-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

157 Other Templates

-

AA Attendance Form

What Is an AA Meeting Court Card Form?

An AA Court Card is a form used by individuals who have been charged with a driving under the influence (DUI) offense and are required to attend Alcoholics Anonymous (AA) meetings as part of their court-mandated sent

AA Attendance Form

What Is an AA Meeting Court Card Form?

An AA Court Card is a form used by individuals who have been charged with a driving under the influence (DUI) offense and are required to attend Alcoholics Anonymous (AA) meetings as part of their court-mandated sent

-

Fidelity Payslip

How to Find a Fillable Fidelity Payslip?

The form is ready to be filled and can be found in PDFLiner catalog. Start by hitting the "Fill this form" button or use the guide below to get the form letter:

Sign In to your account.

Fidelity Payslip

How to Find a Fillable Fidelity Payslip?

The form is ready to be filled and can be found in PDFLiner catalog. Start by hitting the "Fill this form" button or use the guide below to get the form letter:

Sign In to your account.

-

Notice Of Vehicle Repossession Letter Template

Where to Get Fillable Notice Of Vehicle Repossession Letter Template?

You can find the blank file in PDFLiner forms library. To start filling out the form, click the “Fill this form” button, or if you would like to know how to find it here let

Notice Of Vehicle Repossession Letter Template

Where to Get Fillable Notice Of Vehicle Repossession Letter Template?

You can find the blank file in PDFLiner forms library. To start filling out the form, click the “Fill this form” button, or if you would like to know how to find it here let

-

Da 5960 Army Pubs

Acquire a Printable Da 5960 Army Pubs Online

The form is ready to be filled and can be found in PDFLiner catalog. To get the form Either hit the "Fill this form" button or do the steps below:

Log In and go to the home page.

Da 5960 Army Pubs

Acquire a Printable Da 5960 Army Pubs Online

The form is ready to be filled and can be found in PDFLiner catalog. To get the form Either hit the "Fill this form" button or do the steps below:

Log In and go to the home page.

-

State Of Hawaii Death Certificate Worksheet

How Do I Get State Of Hawaii Death Certificate Worksheet Online?You can get the form online at here at PDFliner. Click the "Fill this form" button to open it in the editor, or follow the instructions below:Go to PDFLiner and log in.Look

State Of Hawaii Death Certificate Worksheet

How Do I Get State Of Hawaii Death Certificate Worksheet Online?You can get the form online at here at PDFliner. Click the "Fill this form" button to open it in the editor, or follow the instructions below:Go to PDFLiner and log in.Look

-

Trailer Interchange Agreement Template

Acquire a Printable Trailer Interchange Agreement Template Online

Get your blank document online at PDFLiner. Either push the "Fill this form" button or follow the steps below in case you need to find the form on our website letter:

Trailer Interchange Agreement Template

Acquire a Printable Trailer Interchange Agreement Template Online

Get your blank document online at PDFLiner. Either push the "Fill this form" button or follow the steps below in case you need to find the form on our website letter:

-

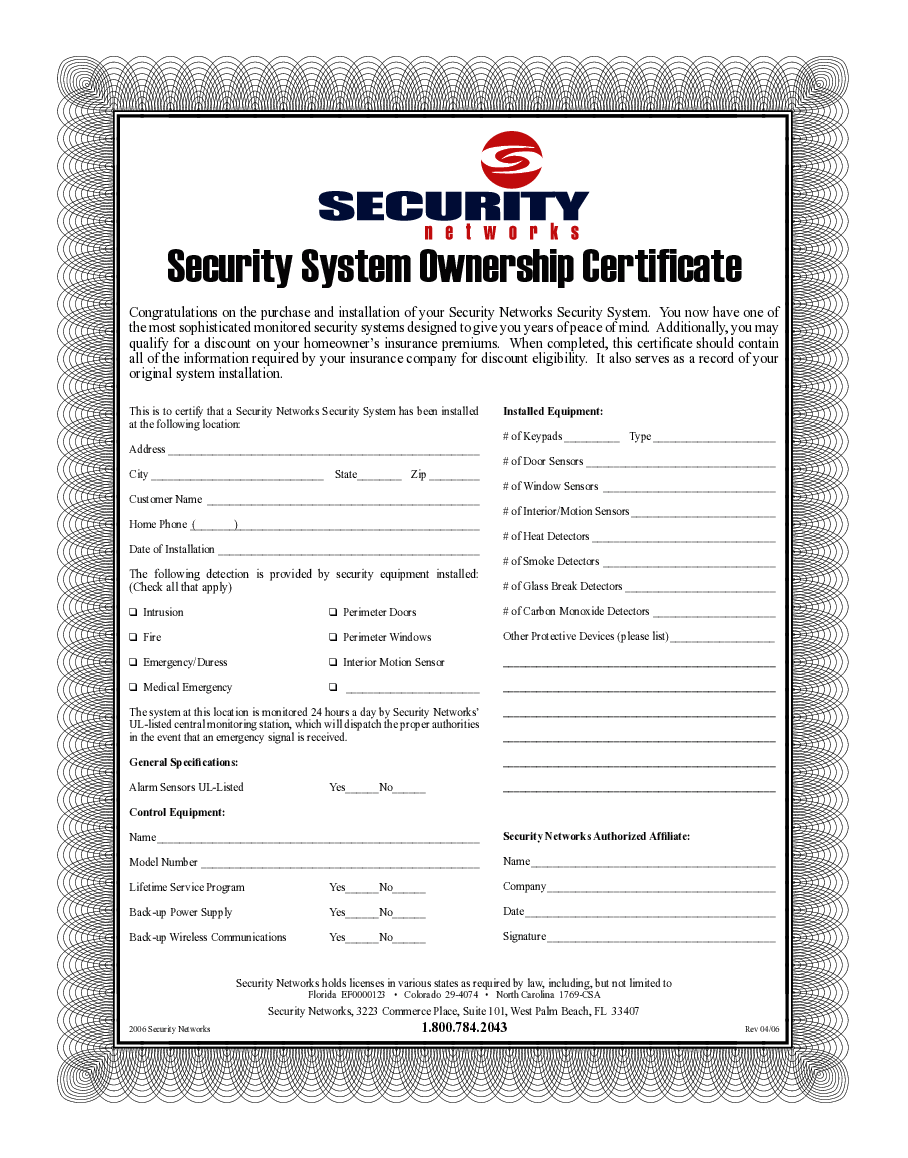

Adt Alarm Certificate For Insurance Pdf

Adt Alarm Certificate For Insurance Pdf

✓ Easily fill out and sign forms

✓ Download blank or editable online

Adt Alarm Certificate For Insurance Pdf

Adt Alarm Certificate For Insurance Pdf

✓ Easily fill out and sign forms

✓ Download blank or editable online

-

Cs L Mvr 50 Pdf No Download Needed

Cs L Mvr 50 Pdf No Download Needed

✓ Easily fill out and sign forms

✓ Download blank or editable online

Cs L Mvr 50 Pdf No Download Needed

Cs L Mvr 50 Pdf No Download Needed

✓ Easily fill out and sign forms

✓ Download blank or editable online

-

Deca Startup Business Plan

Obtain a Fillable Deca Startup Business PlanThere is a huge forms library at PDFLiner, so you can easily find here the needed blank form. To begin filling out the document, push the “Fill this form” button, or if you need to know how to find it letter

Deca Startup Business Plan

Obtain a Fillable Deca Startup Business PlanThere is a huge forms library at PDFLiner, so you can easily find here the needed blank form. To begin filling out the document, push the “Fill this form” button, or if you need to know how to find it letter

-

Windshield Survey Form

How to Get a Fillable Windshield Survey Example?

Use PDFLiner forms catalog to obtain your form. To begin filling out the document, push the “Fill this form” button, or if you need to know how to find it letter, follow the steps:

Windshield Survey Form

How to Get a Fillable Windshield Survey Example?

Use PDFLiner forms catalog to obtain your form. To begin filling out the document, push the “Fill this form” button, or if you need to know how to find it letter, follow the steps:

-

ADP Termination Form

How Do I Get Adp Termination Online?

The form is ready to be filled and can be found in PDFLiner catalog. To get the form Either hit the "Fill this form" button or do the steps below:

Log In and go to the home page.

ADP Termination Form

How Do I Get Adp Termination Online?

The form is ready to be filled and can be found in PDFLiner catalog. To get the form Either hit the "Fill this form" button or do the steps below:

Log In and go to the home page.

-

Washington State Transfer On Death Deed

Obtain a Fillable Washington State Transfer On Death Deed

Use PDFLiner forms catalog to obtain your form. To get the form Either hit the "Fill this form" button or do the steps below:

Log In and go to the home page.

Washington State Transfer On Death Deed

Obtain a Fillable Washington State Transfer On Death Deed

Use PDFLiner forms catalog to obtain your form. To get the form Either hit the "Fill this form" button or do the steps below:

Log In and go to the home page.