-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Government PDF Templates - page 26

-

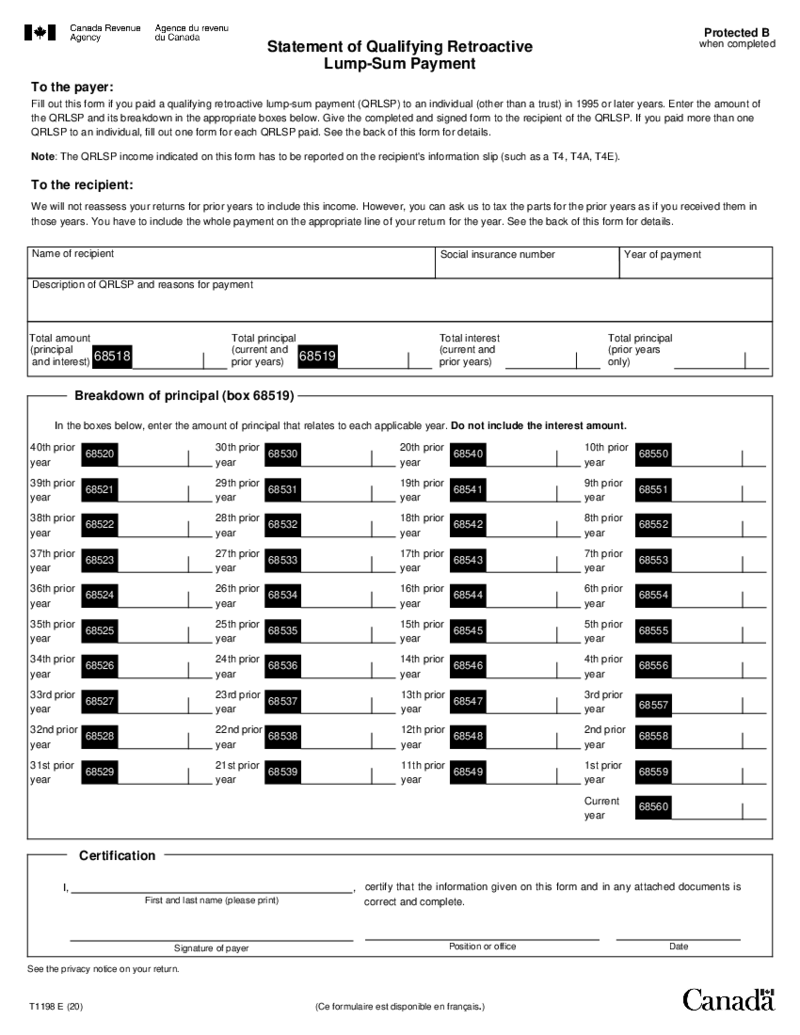

T1198 Statement of Qualifying Retroactive Lump-Sum Payment

What Is Form T1198?

The Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment is a statement you can use to report certain types of lump-sum income.

What Is the T1198 Form Used For?

You can usually use the T 1198 form to re

T1198 Statement of Qualifying Retroactive Lump-Sum Payment

What Is Form T1198?

The Form T1198 Statement of Qualifying Retroactive Lump-Sum Payment is a statement you can use to report certain types of lump-sum income.

What Is the T1198 Form Used For?

You can usually use the T 1198 form to re

-

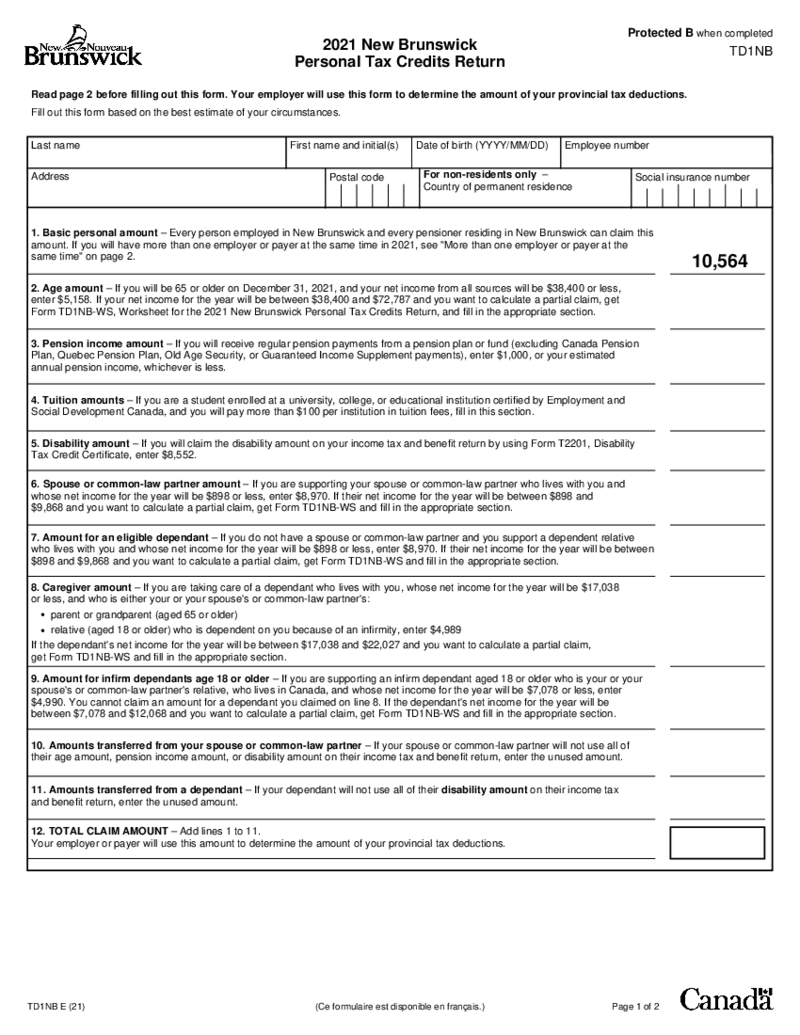

TD1NB 2021 New Brunswick Personal Tax Credits Return

Where to Find a Blank TD1NB 2021 New Brunswick Tax Credits Return?

The document is ready for you to acquire at the PDFLiner library. First of all click "Fill this form" button, and in case you'd like to find it letter see the steps below:

TD1NB 2021 New Brunswick Personal Tax Credits Return

Where to Find a Blank TD1NB 2021 New Brunswick Tax Credits Return?

The document is ready for you to acquire at the PDFLiner library. First of all click "Fill this form" button, and in case you'd like to find it letter see the steps below:

-

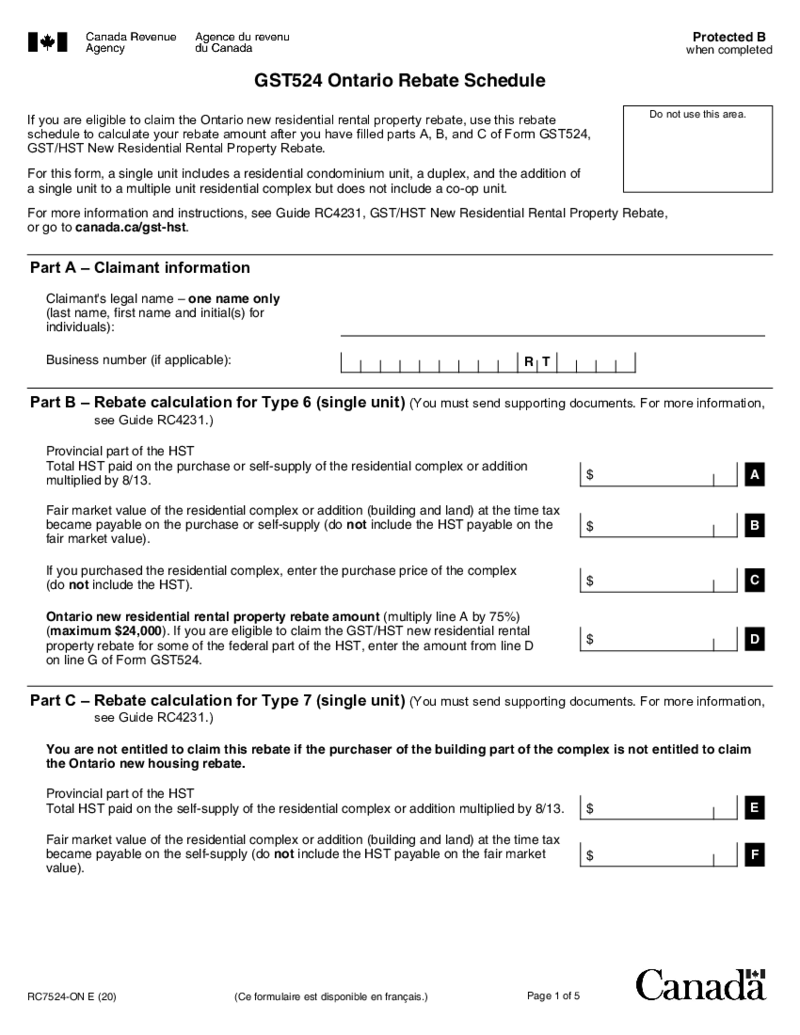

RC7524-ON GST524 Ontario Rebate Schedule

What Is Ontario Rebate Schedule?

GST524 Ontario Rebate Schedule form is a refund of a portion of the provincial sales tax that is paid on the purchase or construction of a newly built home. The rebate for new homes is available to first-time home buyers a

RC7524-ON GST524 Ontario Rebate Schedule

What Is Ontario Rebate Schedule?

GST524 Ontario Rebate Schedule form is a refund of a portion of the provincial sales tax that is paid on the purchase or construction of a newly built home. The rebate for new homes is available to first-time home buyers a

-

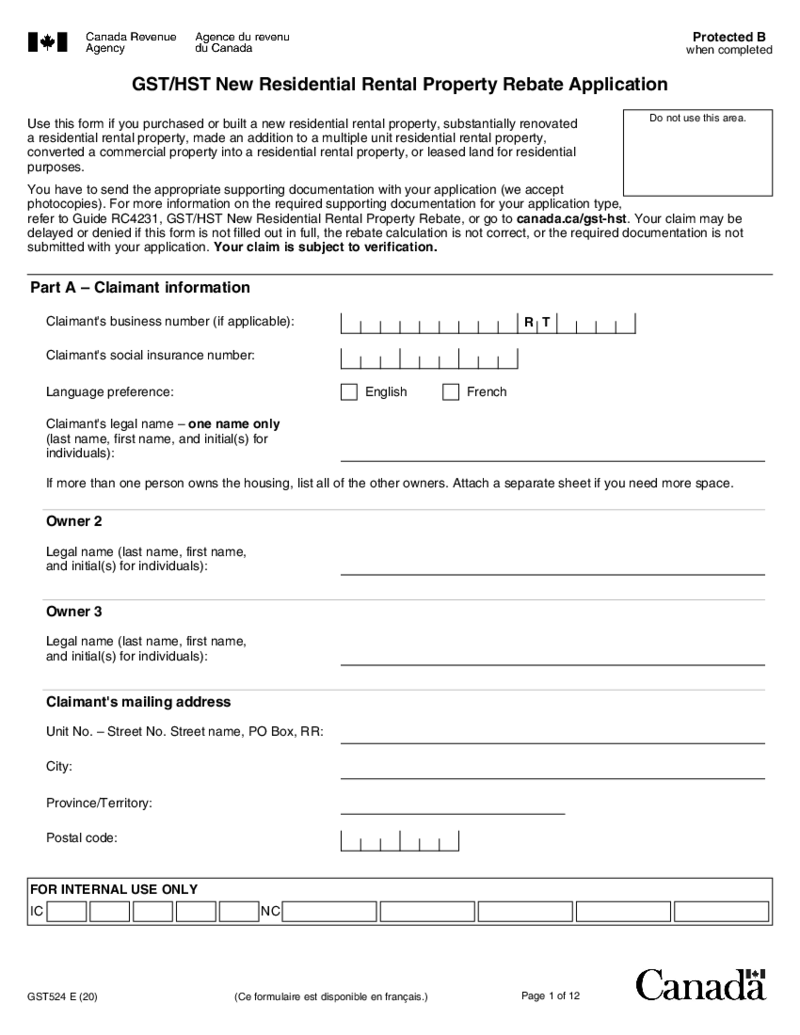

GST524 GST HST New Residential Rental Property Rebate Application

What Is GST524 form?

The GST/HST New Residential Rental Property Rebate Application form is used to claim a rebate for the GST/HST paid on the construction or purchase of a new rental property. The rebate is available to Canadians who rent out residential

GST524 GST HST New Residential Rental Property Rebate Application

What Is GST524 form?

The GST/HST New Residential Rental Property Rebate Application form is used to claim a rebate for the GST/HST paid on the construction or purchase of a new rental property. The rebate is available to Canadians who rent out residential

-

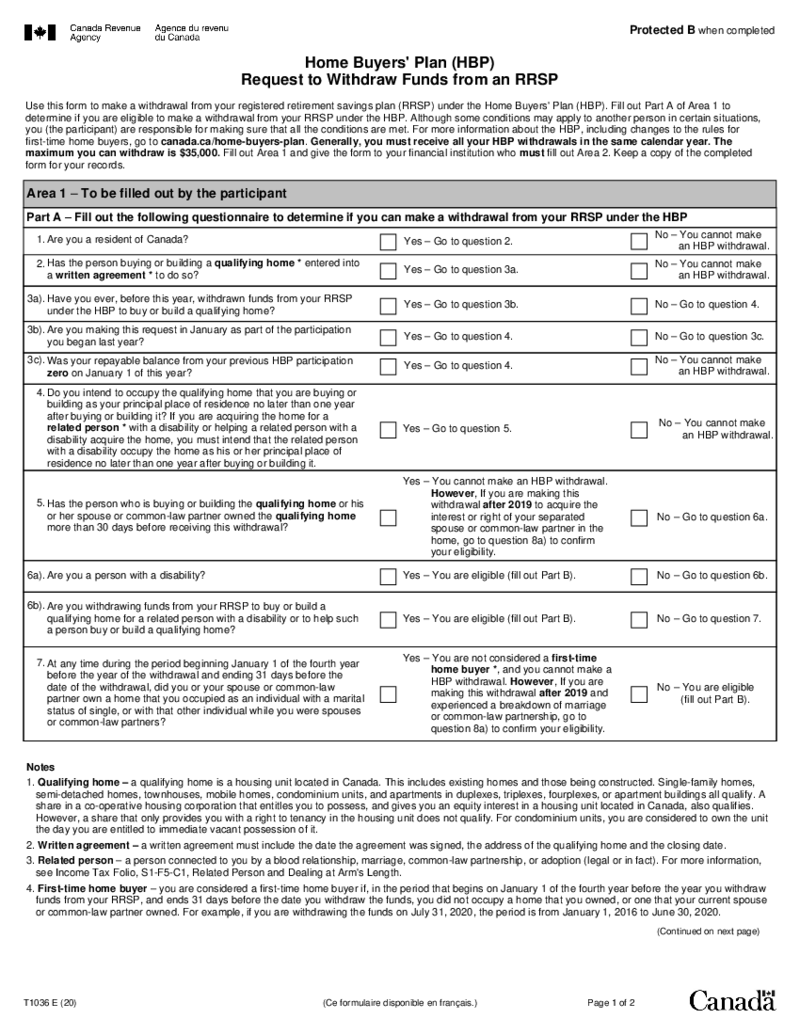

T1036 Home Buyers Plan (HBP) Request to Withdraw Funds from an RRSP

Understanding the Home Buyers' Plan (HBP): Is it Right for You

Considering the Home Buyers' Plan (HBP) as a potential option for utilizing funds from your Registered Retirement Savings Plan (RRSP) can be a significant financial decision, especiall

T1036 Home Buyers Plan (HBP) Request to Withdraw Funds from an RRSP

Understanding the Home Buyers' Plan (HBP): Is it Right for You

Considering the Home Buyers' Plan (HBP) as a potential option for utilizing funds from your Registered Retirement Savings Plan (RRSP) can be a significant financial decision, especiall

-

AUT-01 Authorize a Representative for Offline Access

What Is Authorize a Representative for Offline Access Form?

The AUT-01 Authorize a Representative for Offline Access Form is a document that allows a user to grant another person, such as a friend or family member, access to their account information in t

AUT-01 Authorize a Representative for Offline Access

What Is Authorize a Representative for Offline Access Form?

The AUT-01 Authorize a Representative for Offline Access Form is a document that allows a user to grant another person, such as a friend or family member, access to their account information in t

-

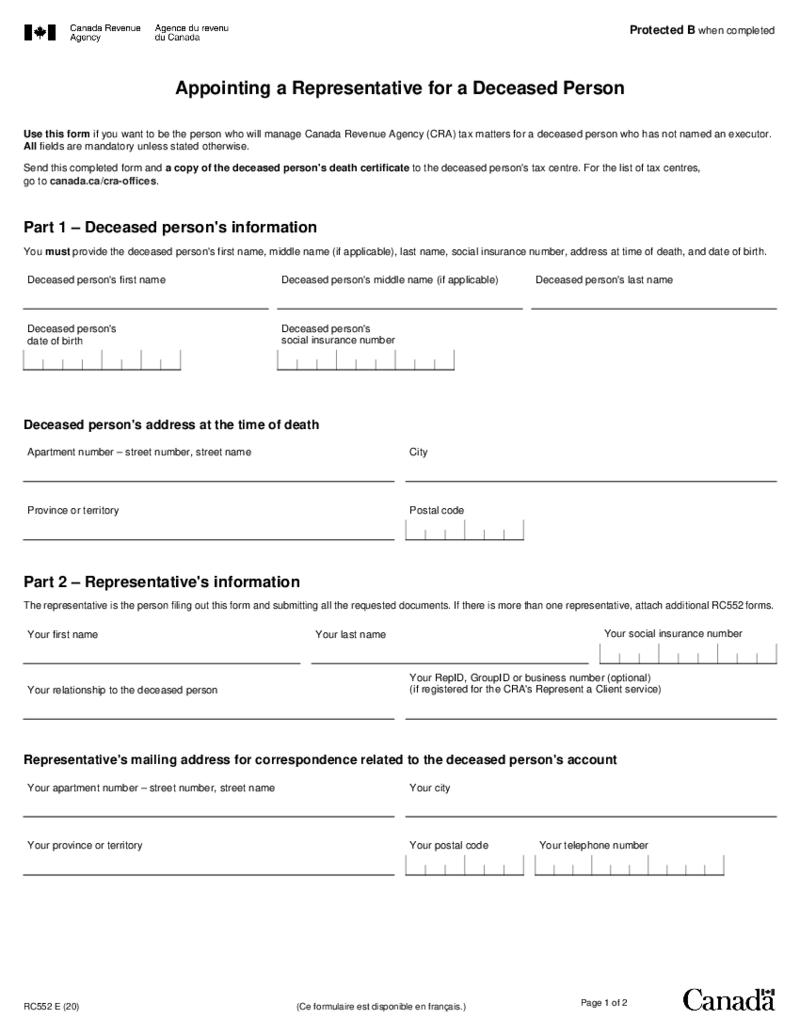

RC552 Appointing a Representative for a Deceased Person

What Is CRA Form RC552?

Also referred to as Appointing a Representative for a Deceased Person, the name of this form is pretty self-explanatory. It’s a document utilized by an individual who’s willing to handle Canada Revenue Agency tax

RC552 Appointing a Representative for a Deceased Person

What Is CRA Form RC552?

Also referred to as Appointing a Representative for a Deceased Person, the name of this form is pretty self-explanatory. It’s a document utilized by an individual who’s willing to handle Canada Revenue Agency tax

-

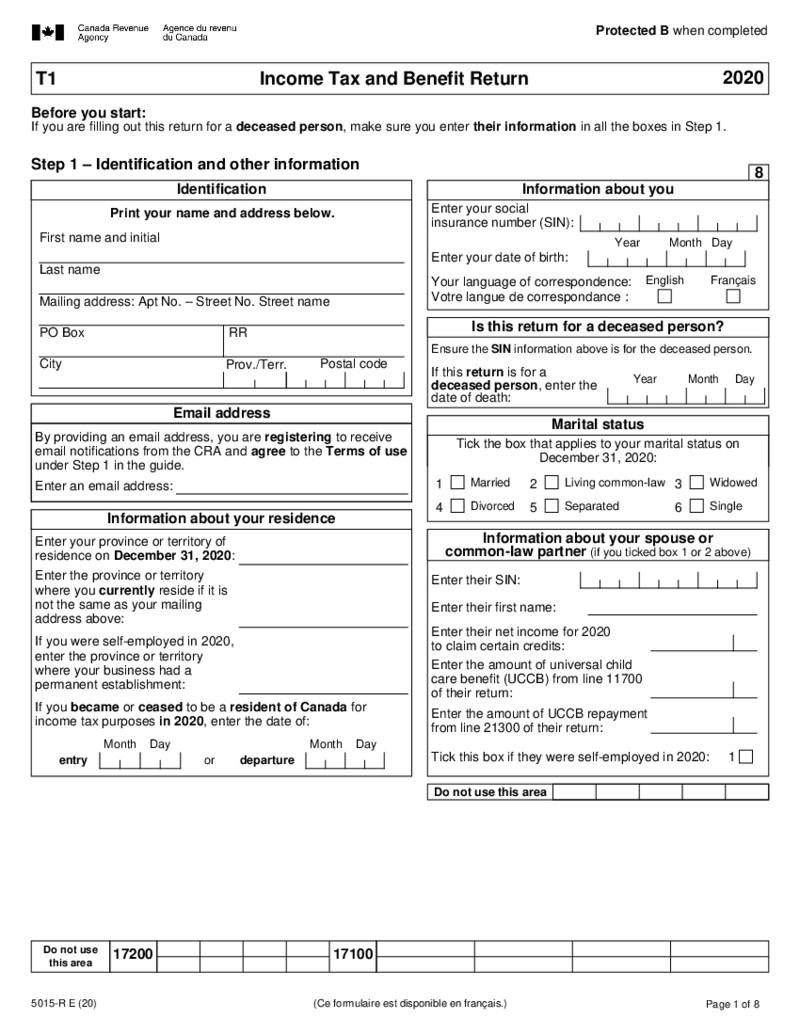

5015-R Income Tax and Benefit Return (for AB, MB and SK only)

5015-R Income Tax and Benefit Return (for AB, MB and SK only)

✓ Easily fill out and sign forms

✓ Download blank or editable online

5015-R Income Tax and Benefit Return (for AB, MB and SK only)

5015-R Income Tax and Benefit Return (for AB, MB and SK only)

✓ Easily fill out and sign forms

✓ Download blank or editable online

-

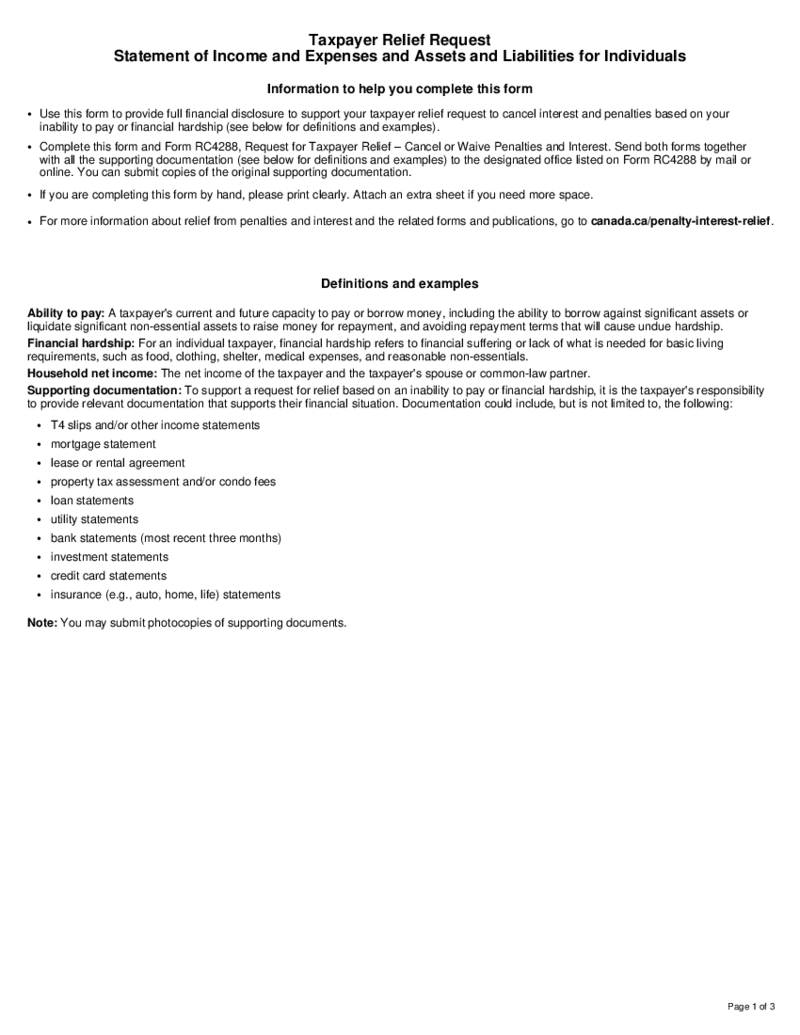

Form RC376

What Is Form RC376?

RC376 Taxpayer Relief Request is a statement of income, expenses, assets and liabilities for individuals. You might use it to request relief from the Canada Revenue Agency (CRA) for taxes you owe. The information on the CRA Taxpayer Re

Form RC376

What Is Form RC376?

RC376 Taxpayer Relief Request is a statement of income, expenses, assets and liabilities for individuals. You might use it to request relief from the Canada Revenue Agency (CRA) for taxes you owe. The information on the CRA Taxpayer Re

-

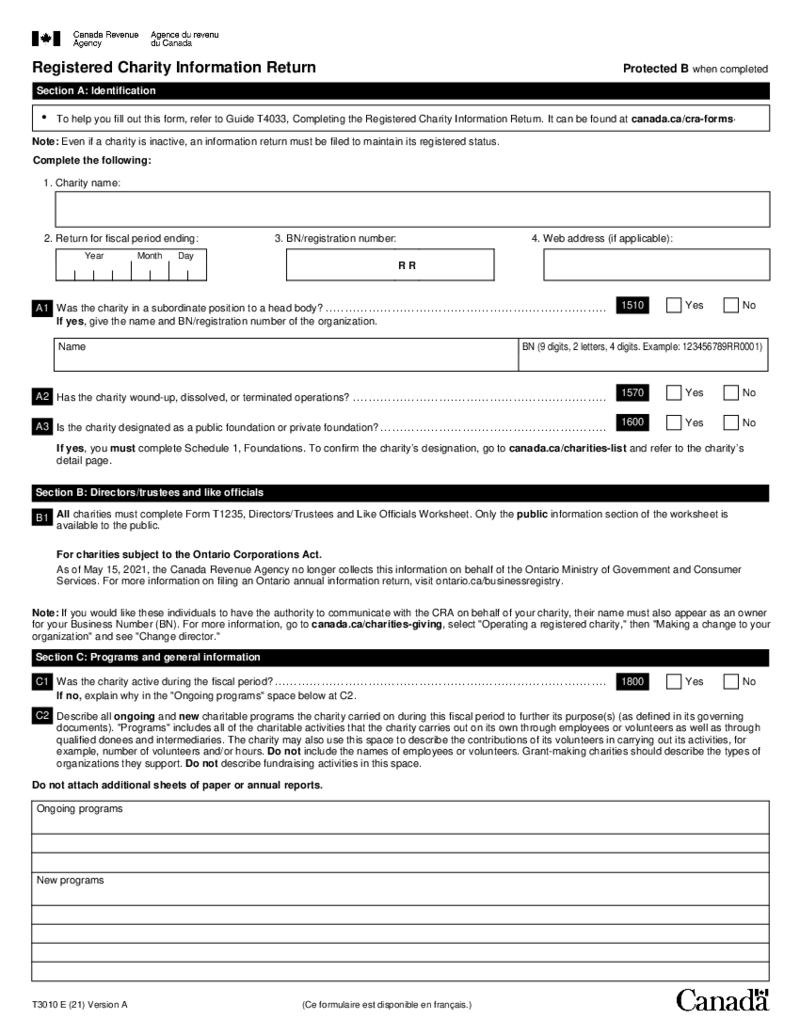

T3010 Registered Charity Information Return

What Is the T3010 Form?

The Registered Charity Information Return (Form T3010) is an annual information return that registered charities in Canada must file with the Canada Revenue Agency (CRA). The return provides information about the charity's acti

T3010 Registered Charity Information Return

What Is the T3010 Form?

The Registered Charity Information Return (Form T3010) is an annual information return that registered charities in Canada must file with the Canada Revenue Agency (CRA). The return provides information about the charity's acti

-

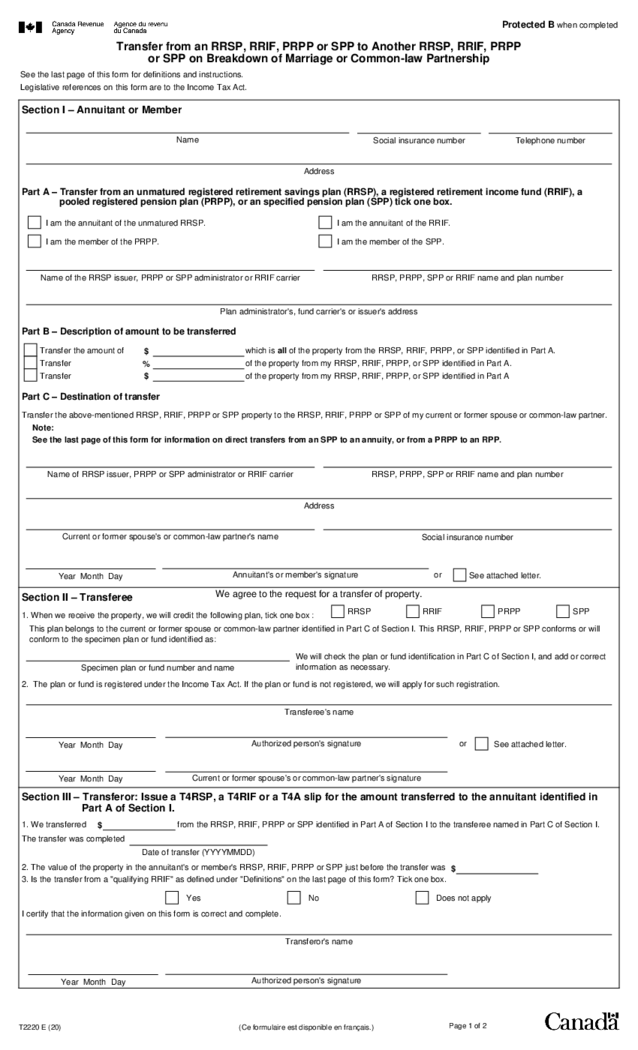

Form T2220

What Is the T2220 Form?

You might use a CRA Form T2220 to transfer money from one RRSP or RRIF to another RRSP or RRIF when a marriage breaks up. This is often done when a couple divorces, as it can help them divide their assets more evenly.

Wh

Form T2220

What Is the T2220 Form?

You might use a CRA Form T2220 to transfer money from one RRSP or RRIF to another RRSP or RRIF when a marriage breaks up. This is often done when a couple divorces, as it can help them divide their assets more evenly.

Wh

-

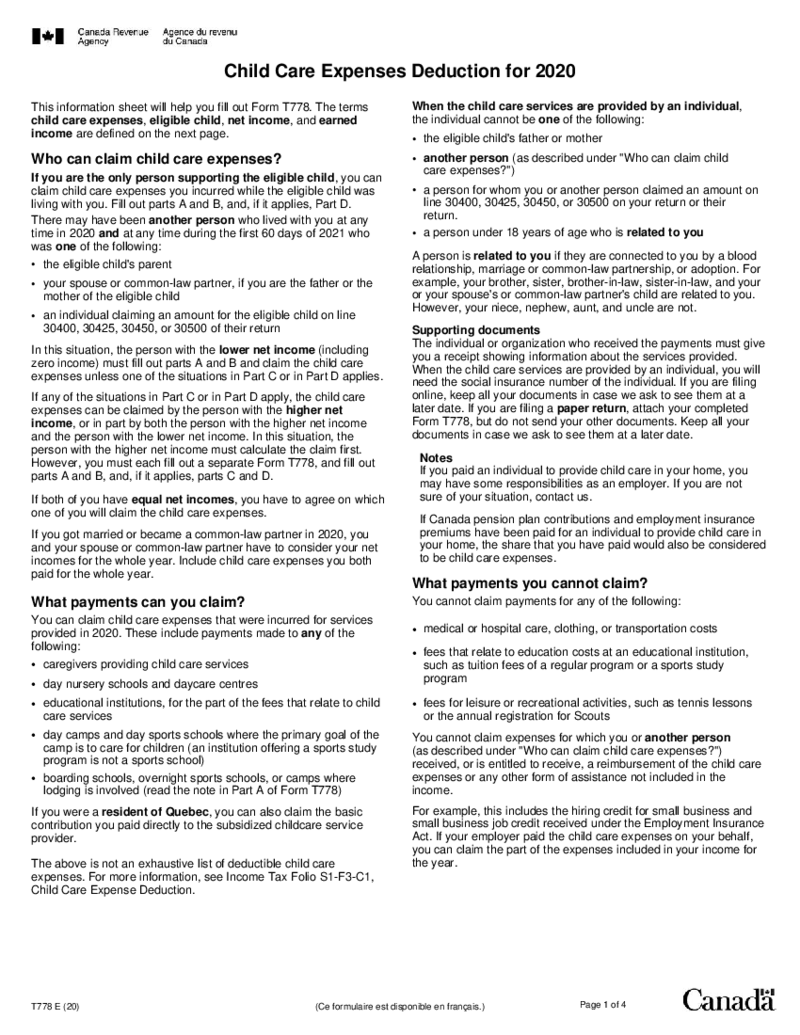

T778 Child Care Expenses Deduction for 2020

How to Get a Fillable T778 Child Care Expenses Deduction for 2020?

The form is ready to be filled and can be found in PDFLiner catalog. Either push the "Fill this form" button or follow the steps below in case you need to find the form on our we

T778 Child Care Expenses Deduction for 2020

How to Get a Fillable T778 Child Care Expenses Deduction for 2020?

The form is ready to be filled and can be found in PDFLiner catalog. Either push the "Fill this form" button or follow the steps below in case you need to find the form on our we