-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Maryland Tax Forms - page 2

-

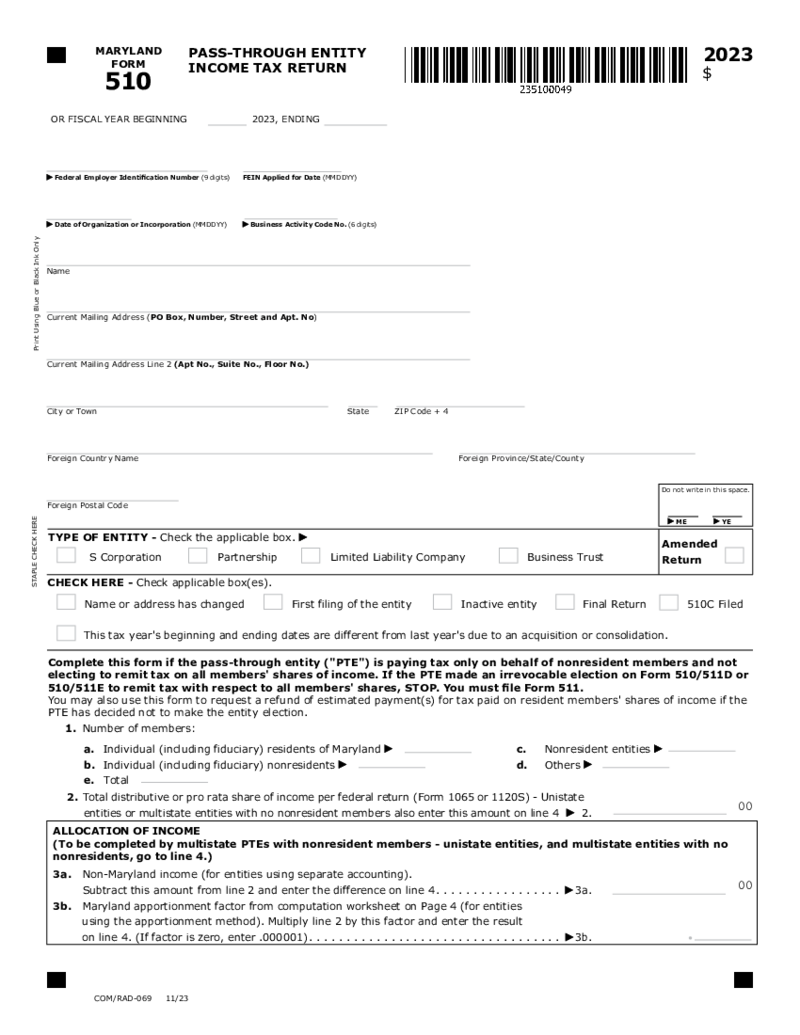

Form 510 Pass-Through Entity Tax Return

What Is Maryland 510 Form

Also known as the ‘Pass-Through Entity Income Tax Return,’ the Maryland 510 form is a crucial document for pass-through entities operating in the Old Line State. Its paramount purpose is to report income, deductions,

Form 510 Pass-Through Entity Tax Return

What Is Maryland 510 Form

Also known as the ‘Pass-Through Entity Income Tax Return,’ the Maryland 510 form is a crucial document for pass-through entities operating in the Old Line State. Its paramount purpose is to report income, deductions,

-

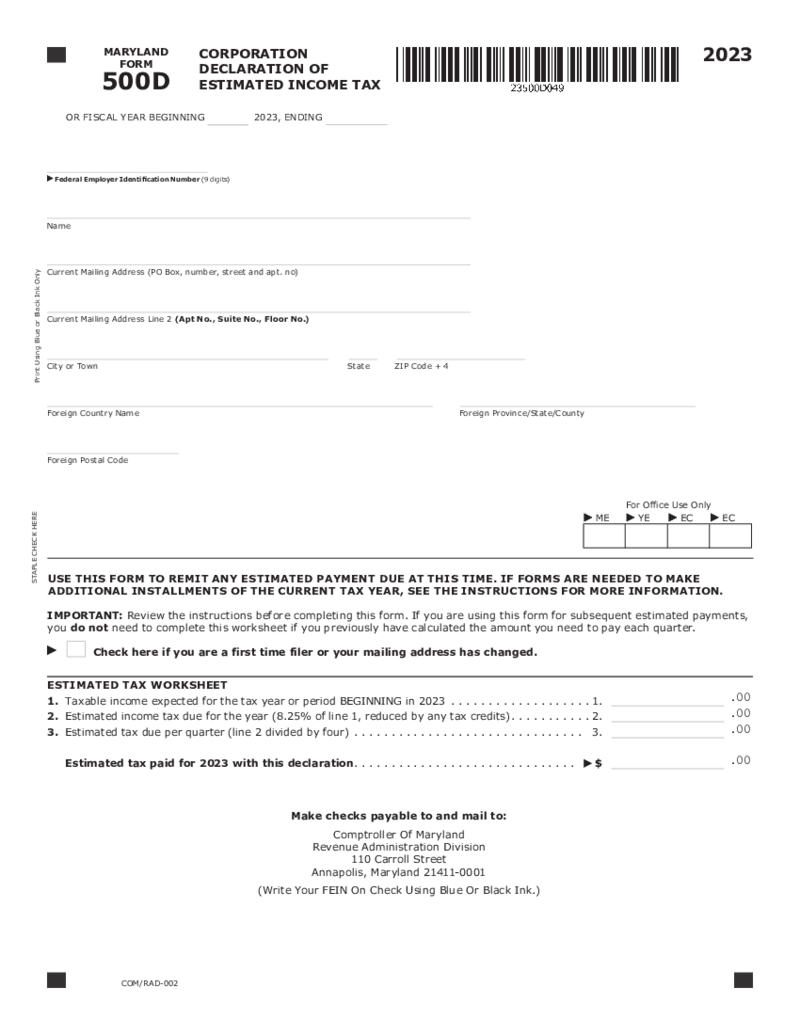

Form 500D Declaration of Estimated Corporation Income Tax

What Is Maryland Form 500D?

Form 500D is a tax document required by the Comptroller of Maryland. It's designed for corporations to calculate and remit estimated tax payments. If your corporation expects to owe $1,000 or more in total tax for the year,

Form 500D Declaration of Estimated Corporation Income Tax

What Is Maryland Form 500D?

Form 500D is a tax document required by the Comptroller of Maryland. It's designed for corporations to calculate and remit estimated tax payments. If your corporation expects to owe $1,000 or more in total tax for the year,

-

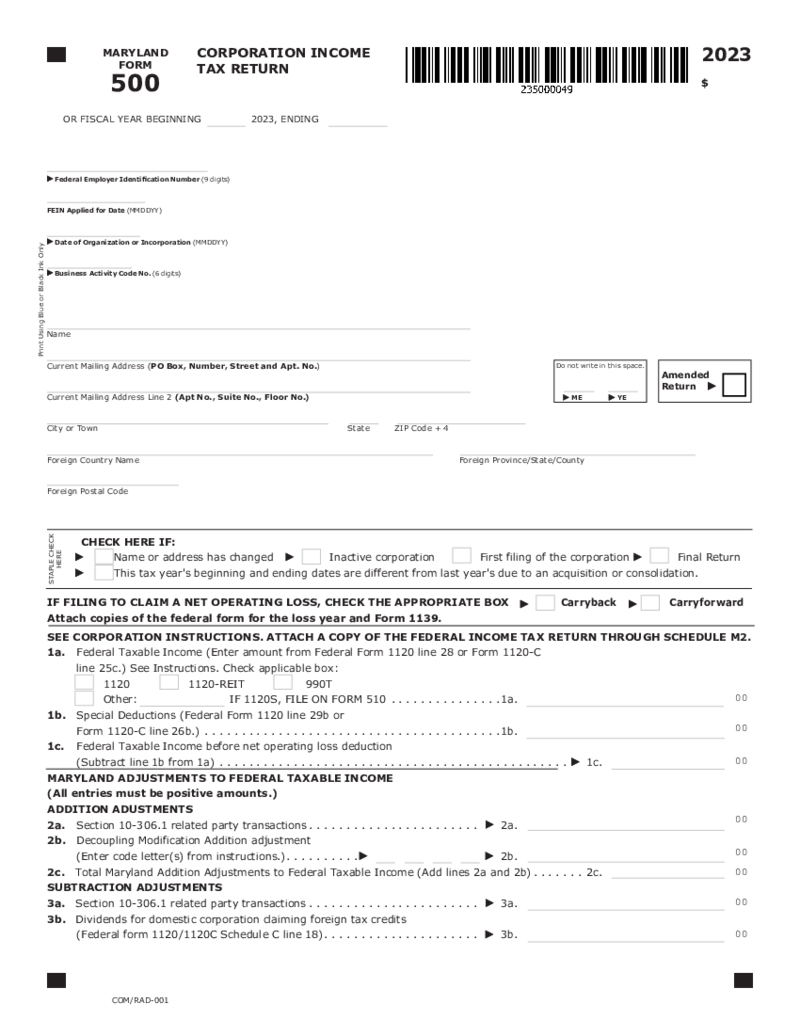

Form 500 Maryland Corporation Income Tax Return

What Is the 500 Form Maryland?

The digital age has greatly simplified the process of filing taxes, and an exemplary part of this process is the Form 500. This is the standard income tax return form for Maryland corporations. This document is vital for cor

Form 500 Maryland Corporation Income Tax Return

What Is the 500 Form Maryland?

The digital age has greatly simplified the process of filing taxes, and an exemplary part of this process is the Form 500. This is the standard income tax return form for Maryland corporations. This document is vital for cor

-

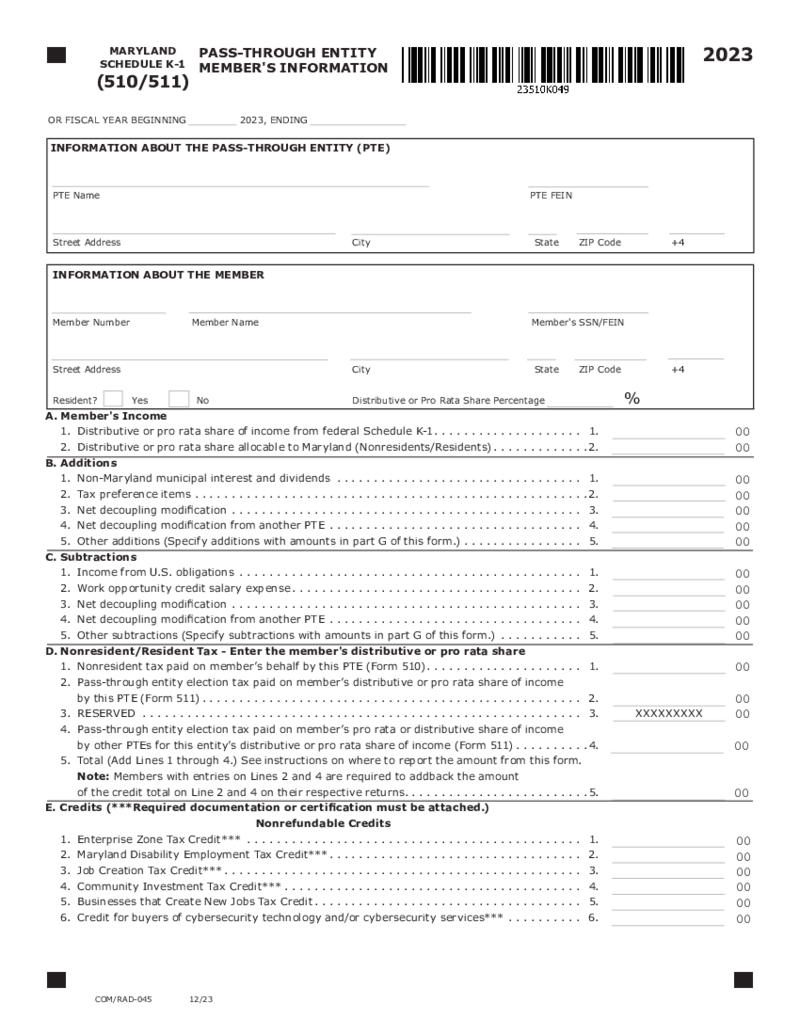

Form 510 Schedule K-1 Maryland Pass-Through Entity Members Information

What Is the Maryland Form 510 Schedule K 1?

The Maryland Form 510 Schedule K-1, or the Pass-Through Entity Members Information Form, is a state tax document used in M

Form 510 Schedule K-1 Maryland Pass-Through Entity Members Information

What Is the Maryland Form 510 Schedule K 1?

The Maryland Form 510 Schedule K-1, or the Pass-Through Entity Members Information Form, is a state tax document used in M

-

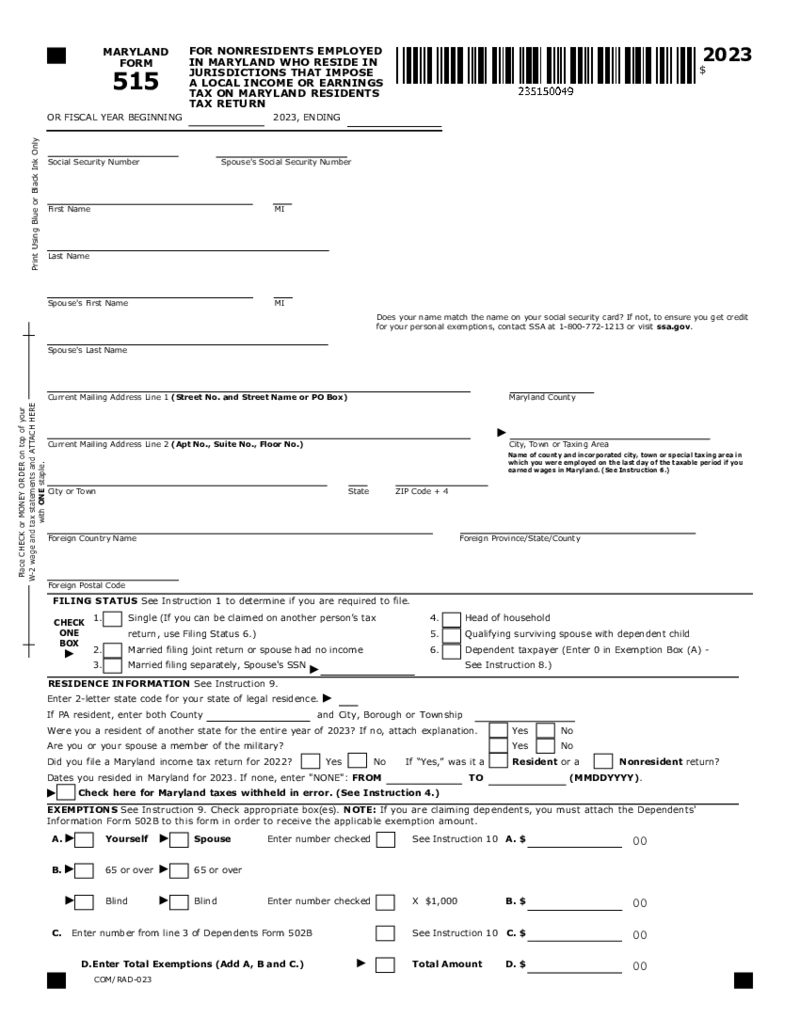

Maryland Tax Form 515

What Is Maryland 515 Form?

When tax season arrives, Maryland residents and those with income sourced from the state may find themselves fa

Maryland Tax Form 515

What Is Maryland 515 Form?

When tax season arrives, Maryland residents and those with income sourced from the state may find themselves fa

-

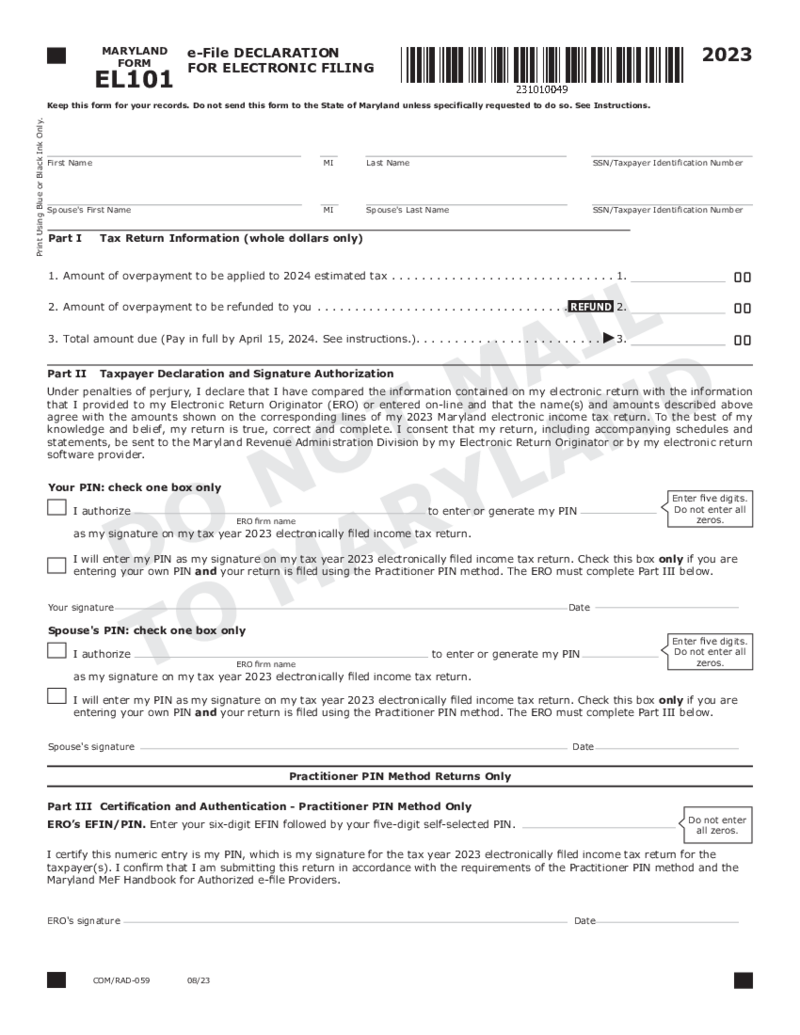

Maryland Form EL101

What is the Maryland EL101 form?

Fillable Maryland EL101 form is the document that declares and authorizes electronically sent the return of the Electronic Return Organization. Download Maryland EL101 document and complete it while using the Practitioner

Maryland Form EL101

What is the Maryland EL101 form?

Fillable Maryland EL101 form is the document that declares and authorizes electronically sent the return of the Electronic Return Organization. Download Maryland EL101 document and complete it while using the Practitioner

-

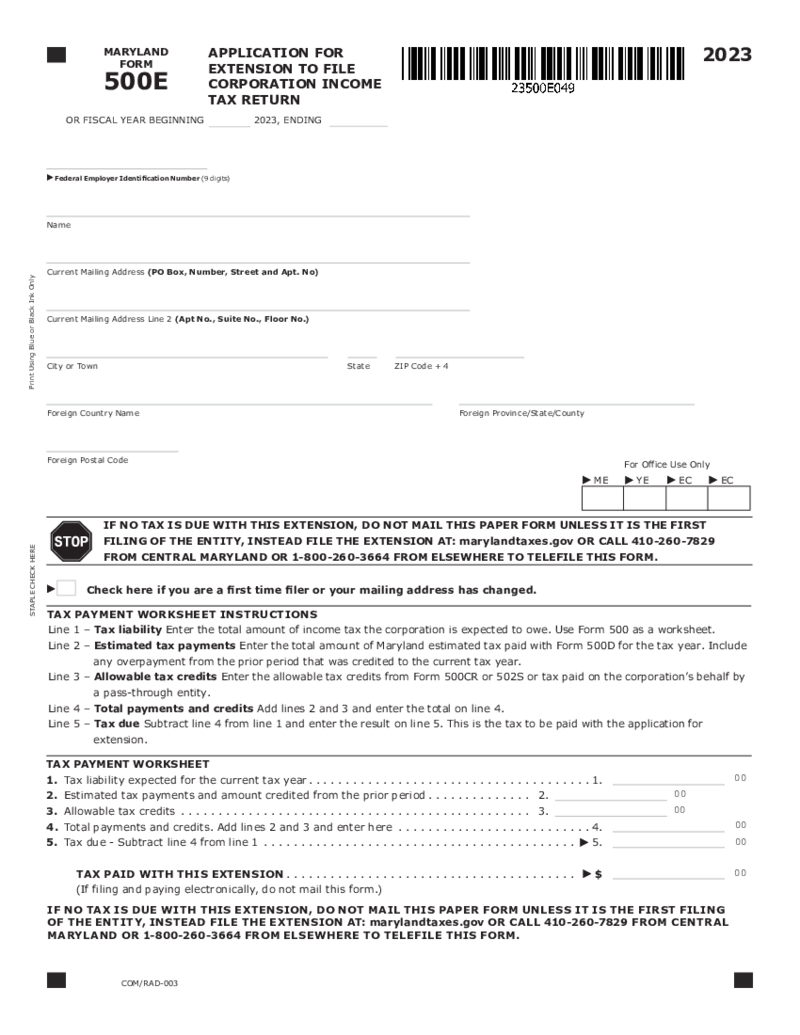

Form 500E Application for an Extension to File Corporation Income Tax Return

What Is Maryland Form 500E?

The Maryland Form 500E serves as an application that grants corporations an extension of time to file their Maryland income tax return. It's crucial for businesses that need extra time beyond the April 15 deadline to ensure

Form 500E Application for an Extension to File Corporation Income Tax Return

What Is Maryland Form 500E?

The Maryland Form 500E serves as an application that grants corporations an extension of time to file their Maryland income tax return. It's crucial for businesses that need extra time beyond the April 15 deadline to ensure

-

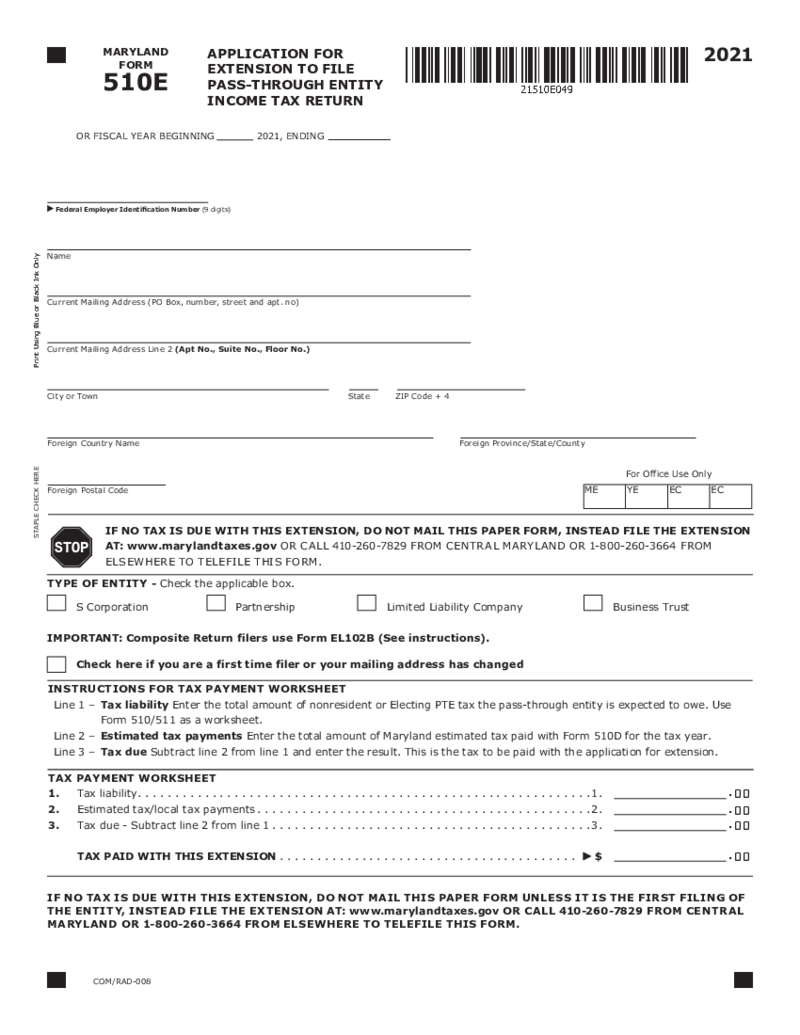

Maryland Form 510E (2021)

What Is a Maryland Form 510e

Navigating the complex world of taxes, Maryland Form 510E stands out as a beacon for entities seeking extra time to file their pass-through entity tax returns. This form, specifically designed for use in Maryland, requests an

Maryland Form 510E (2021)

What Is a Maryland Form 510e

Navigating the complex world of taxes, Maryland Form 510E stands out as a beacon for entities seeking extra time to file their pass-through entity tax returns. This form, specifically designed for use in Maryland, requests an

-

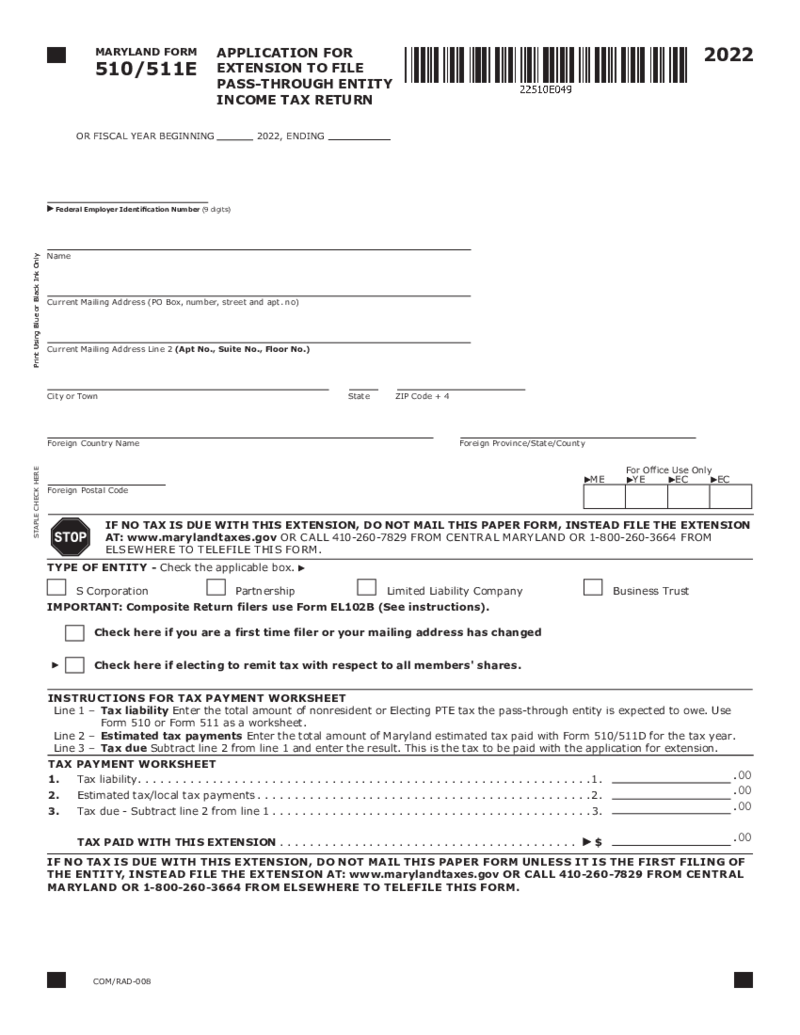

Form 510E - 511E Application for Extension to File Pass-Through Entity

What is Maryland Form 510E

The Maryland Form 510E, also known as the Application for Extension to File Pass-Through Entity Income Tax Return, is a legal document that allows pass-through entities such as S corporations, partnerships, limited liability com

Form 510E - 511E Application for Extension to File Pass-Through Entity

What is Maryland Form 510E

The Maryland Form 510E, also known as the Application for Extension to File Pass-Through Entity Income Tax Return, is a legal document that allows pass-through entities such as S corporations, partnerships, limited liability com

FAQ:

-

When will Maryland tax forms be available?

Maryland forms are always available on the official website and on PDFLiner. If you are looking for the updates they usually appear close to the time when you need to fill the report. However, you can check the website once a week. Don’t miss the deadline for tax forms or you will be fined.

-

Where to file Maryland tax forms?

Maryland officials offer two ways to send the forms. You can either send them electronically, using the website or you can send them by regular mail. Each form has its own demands and addresses mentioned by the government.