-

Templates

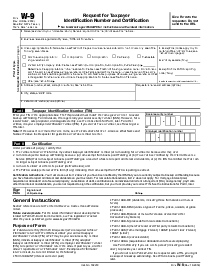

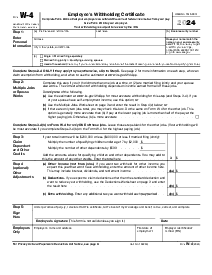

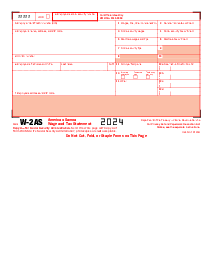

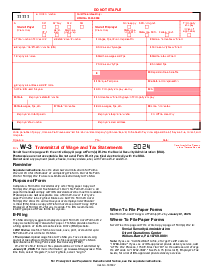

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 8038 (2021)

Get your Form 8038 (2021) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form 8038

Form 8038, the Information Return for Tax-Exempt Private Activity Bond Issues, is an essential document for issuers of specific tax-exempt bonds. This form plays a pivotal role in the governance of tax-exempt financing, particularly for private activity bonds. Its primary purpose is to provide the Internal Revenue Service (IRS) with information regarding the issuance of these bonds, ensuring compliance with federal tax requirements. By meticulously documenting the utilization of funds from tax-exempt bonds, Form 8038 assists in preserving the integrity of the tax-exempt bond market.

When to Use IRS Form 8038

IRS Form 8038 is utilized under several conditions related to issuing tax-exempt bonds. The scenarios in which one needs to file this form include but are not limited to:

- Issuance of qualified private activity bonds that meet the federal tax exemption criteria.

- Refinancing of existing tax-exempt bonds where the issuer remains accountable for reporting.

It's crucial for entities that engage in these transactions to familiarize themselves with the specific conditions under which Form 8038 becomes a requirement, ensuring their operations stay compliant with federal regulations.

How To Fill Out IRS Form 8038 Instructions

Filling out IRS Form 8038 involves a detailed process to ensure accuracy and compliance:

Identify the Issuer:

Begin by providing detailed information about the issuer, including name, employer identification number, and address.

Bond Details:

Furnish specifics about the bond issue, such as the issue date, CUSIP number, and the total amount of the issue.

Use of Proceeds:

This section requires a detailed account of how the proceeds from the issue will be utilized. It includes segments for issuance costs, refinancing details, and allocations to different projects or purposes.

Private Business Use:

For private activity bonds, disclose information regarding any private business use associated with the bond proceeds.

Arbitrage Details:

Supply any relevant information regarding arbitrage relating to the bond issue.

Detailed instructions for each section ensure that issuers accurately report the necessary information, which is crucial for maintaining the tax-exempt status of the bonds.

When Is IRS Form 8038

The deadline for submitting IRS Form 8038 is crucial for issuers to bear in mind. Generally, the form should be filed no later than the 15th day of the second calendar month after the close of the calendar quarter in which the bond is issued. This timely submission is essential for adhering to IRS regulations and ensuring the tax-exempt status of the bonds. Being aware of this deadline and planning accordingly is invaluable for all parties involved in the issuance of tax-exempt bonds.

In conclusion, understanding and accurately completing IRS Form 8038 is vital for issuers of tax-exempt private activity bonds. This form ensures compliance with federal tax laws, maintaining the tax-exempt status of the bonds, and supporting the transparent operation of the tax-exempt bond market.

Fillable online Form 8038 (2021)