-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

New York Form NYS-1

Get your New York Form NYS-1 in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is New York State Nys 1 Form

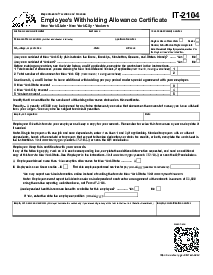

When it comes to payroll tax responsibilities, understanding and adhering to state requirements is crucial for employers. The New York State Nys 1 form, officially known as the Return of Tax Withheld, is a critical document for any employer in New York. This form is essential in reporting and remitting the state income taxes withheld from employees' paychecks. Employers must know the NYS-1 form to ensure compliance and avoid penalties.

When to Use New York State Tax Form Nys 1

Employers must utilize the New York State Tax form Nys 1 under several conditions. Primarily, it applies in situations where:

- After running payroll, if taxes withheld meet or exceed a certain threshold set by the New York State Department of Taxation and Finance, the NYS-1 form should be filed.

- When accumulated withholdings reach the New York State's stipulated amount, filing this form becomes necessary.

- An employer's withholding tax liability from the previous calendar year determines how often they must file the NYS-1 form.

- If any adjustments or additional tax withholdings were not initially accounted for, this form must be submitted.

- After concluding the year's final payroll, if additional withholdings are necessary, the NYS-1 form is used to report them.

- The above situations prompt the need for timely filing to keep an employer in good standing with the state taxation authorities.

How To Fill Out Nys 1 Form New York State Instruction

Before you begin, keep handy all the necessary payroll information and the amount of New York State, New York City, and Yonkers tax withheld from your employees.

Identification:

Enter your Withholding Identification Number at the top of the form.

Section A - Employer’s Legal Name and Payroll Information:

Write the legal name of your business as the employer.

Input the last payroll date for the period the return covers in the format.

If you permanently ceased paying wages, enter the date of the final payroll.

Section B - Additional Payment:

If making an additional payment, mark an 'X' in the box provided.

Certification:

Review the information for accuracy.

Sign and date the form to certify that the information is true, correct, and complete.

Provide your printed name and telephone number.

If you are a new employer or have a change of address, mark 'X' in the appropriate box.

Fillable online New York Form NYS-1