-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Taxable Social Security Benefits Worksheet (2017)

Get your Taxable Social Security Benefits Worksheet (2017) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Worksheet Taxable Social Security Benefits?

Social Security benefits are an important source of income for retired workers, people with disabilities, and surviving spouses. However, depending on your overall income and tax filing status, a portion of these benefits may be subject to federal tax. The IRS provides a document known as the Taxable Social Security Benefits Worksheet to determine the taxable portion. Managing this aspect can be complex for individuals preparing their 2017 tax return, and the worksheet is invaluable.

Purpose of the Social Security Taxable Benefits Worksheet

When it comes to understanding and calculating your taxes, the Social Security Benefits tax worksheet comes into play. This taxable worksheet template is designed to aid taxpayers in determining the exact portion of Social Security benefits that should be included as taxable income on their tax return. If you're receiving Social Security benefits, it's crucial to check whether some of that income will contribute to your tax bill. The worksheet uses a series of questions and calculations that factor in other income and deductions to arrive at the taxable amount.

How to Fill Out Social Security Benefits Tax Worksheet Accurately

PDFliner streamlines the process of filling out this IRS form online:

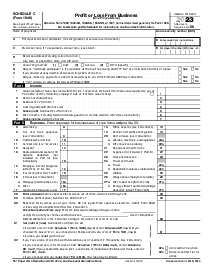

- Enter the total amount from box 5 of all your Forms SSA-1099 and Forms RRB-1099 into Line 1. This should also be entered on Form 1040, Line 20a.

- Multiply Line 1 by 50% (0.50) and record the result as Line 2.

- Combine the amounts from Form 1040, lines 7, 8a, 9a, 10–14, 15b, 16b, 17–19, and 21 together and enter it as Line 3.

- Enter the amount, if any, from Form 1040, line 8b onto Line 4.

- Combine Lines 2, 3, and 4 together and record the sum as Line 5.

- Determine whether Line 6 (total of Lines 23–32 + any write-in adjustments) is greater or less than Line 5.

- a. If Line 6 is less than Line 5, none of your social security benefits are taxable. Enter -0- on Form 1040, Line 20b.

- b. If Line 6 is greater than Line 5, proceed to Step 7.

- For married couples filing jointly, enter $32,000. For singles, heads of households, qualified widows(ers), or those who filed separately but lived apart from their spouses during the entirety of 2017, enter $25,000. Skip Steps 8–15 if married filing separately and living with your spouse at any point in 2017.

- Multiply Line 7 by 85% (0.85) and enter the result as Line 16. Proceed to Step 9.

- Compare Line 7 and Line 8. If Line 8 is less than Line 7, none of your social security benefits are taxable. Enter -0- on Form 1040, Line 20b. If not, continue to Step 10.

- Enter either $12,000 for married filing jointly or $9,000 for other eligible filers as Line 10.

- Subtract Line 10 from Line 9 and enter the result as Line 11. If the result is zero or less, enter -0-.

- Enter the smaller value between Line 9 and Line 10 as Line 12.

- Divide Line 12 by 2 and round down to the nearest whole number. Record the result as Line 13.

- Take the smaller value between Line 2 and Line 13 and record it as Line 14.

- Multiply Line 11 by 85% (0.85) and enter the result as Line 15. If Line 11 is zero, enter -0-.

- Add Line 14 and Line 15 together and record the sum as Line 16.

- Multiply Line 1 by 85% (0.85) and record the result as Line 17.

- Choose the smallest value between Line 16 and Line 17 and enter it as both Line 18 and Form 1040, Line 20b.

Maximizing your tax filing experience

PDFliner, an online platform for fillable PDF forms, simplifies the process of completing the taxable social security benefits worksheet. PDFliner allows you to access the worksheet, complete it online, save and e-sign it, and even print a copy for your records or mail it with your tax return. This ensures you have an error-free, clear, and legible worksheet that aligns with IRS standards.

Fillable online Taxable Social Security Benefits Worksheet (2017)