returns and ensure IRS filing with easeExplore all templatesW-9 FormsEasily manage and share taxpayer details to streamline payments and meet IRS requirements with confidenceExplore all templatesOther Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

- 1099 Forms

- W-9 Forms

- Other Tax Forms

- Real Estate

- Legal

- Medical

- Bill of Sale

- Contracts

- Education

- All templates

HIPAA Compliance Patient Consent Form

HIPAA Compliance Patient Consent Form

Legal Aid Queensland Application

Legal Aid Queensland Application

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Form Vs-4 Commonwealth of Virginia - Report of divorce or Annulment

Recertification for Calfresh Benefits (CF 37)

Recertification for Calfresh Benefits (CF 37)

Pennsylvania Last Will and Testament Form

Pennsylvania Last Will and Testament Form

AU Mod(JY), Parent(s), Guardian(s) details

AU Mod(JY), Parent(s), Guardian(s) details

Missouri Form 5086 - Secure Power of Attorney

Missouri Form 5086 - Secure Power of Attorney

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 5558

Get your Form 5558 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

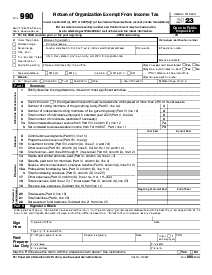

What Is Form 5558?

The 5558 form is also known as the Application for Extension of Time To File Employee Plan Return. This is a unique one-time form that is widely used by employers. If you have never heard of what is form 5558, you may have never had a situation with a delay of plan returns. Yet, it may happen to anyone, and you need to be prepared for such a case.

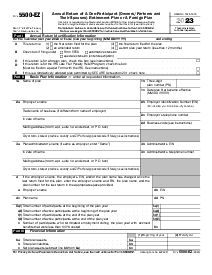

The form was created by the Department of the Treasury Internal Revenue Service, and you have to send the filled blank there. Sending form 5558 to the IRS does not free you from the need to make the plan return for the employee. It can be used only for one extension, not more. Normally it can be applied to only 3 tax reports. You can use the IRS form 5558 together with the 5500, 5500-EZ, and 5330 forms.

If you fill it out, you receive two and a half months to send the report with 8955-SSA form, and the 5500 annual tax report. You still have to pay taxes in time, since it does not provide a delay in paying. If you delayed the payment of taxes you need to make payment and fill the form 5530 too.

What Do I Need the Form 5558 For?

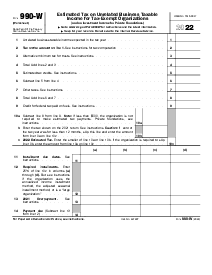

- An employer who needs an extension for the annual return report of an employee benefit plan, the annual return of a one-participant retirement plan, or the return of excise taxes related to employee benefit plans, you have to learn what is form 5558 used for;

- Based on IRS form 5558 fillable rules, you can’t delay the payment of taxes while filling out the form. You still need to pay taxes for your employees in time, while you can use 2.5 extra months to complete the document on the tax return appropriately;

- You can use this form only for one extension. Don’t rush with the decision, since you may need this offer for the next year, for example. The form 5558 extension is exclusive, and you need to make sure that you will not need it anymore.

How to Fill Out Form 5558?

You will find IRS form 5558 fill in offer only on PDFLiner, the editor with enough tools to complete all sections online. IRS also offers you to take a look at the form, but nothing more. Once you read the instructions on IRS and check out the form, you can go to PDFLiner and its wide range of tools. This editor helps you to create electronic signatures recognizable by officials. Inside the document, you will also find instructions for each section.

While the whole document is 3 pages long, the two last pages belong to the rules and explanations. It is better to read them before you begin to write anything down there. Be careful with the information you provide since you can’t make mistakes there. After you complete the form, you can save it on your device, send it to the other party’s email or file it online to the IRS. You may also print it and send it by regular mail. Pay attention to these brief form 5558 filing instructions:

- Include the identification information in Part 1. Fill it with the name of the administrator, filer, or sponsor of the plan. Provide information on the address, ID number, SSN, name of the plan, number, and ending time;

- Provide information on the extension of time that you need to file one of the forms 5500 or 8955-SSA. You have to put the tick if the box in section 1 matches your case, name the date of extension, and deadline;

- Describe your specific case in Part 3, including the deadline, payment amount that is attached, and description of the details of why you need to use this form;

- Put your signature and date at the end of the document.

Organizations That Work With Form 5558

- Department of the Treasury Internal Revenue Service.

Fillable online Form 5558