-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Form ST-129

Get your New York Form ST-129 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is New York State Form St 129

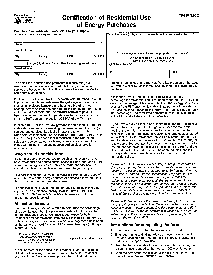

New York State form ST-129 is an essential document for certain taxpayers who wish to claim a sales tax exemption on lodging expenses. It specifically applies to eligible organizations, such as religious, charitable, or educational entities, when they make accommodations-related purchases within the state. This form is legally binding and ensures that qualifying groups receive the tax benefits they're entitled to, provided accommodations align with the organization's tax-exempt purpose.

When to Use New York State Tax Form St 129

This form is utilized in several situations, all centered around lodging purchases. Here are the scenarios where New York State Tax form ST-129 comes into play:

- When an organization books a hotel or motel for activities related to its exempt purposes.

- Utilized during stays for official conferences, retreats, or meetings that further the organization’s mission.

- If the accommodation is needed for employees or authorized representatives of the exempt organization during travel for charitable work.

- When lodging is essential for carrying out educational activities in line with the organization's exempt status.

Notably, the form is not applicable for individual use and cannot be used for personal employee vacations or any non-exempt activities carried out by the organization.

How To Fill Out New York State St 129 Form

The form must be properly completed and presented to the hotel or motel operator upon check-in or check-out.

Hotel or Motel Information:

Enter the Name and the Address of the hotel or motel where you will be staying.

Indicate the City, State, ZIP code, and Country if applicable.

Dates of Occupancy:

Enter the From and To dates of your stay.

Certification Section:

As a government employee, certify that the room charges are paid for by your governmental entity and incurred in performing your official duties.

Details of Governmental Entity:

Fill in the details of the Governmental entity (federal, state, or local) and the specific Agency, department, or division for which you work.

Employee Information:

Print or type your Name and Title.

Provide your Signature in the designated area and enter the Date prepared.

Fillable online New York Form ST-129