-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

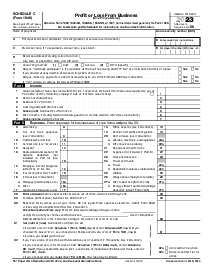

Qualified Dividends and Capital Gain Tax Worksheet (2018)

Get your Qualified Dividends and Capital Gain Tax Worksheet (2018) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Qualified Dividends and Capital Gain Tax Worksheet

The Qualified Dividends and Capital Gain Tax Worksheet is essential for taxpayers who have received dividends or realized capital gains during the tax year. This particular worksheet assists in calculating the tax owed on these specific types of income using lower tax rates. The purpose is to ensure that individuals benefit from the preferential tax treatment afforded to these income categories under the Internal Revenue Code.

How To Fill Out Qualified Dividends and Capital Gain Tax Worksheet Instructions

Filling out the worksheet involves a step-by-step guide to ensure accuracy and compliance:

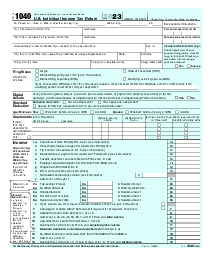

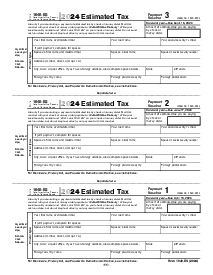

- Step 1: Gather all necessary tax documents, including your Form 1040, 1099-DIV, and 1099-B.

- Step 2: Input your taxable income from Form 1040 on the worksheet.

- Step 3: Add your qualified dividends and long-term capital gains to this amount.

- Step 4: Follow subsequent lines to subtract deductions and apply specific rates to portions of your income.

- Step 5: Calculate the preliminary tax figures based on these rates.

- Step 6: Compare the result with your standard tax liability figure, computed without the lower rates.

- Step 7: Use the lesser of the two figures to determine the tax.

- Step 8: Complete the remaining steps to adjust this figure with any other tax credits or payments, arriving at the final tax due.

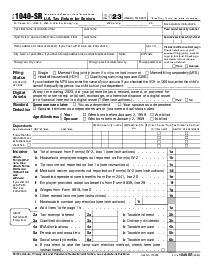

Which Taxpayers Will Use The Qualified Dividends and Capital Gain Tax Worksheet

The form is generally utilized by taxpayers who meet certain conditions. These taxpayers include:

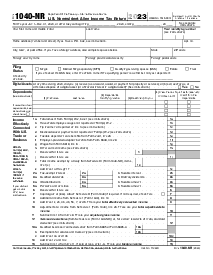

- Individuals who have invested in the stock market or mutual funds have received distributions or sold assets for a gain.

- Taxpayers with investment portfolios that generate dividends are qualified according to tax laws.

- Those with a combination of ordinary income and investment income are in a position to benefit from the lower tax rates on qualified dividends and long-term capital gains.

Each year, the IRS provides a range of tax worksheets and forms tailored to the varied financial scenarios of taxpayers. The form is specifically designed for those with investment income and is a critical tool in calculating their correct tax liability.

Fillable online Qualified Dividends and Capital Gain Tax Worksheet (2018)