-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Form NYS-50-T-Y

Get your New York Form NYS-50-T-Y in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is A Form NYS-50-T-Y

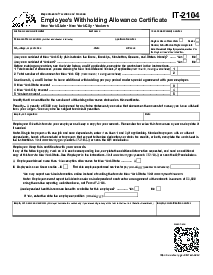

Form NYS-50-T-Y is the official document employers use to determine the amount of Yonkers resident personal and non-resident earnings tax to withhold from their employee's paychecks. It provides withholding tax tables and methods, including various payment frequencies such as weekly, biweekly, semimonthly, monthly, and daily payroll periods. This form is particularly relevant for businesses operating within Yonkers, New York, to ensure compliance with local tax obligations for resident and non-resident employees.

When to Use Form NYS 50 T Y

Employers should use Form NYS-50-T-Y in the following situations:

- While preparing payroll for employees who are residents of Yonkers, calculate the resident personal income tax surcharge.

- When processing payroll for employees who are non-residents of Yonkers but earn income within the city limits, withhold the non-resident earnings tax.

- If there are changes in the tax rates or tax laws that impact withholding requirements.

- Supplemental wage payments such as bonuses, commissions, or overtime may be subject to different withholding rates.

How To Fill Out Form NYS-50-T-Y Instruction

Instructions for Filling Out New York Form NYS-50-T-Y:

Gather Information:

Before filling out the form, ensure you have all necessary information, including your Employer Identification Number (EIN), business name and address, the employee's details, and their withholding allowances.

Identification Section:

Fill in the required fields at the top of the form, including the calendar year, your business's EIN, name, and address.

Employee's Information:

Enter the employee's full name, Social Security Number, and address. This ensures that the withholdings are accurately recorded against the correct individual.

Withholding Allowances:

The employee should have completed a withholding allowance certificate (Form IT-2104 or W-4) indicating the number of allowances they claim. Enter this information in the designated area on the form.

Payroll Information:

Input the gross pay for the employee for the pay period, including all taxable wages.

Calculate Withholding:

Use the tables in the NYS-50-T-Y to determine the withholding amount based on the employee's pay period, gross wages, and the number of allowances claimed.

To use the tables, locate the row corresponding to the employee's gross wages. Then, move to the column associated with the number of allowances claimed to find the withholding amount.

If necessary, make additional adjustments if the employee has requested an additional withholding amount or if any tax credits apply.

Total Withholding:

Sum up the total withholding amount and enter it into the designated field. This amount should be remitted to the New York State Tax Department for that employee for the pay period.

Signature:

Ensure that a responsible party (such as the employer or payroll administrator) signs the form to certify the correct information.

When to File Form NYS 50 T Y

Form NYS-50-T-Y does not need to be filed with any tax authority; rather, it is a reference document to guide employers. The form should be used throughout the year whenever payroll is processed to ensure the correct withholding of Yonkers taxes from employees' wages. Employers must consistently apply the withholding methods for every pay period to comply with Yonkers tax regulations, and they must adjust their practices when new versions of the form are published, typically at the start of a new tax year or when tax rates change.

Fillable online New York Form NYS-50-T-Y