-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 5498

Get your Form 5498 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

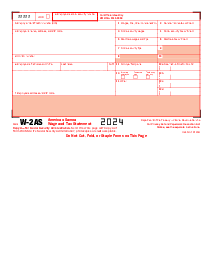

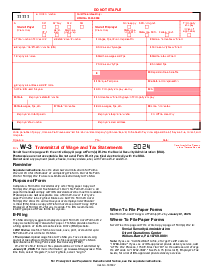

What Is Form 5498?

Not many taxpayers can answer what is a tax form 5498. This form is not widely used by every US citizen until they begin to think of a retirement plan. It is called the IRA Contributions Information and it was created by the Internal Revenue Service Center Department of the Treasury to report to the department all the contributions that you’ve made to the IRS during the tax year. It also reports on the retirement account you have.

Those who start saving money for retirement using the IRS receive a 5498 form every year. The company that leads your IRA has to report to you all contributions that were made during the year. They have to report the same information to the IRS as well.

Based on your IRA type you need to use form 5498 to make the reports on IRS deductions in the tax return form. There is extra information on your IRA account that your managing company provides based on the specific case. The form must be sent to the IRS by May 31.

What Do I Need the Form 5498 For?

- The tax 5498 form is used by the institution that is responsible for managing your individual retirement arrangement plan. By sending the form as a report to the IRS, they notify the department on the savings you have and contributions you’ve made during the year;

- You can use tax form 5498 as well in case you have a specific type of IRA agreement and you need to fill in the contribution deductions in the tax report form you send to the IRS. You need to wait till the form is sent to you by your IRA’s managing company;

- The IRS needs the form from the managing institution of your IRA plan to calculate the income and expenses.

How to Fill Out Form 5498?

Once you’ve learned what is form 5498 used for, you have to make sure that you know what to expect from it. There are several copies that your IRA-leading company has to include. If you see a lack of information you have to contact your representative.

Copy A must be sent to the Internal Revenue Service Center together with form 1096. Copy B is made for the participant and it does not have to be sent to the IRS. You will see separate instructions for this copy within IRS form 5498. Copy C is for the issuer or trustee. Read the instructions to it in advance.

The form is available on the official IRS website. You can also find it on PDFLiner where you can fill it out online. PDFLiner offers all the tools you need for it. Once you fill out the form you have to send copies to the parties mentioned in them. You can do it online or by regular mail. Follow the next steps, filling 5498 form IRS:

- Provide information on the trustee or the issuer, including the name, address, country, ZIP code, and TIN;

- Provide information on the participant, including TIN, name, and address. Don’t forget to include the account number, based on the instructions made by the IRS;

- Calculate the IRA contributions in section 1 and rollover contributions in section 2;

- Name the Roth IRA conversion amount in section 3, recharacterized contributions in section 4;

- Name the FMV of the account in section 5 and the life insurance cost in section 6;

- Put the tick in the appropriate box in section 7;

- Calculate the SEP contributions in section 8, SIMPLE in section 9, and Roth IRA in section 10;

- Put a tick in section 11 if the RMD is for 2021;

- Name the RMD date and amount in sections 12a and 12b;

- Mention the postponed contribution in section 13a, year in section 13b, and code in 13c;

- Write down repayments in 14a, and code in 14b;

- Provide the FMV of specified assets in section 15a and code in 15b.

Organizations That Work With Form 5498

- Internal Revenue Service Center Department of the Treasury.

Fillable online Form 5498