-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Other tax forms - page 9

-

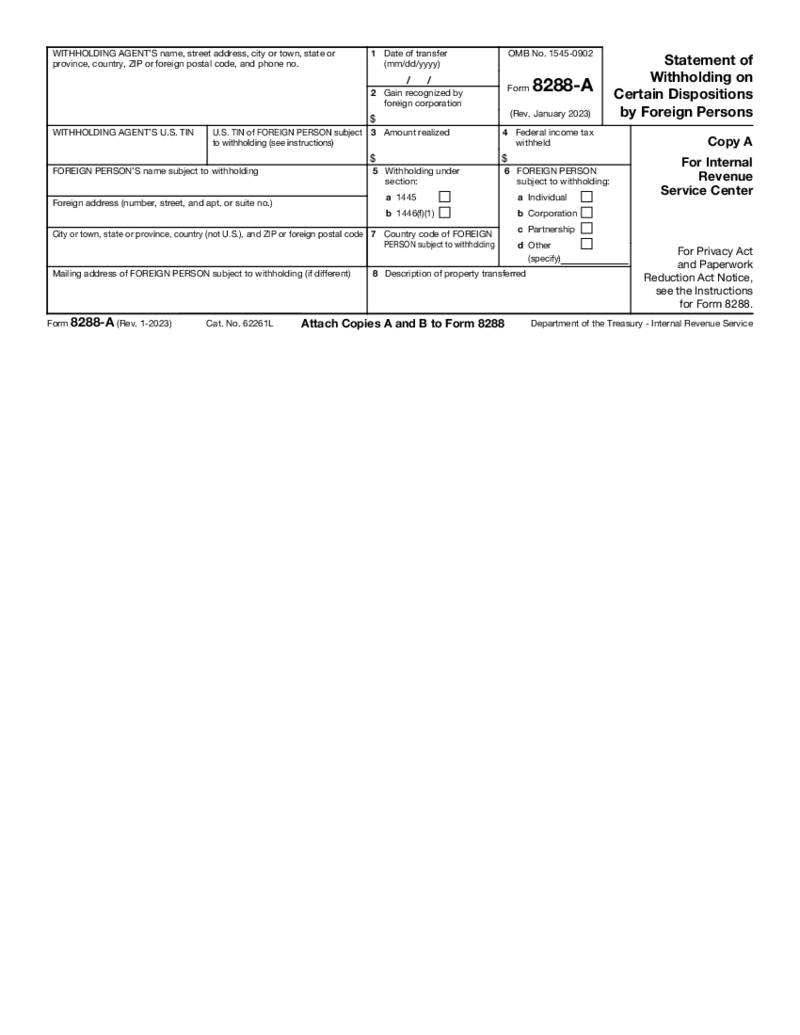

Form 8288-A (2023)

What is Form 8288-A 2024?

The 8288 A form is called Statement of Withholding on Dispositions by Foreign Persons of US Real Property Interests. This document is used with another form 8288. It is a well-known statement for the transferees and buyers. You m

Form 8288-A (2023)

What is Form 8288-A 2024?

The 8288 A form is called Statement of Withholding on Dispositions by Foreign Persons of US Real Property Interests. This document is used with another form 8288. It is a well-known statement for the transferees and buyers. You m

-

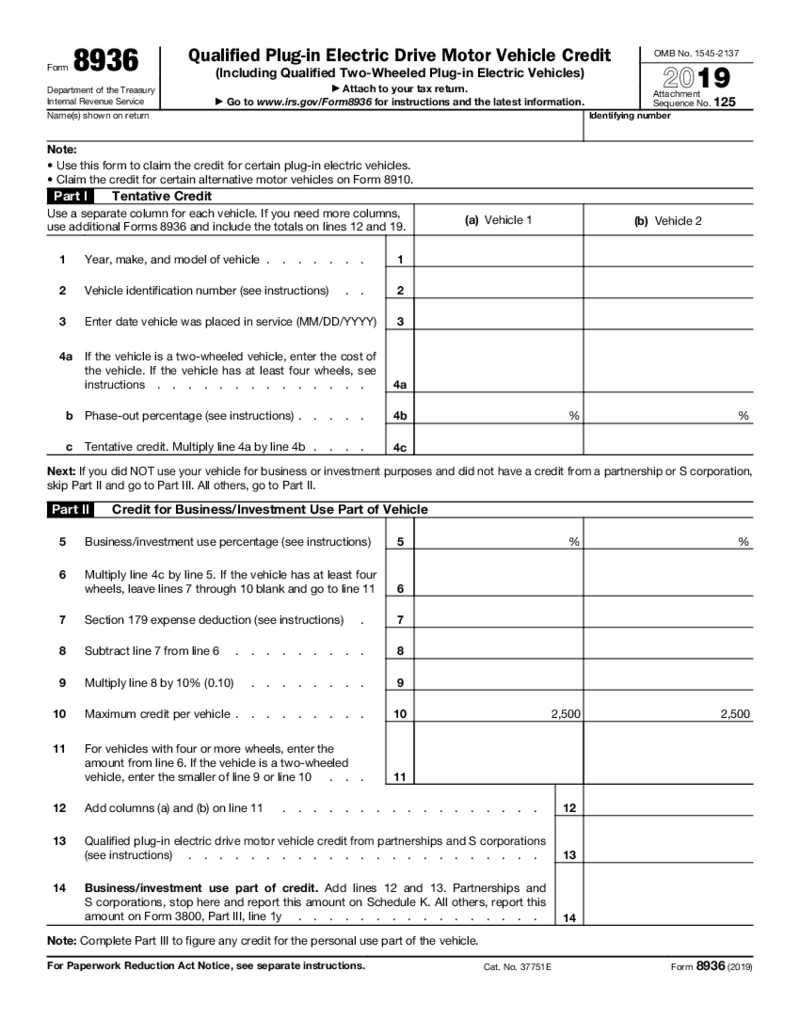

IRS Form 8936 (2019)

What Is Form 8936 2019

Form 8936 for 2019, also recognized as the Qualified Plug-in Electric Drive Motor Vehicle Credit form, is a document provided by the Internal Revenue Service (IRS) that taxpayers use to figure out

IRS Form 8936 (2019)

What Is Form 8936 2019

Form 8936 for 2019, also recognized as the Qualified Plug-in Electric Drive Motor Vehicle Credit form, is a document provided by the Internal Revenue Service (IRS) that taxpayers use to figure out

-

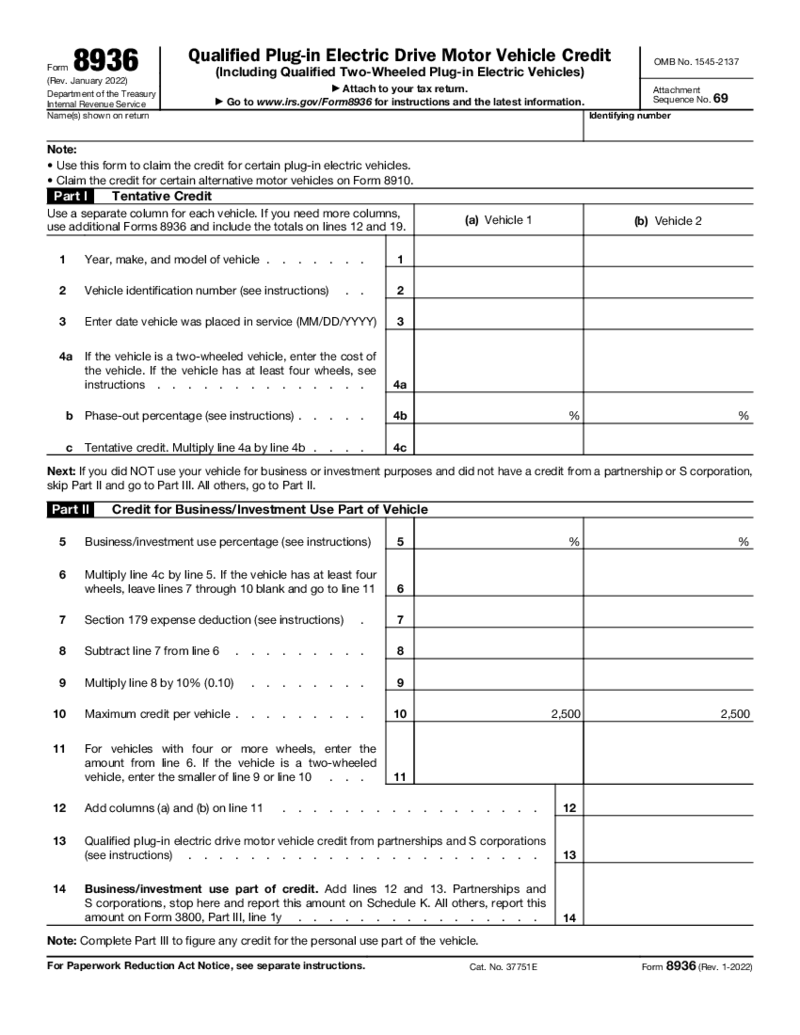

Form 8936

What Is A Form 8936

Form 8936 is a tax document issued by the Internal Revenue Service (IRS) entitled 'Qualified Plug-in Electric Drive Motor Vehicle Credit.' This form is integral for individuals who have purchased a qualif

Form 8936

What Is A Form 8936

Form 8936 is a tax document issued by the Internal Revenue Service (IRS) entitled 'Qualified Plug-in Electric Drive Motor Vehicle Credit.' This form is integral for individuals who have purchased a qualif

-

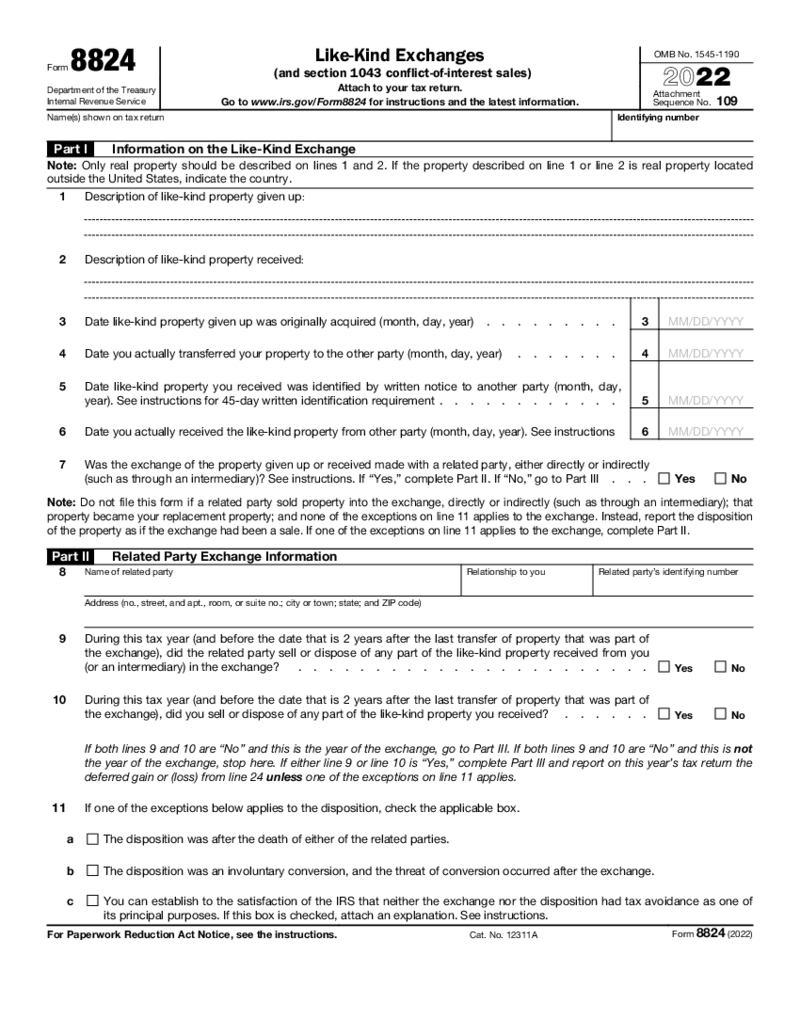

Form 8824

What is The 8824 Form?

IRS Form 8824 is a two-page document used in various exchange transactions. For example, you can sell some business objects, say real estate, for a higher price than you bought them. Such capital gains should be taxable, but you can

Form 8824

What is The 8824 Form?

IRS Form 8824 is a two-page document used in various exchange transactions. For example, you can sell some business objects, say real estate, for a higher price than you bought them. Such capital gains should be taxable, but you can

-

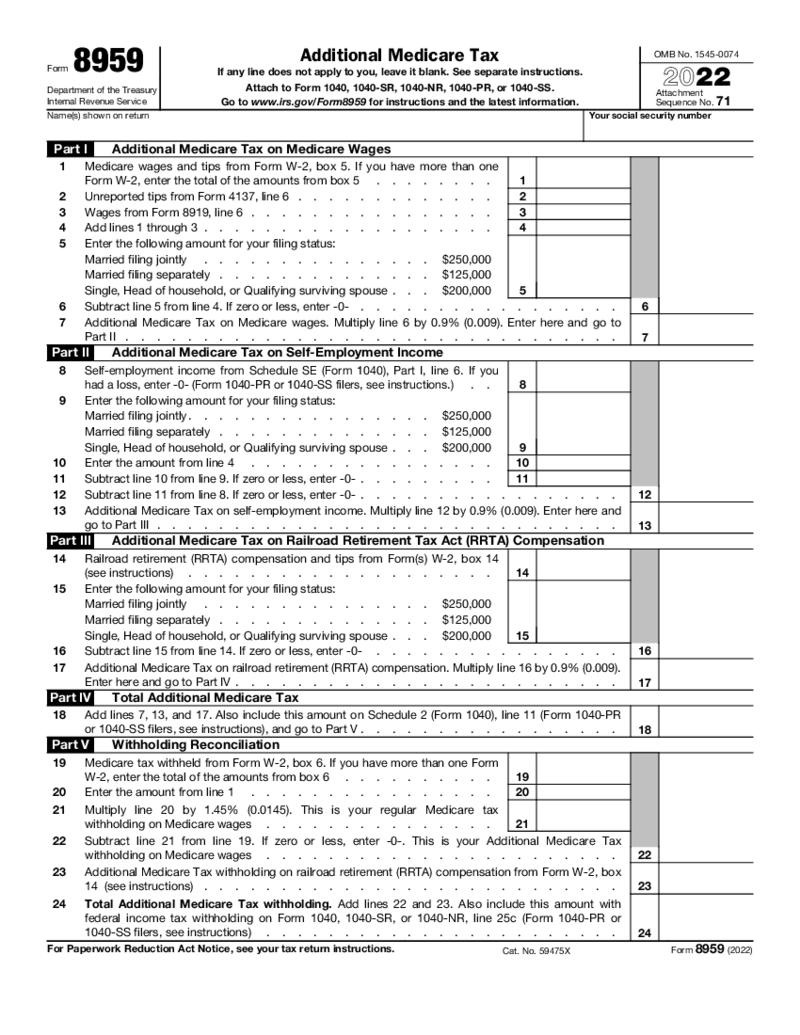

Form 8959

What is Form 8959?

The 8959 Form is an application that is used to calculate additional medicare tax. It needs to be completed only by those whose medicare wages are over the established threshold. This document is an addition to your main tax return.

Form 8959

What is Form 8959?

The 8959 Form is an application that is used to calculate additional medicare tax. It needs to be completed only by those whose medicare wages are over the established threshold. This document is an addition to your main tax return.

-

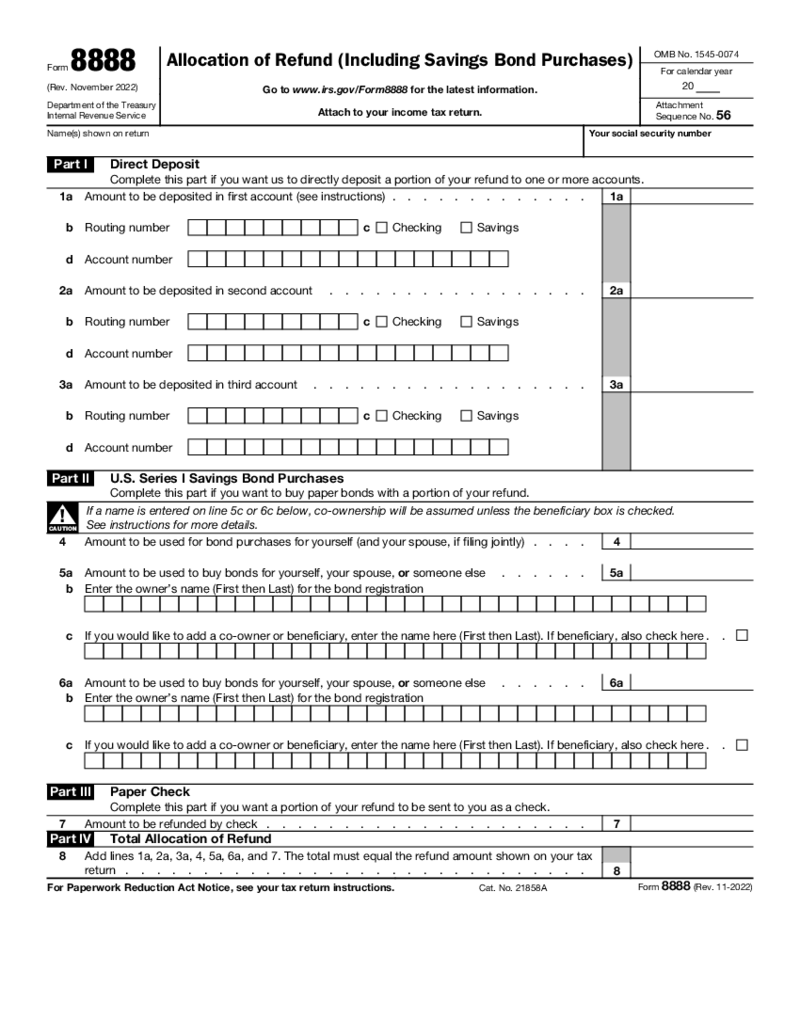

Form 8888

What is Form 8888?

The 8888 tax form is a one-page application to distribute the refunds you receive to different bank accounts or funds or to purchase bonds. That is, instead of receiving funds and allocating them on your own, you can arrange a direct tr

Form 8888

What is Form 8888?

The 8888 tax form is a one-page application to distribute the refunds you receive to different bank accounts or funds or to purchase bonds. That is, instead of receiving funds and allocating them on your own, you can arrange a direct tr

-

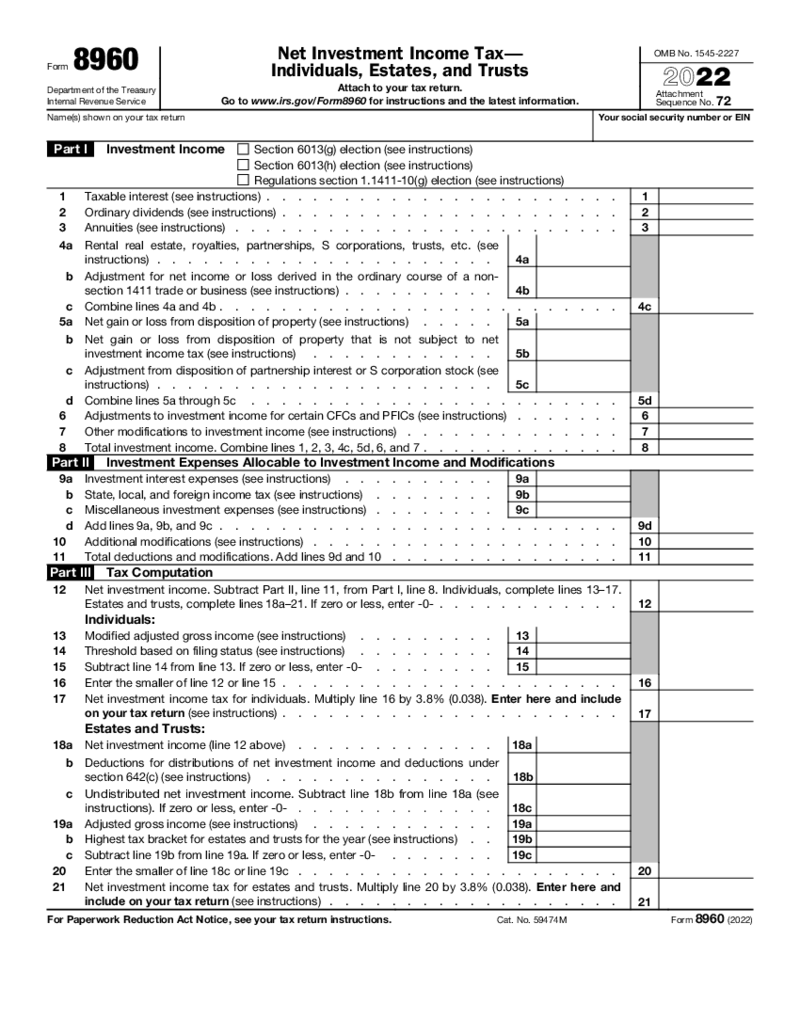

Form 8960

What is an 8960 Form?

The tax form 8960 is an application for calculating taxes on your income from interest, dividends, annuities, and so on. Depending on the size of your gross income (MAGI), you might need to complete this document with your return for

Form 8960

What is an 8960 Form?

The tax form 8960 is an application for calculating taxes on your income from interest, dividends, annuities, and so on. Depending on the size of your gross income (MAGI), you might need to complete this document with your return for

-

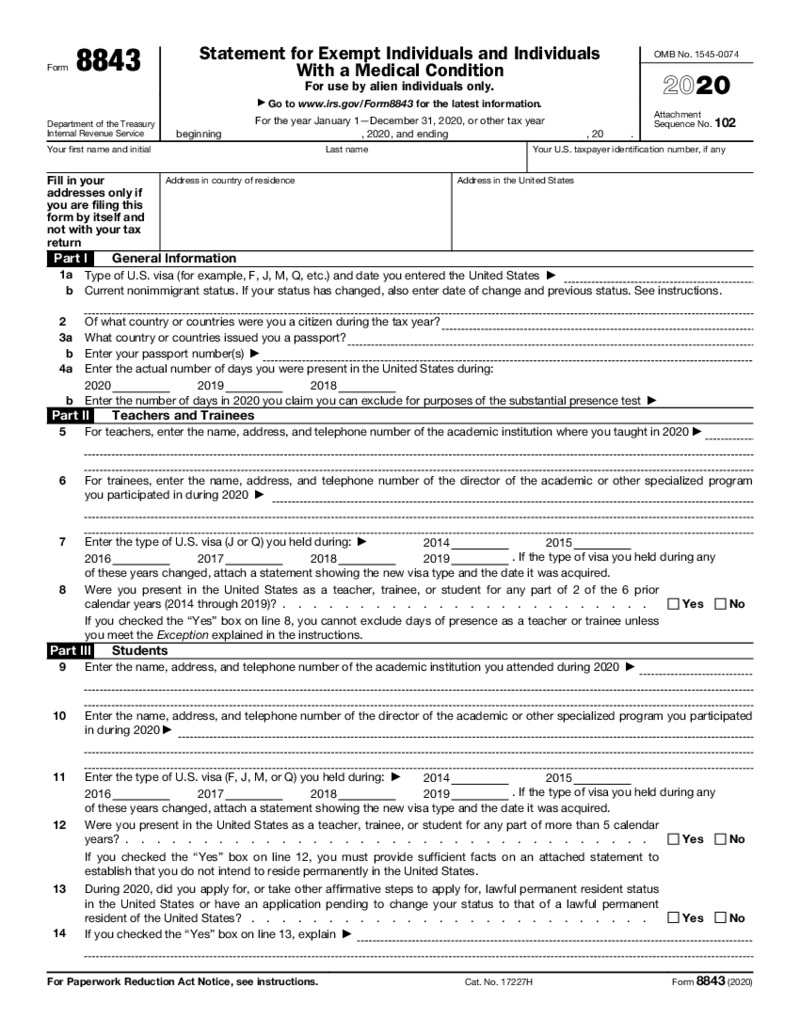

Form 8843 (2020)

Where to Get Fillable Form 8843 Example?

The form is ready to be filled and can be found in PDFLiner catalog. First of all click "Fill this form" button, and in case you'd like to find it letter see the steps below:

Enter y

Form 8843 (2020)

Where to Get Fillable Form 8843 Example?

The form is ready to be filled and can be found in PDFLiner catalog. First of all click "Fill this form" button, and in case you'd like to find it letter see the steps below:

Enter y

-

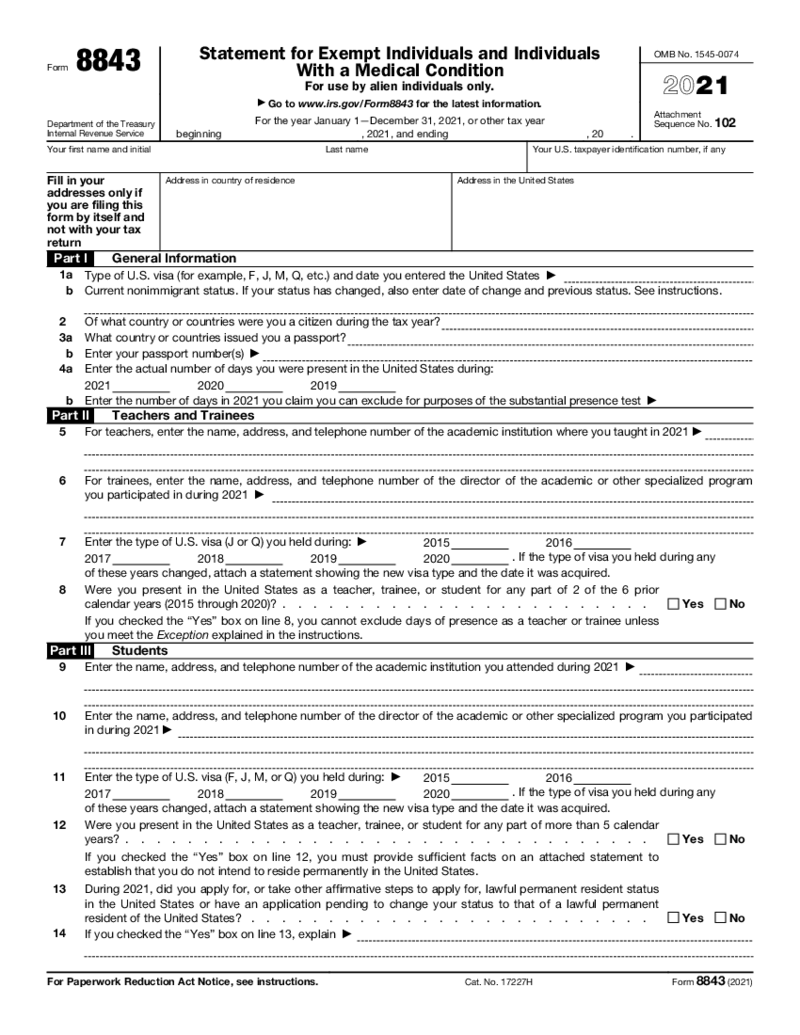

Form 8843 (2021)

What Is Form 8843 2021

Form 8843 for 2021 is a tax form specifically designed for certain nonresident alien individuals in the United States, including those with F, J, M, or Q visas. Its primary purpose is to explain the nature of their presence in the U

Form 8843 (2021)

What Is Form 8843 2021

Form 8843 for 2021 is a tax form specifically designed for certain nonresident alien individuals in the United States, including those with F, J, M, or Q visas. Its primary purpose is to explain the nature of their presence in the U

-

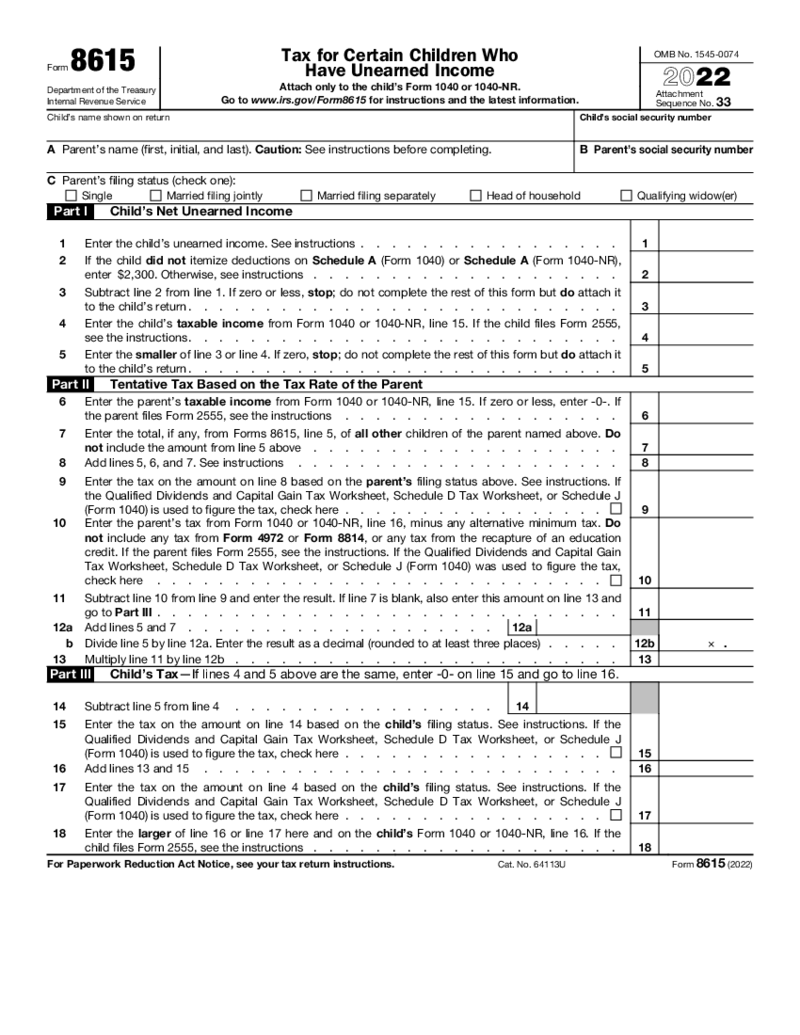

Form 8615

What Is Form 8615?

If you are looking for what is tax form 8615, you have come to the right place. This form is called Tax for Certain Children Who Have Unearned Income. It is used only with the 1040NR or 1040 form for the child. The 8615 form was created

Form 8615

What Is Form 8615?

If you are looking for what is tax form 8615, you have come to the right place. This form is called Tax for Certain Children Who Have Unearned Income. It is used only with the 1040NR or 1040 form for the child. The 8615 form was created

-

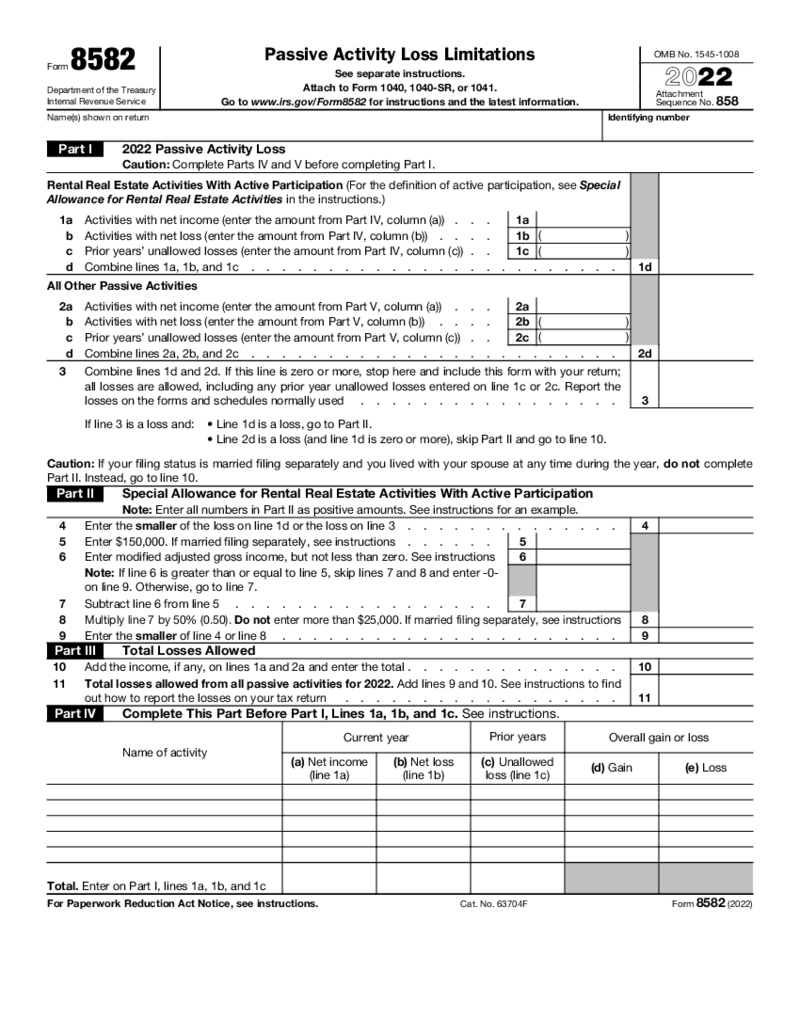

Form 8582

What is Form 8582?

Read this section to understand what is form 8582. The form is known as the Passive Activity Loss Limitations. The document was created by the Department of the Treasury Internal Revenue Service and must be filed there as well. The 8582

Form 8582

What is Form 8582?

Read this section to understand what is form 8582. The form is known as the Passive Activity Loss Limitations. The document was created by the Department of the Treasury Internal Revenue Service and must be filed there as well. The 8582

-

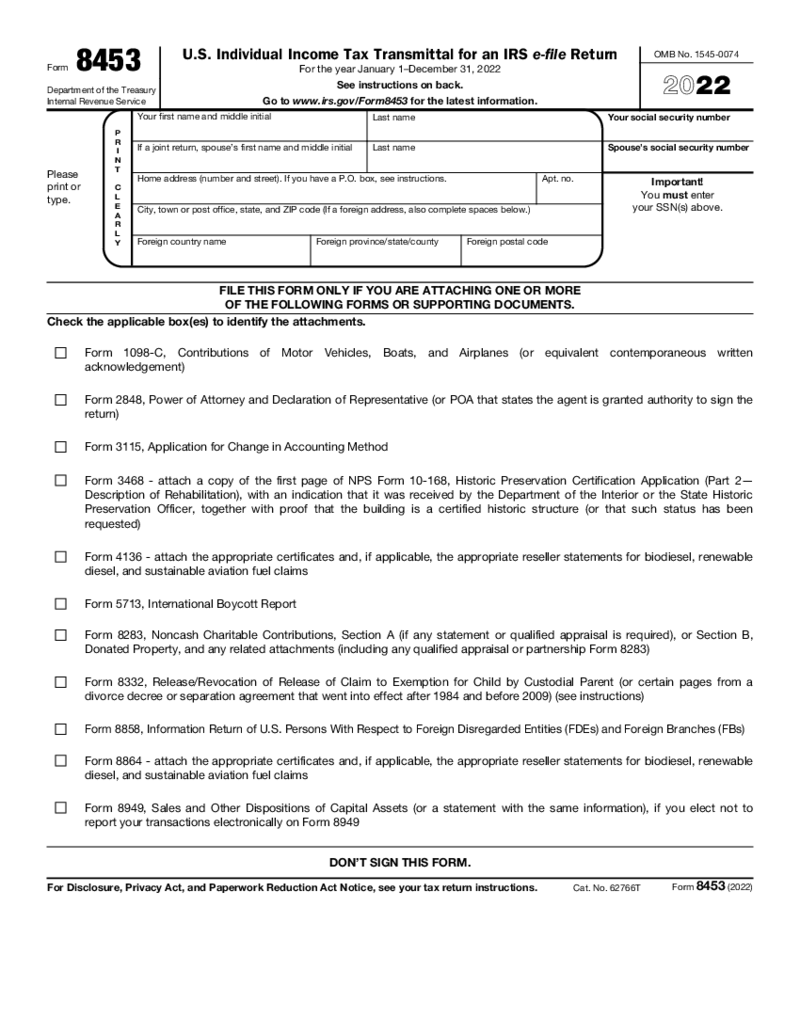

Form 8453

What Is Form 8453?

The 8453 form is also known as the US Individual Income Tax Transmittal for an IRS e-file Return. There is a strict deadline for the document to be filed which must be followed. You need to mail this form within 48 hours after IRS accep

Form 8453

What Is Form 8453?

The 8453 form is also known as the US Individual Income Tax Transmittal for an IRS e-file Return. There is a strict deadline for the document to be filed which must be followed. You need to mail this form within 48 hours after IRS accep

FAQ

-

What tax forms do I need?

That depends on a wide variety of factors, such as the state you live in, the specificity of your work, the format of your operation, and the like. You can consult a tax expert if you have questions on these nuances.

-

What are allowances on tax forms?

A withholding allowance is an exemption reducing the amount of income tax withheld from an employee’s wages. Upon determining your employees’ withholding allowances, you can easily pinpoint their federal income taxes.

-

When will unemployment send out tax forms?

You’re probably trying to ask us when your state unemployment office will mail you Form 1099-G (the total amount of taxable unemployment payment). The due date in this respect is January 31.

-

Where can I pick up tax forms?

You can head to your local IRS office or a post office, or library that offers tax forms. But why all the fuss if you can download the needed tax templates from our digital library. Give PDFLiner a go and you’ll forget about the alternative (and rather subpar) methods.