-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Form TP-385

Get your New York Form TP-385 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Tp-385 Tax Form

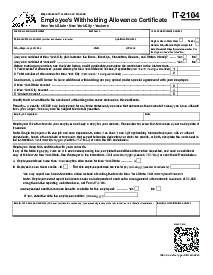

New York form TP-385 is a state-specific tax document used by residents or part-time residents for specific tax reporting purposes. This form is typically associated with real property transactions or other situations requiring documentation from the New York State Department of Taxation and Finance. The primary function of the TP-385 form is to ensure that appropriate details about certain transactions are reported accurately, complying with the state tax laws.

When to Use Tp-385 Tax Form

The TP-385 Tax form has its particular uses for individuals or entities partaking in specific activities:

- The form may be required for reporting the sale or transfer of real property within New York State.

- Companies involved in mergers or acquisitions might need to file this form as part of the tax implications of the transaction.

- The TP-385 can play a part in tax planning or filing related to estates, trusts, or inheritances.

- In cases of legal settlements of property or assets in New York, this form might be necessary.

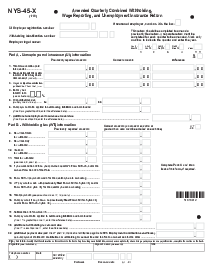

How To Fill Out Nys Tax Form Tp-385 Instruction

Step-by-step Instruction to Fill Out New York form TP-385

- Enter your personal identification or business information. This might include your full name, social security number (or employer identification number for businesses), address, and other required contact information.

- Indicate the tax year or period you are filing the form. If the form applies to a specific date, enter the correct date.

- Enter your income details as requested on the form. This could include wages, business income, interest, dividends, or any other sources of income.

- If applicable, itemize your deductions and calculate any tax credits for which you are eligible. Be sure only to claim deductions and credits that are allowed under New York tax law.

- Follow the form's instructions for calculating your tax. This could involve applying certain rates to your adjusted gross or taxable income figure.

- If you are due a refund, provide the details for the account to which you would like the refund to be deposited. If you owe tax, calculate the amount and prepare to submit payment by the due date.

- Once all sections of the form are complete, review the form for accuracy. Sign and date the form where indicated. If you are filing jointly, both parties need to sign the form.

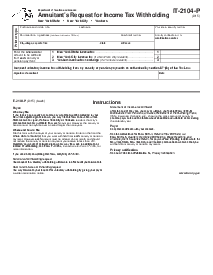

Fillable online New York Form TP-385