-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

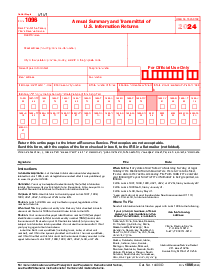

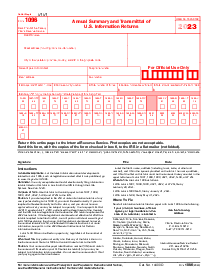

Form W-3SS

Get your Form W-3SS (2024) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is Form W-3SS

Form W-3SS, "Transmittal of Wage and Tax Statements," is the summary page used to report total wage and tax information for employers filing form W-2AS, W-2CM, W-2GU, or W-2VI. Employers in American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), Guam, and the U.S. Virgin Islands use this form to transmit Copy A of wage and tax statements.

What Is The Difference Between W-3 And W-3SS?

The forms W-3 and W-3SS serve similar purposes but are used in different contexts. form W-3 is the "Transmittal of Wage and Tax Statements" used in the United States to accompany form W-2 when submitted to the Social Security Administration. It summarizes the total earnings, Social Security wages, Medicare wages, and withholding for all employees for the year.

Form W-3SS, "Transmittal of Wage and Tax Statements for American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands", is specifically for employers in these U.S. territories. It serves the same purpose as the standard W-3 form but is tailored for use in these territories.

How To Fill Out Form W 3SS Instruction

Filling out form W-3SS involves these steps:

- If applicable, enter your control number.

- Check the boxes that apply to your type of business.

- Enter the total number of W-2 forms you submit.

- Provide your EIN.

- Fill in your business name and address.

- List any other EINs used if applicable.

- Report totals from your W-2 forms.

- Enter the total income tax, social security tax, and Medicare tax withheld.

- Provide a contact person's name, telephone number, fax number, and email address.

- The form must be signed and dated by the employer or authorized representative.

Ensure accuracy in reporting, as this form summarizes the information on all the W-2 forms you submit. For detailed instructions, refer to the IRS guidelines.

How To File Form W-3SS

To file form W-3SS, employers must send this form along with form W-2 Copy A to the Social Security Administration by the required deadline. This form should not be filed if you have already submitted it electronically. Ensure the form and the individual W-2s bear the correct tax year and employer identification number. Form W-3SS and its accompanying forms W-2 are due by January 31 following the tax year reported. This applies to both paper and electronic filings. If this date falls on a weekend or legal holiday, filings are due the next business day.

Form Versions

2024

Form W-3SS (2022)

Fillable online Form W-3SS (2024)