-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 5471 Schedule J

Get your Form 5471 Schedule J in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding Form 5471 Schedule J

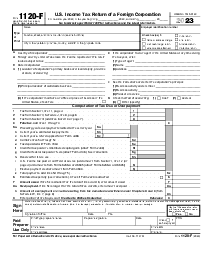

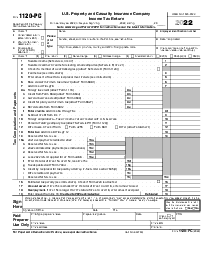

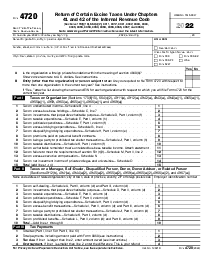

The Form 5471 Schedule J is commonly referred to as the Accumulated Earnings and Profits (E&P) of Controlled Foreign Corporations form by the Internal Revenue Service (IRS). This form is typically filled out by certain U.S. persons who own a corporation in foreign territories.

Who needs to file schedule J 5471?

If you are a U.S. shareholder in a Controlled Foreign Corporation (CFC), you must file the 5471 form Schedule J. Fulfilling this tax obligation is necessary if you own more than 50% of the corporation's total voting power or value.

How to Fill Out IRS Form 5471 Schedule J

Filling out the IRS form repatriation tax 5471 schedule J does require careful attention to detail due to the complexity of the information requested. Here are some basic steps:

- Start filling out the Schedule J 5471 Form by entering your personal filing information in the fields given at the top of the form. This includes your full legal name followed by your identifying number.

- In the next section, write down the name of the foreign corporation you are filing for. Be sure to double-check the spelling and format.

- If there is a specific EIN (Employer Identification Number) associated with the corporation, fill it out in the corresponding field.

- Enter the Reference ID number in the provided space. This is not your personal account ID nor EIN. It is a separate ID number given for tax purposes.

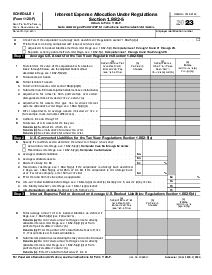

- You’ll now move to Part I, titled ‘Accumulated E&P of Controlled Foreign Corporation’. Here, you should fill in the numbers corresponding to the current year's Earnings and Profits (E&P) of the corporation in lines. Ensure to check the accuracy of these values as they might be subject to verification.

- In Part II, fill in the figures that pertain to ‘Nonpreviously Taxed E&P Subject to Recapture as Subpart F Income’, specified in lines 1 to 4. This section is for detailing the Earnings and Profits that haven't been previously taxed and are subject to recapture rules.

- Lastly, review the entire form before finalizing it. Make sure that all the numerical and text entries are exact and accurate for the financial year being reported. Any discrepancy in the figures can lead to unintended legal issues.

Impotence of 5471 form schedule J

The Tax Cuts and Jobs Act of 2017 saw the introduction of a new repatriation tax directly affecting certain foreign corporations' shareholders. Schedule J serves a vital role in this tax computation. The repatriation tax is a one-time tax levied on the untaxed foreign earnings of foreign subsidiaries of U.S companies. 5471 Schedule J aids in tallying these earnings and therefore, the repatriation tax due.

Fillable online Form 5471 Schedule J