-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

How to Fill Out Schedule C — Easier than You Thought

Before we get to deal with the 1040 tax return form, you may have a few questions. Particularly, what is the purpose of a Schedule C? Form 1040 Schedule C is a loss/income tax form. Everyone who does freelance, side gigs, or owns a single-person enterprise needs to file the form. We’ll show you how to do it and provide some tips on how to save a few tax dollars.

What Is a Schedule C Tax Form

It is a mandatory tax document, in which you provide details on how much money you make or lose as a sole proprietor of a certain enterprise. It is issued by the IRS, to which you must send the filled copy of the form.

This year’s deadline for filing IRS tax forms is May 17. If you fail to submit the form by that time, penalties and dues will follow.

If you were a victim of the winter storms, you have a right to IRS disaster relief. That means getting a delay until June 15. If you want to know how to get the form 1040 Schedule C, we provide a guide on how to fill it out and edit it online.

Who Should Fill Out a Schedule C Form

So, who files a Schedule C? If you’re a sole proprietor of a small business or work for yourself, this form is obligatory for you to submit.

Basically, if you operate a flower stand solo, have an ice-cream truck, provide nail service in a mall, or design websites while not being affiliated with a company that provides such services — you are a sole proprietor.

That is why all freelancers are obliged to file tax forms like Schedule C. But there are also a few additions you need to know about:

- LLC. If you run a single-person LLC that has no employees except you, filing 1040 Schedule C is also a must. The reason is, in reality, there’s no difference between your LLC’s revenue and your personal income.

- Side-gigs. If you have a full-time job but still do side gigs from time to time, you also need to file this form.

- Farmers. In case your freelance work is about farming, you may need another form, Schedule F.

- Rental. Finally, if you raise extra money from renting or receiving royalties, you need to file Schedule E.

This Schedule doesn’t apply to C or S-type corporations.

How to Fill Out Schedule C for Form 1040

Now, let’s see how to fill out the 1040 Schedule С step by step.

- Income. Knowing how much exactly you have earned, calculate your gross profit and gross income.

- Business expenses. In this section, enter all possible expenses you’ve had. It can be advertising, logistics, lawyers, storage, flower refrigerating, rental costs, travel expenses, and so on.

- Goods. You need to assess the total cost of goods/services that you sold and inventory at the beginning and at the end of the year.

- Profit. Now that you know the total sum of your expenses, subtract them from your gross profit. For this amount of money, you will pay your income tax.

- Loss. If your calculations show that you didn’t earn any money and even lost some, that means you have a net loss. It can be deductible on your tax return.

It’s the general portion of the Schedule C 1040 instructions. And now, we’d like to provide a specific step-by-step guide about filing the form.

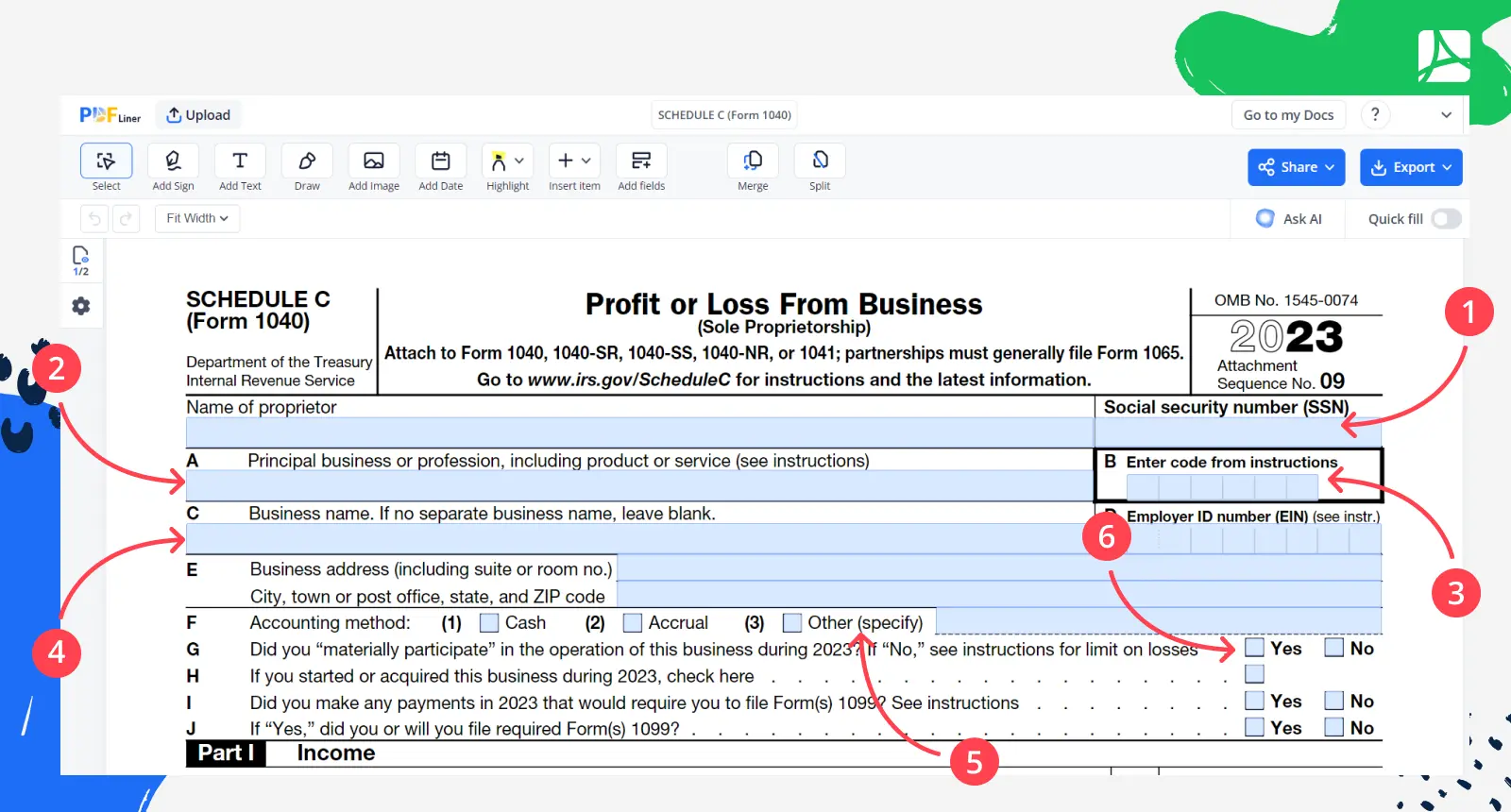

Step 1: Enter your personal information (full name and SSN).

Step 2: Specify your business or professional activity and if you have a specific group of customers, also describe them here. For example: "software developer for retailers".

Step 3: Find your six-digit code in the Principal Business or Professional Activity Codes and enter it on line B.

Step 4: Write your business name if you have one and provide your employer ID number if you are an employer. Provide your business address.

Step 5: Choose an accounting method:

- Cash accounting method: Income is recorded when it is received and expenses are recorded when they are paid, regardless of when they were earned or incurred. This means that if you receive payment for a service in December but don't deposit the money until January, the income would be recorded in January instead of December.

- Accrual accounting method: Income is recorded when it is earned and expenses are recorded when they are incurred, regardless of when the payment is received or made.

- Other accounting methods: Use this option if you don't apply nether cash or accrual methods. Specify which method do you use, for example: Hybrid, Long-term contract, Completed contract, Percentage of completion method.

Cash accounting method is simpler than accrual accounting method, which records income and expenses when they are earned or incurred, but it may not accurately reflect the financial position of a business at a given point in time.

Step 6: Answer the questions from lines G to J.

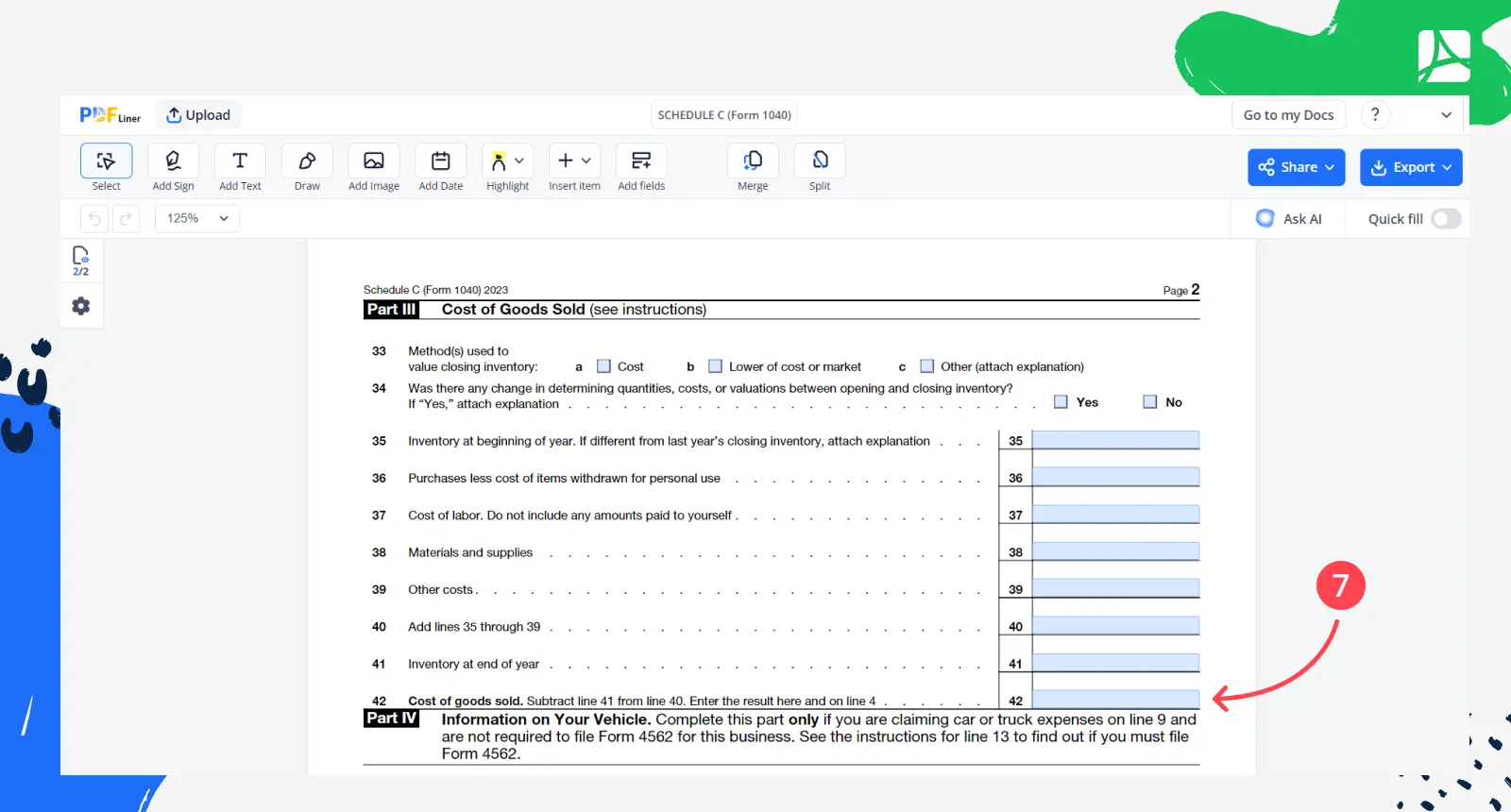

Step 7: Move to Part 3 and calculate the cost of goods to use the amount from line 42 in line 4.

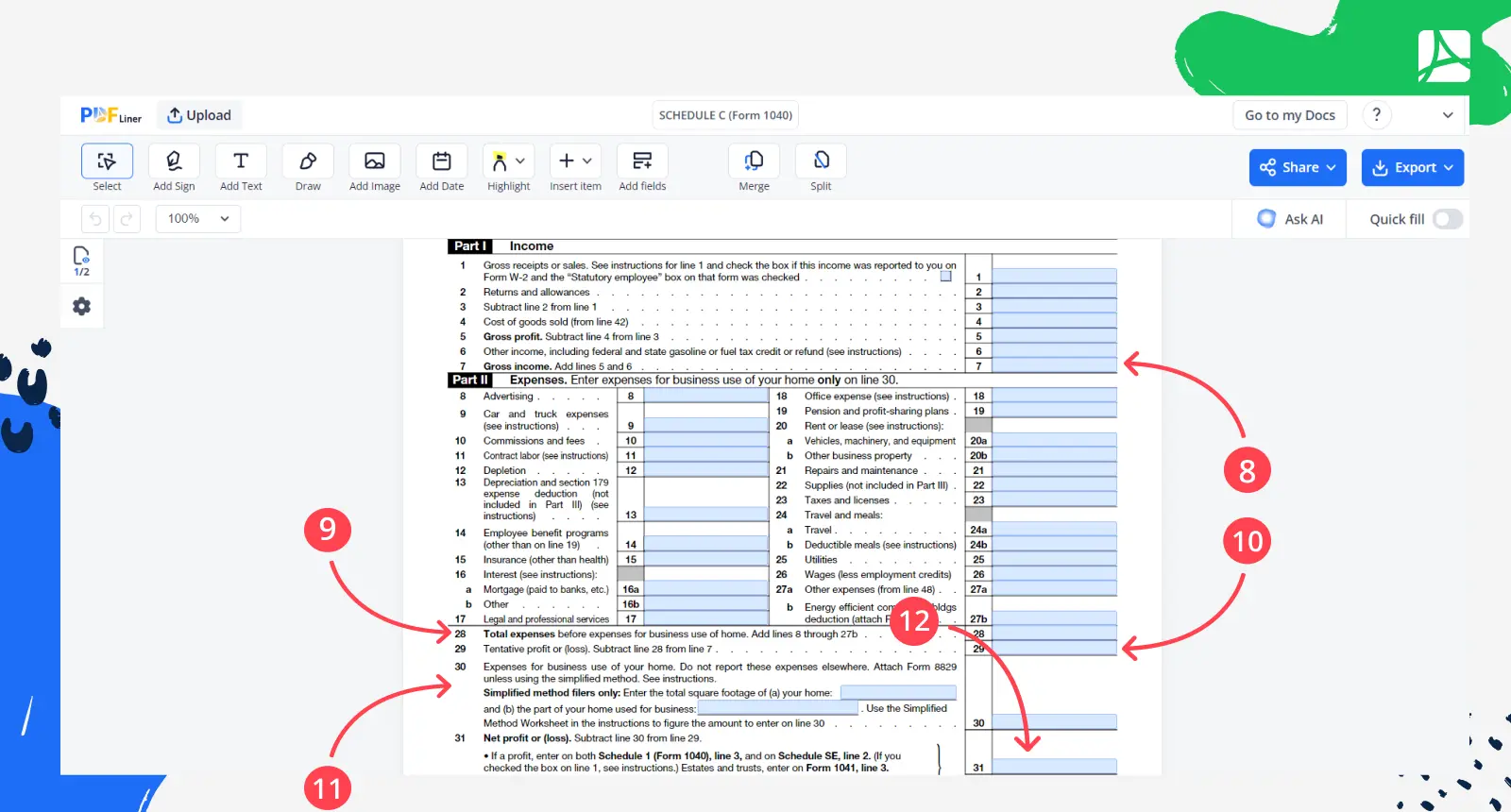

Step 8: Calculate your gross profit and gross income using Part 1.

Step 9: Enter all your business expenses that you spent during the year and calculate them on line 28 of Part 2.

Step 10: Subtract your total expenses from your total income (Part 1, line 7) to get your tentative profit or loss.

Step 11: Deduct your home office expenses using a simplified method worksheet to calculate the amount.

Step 12: Calculate your net profit or loss by subtracting line 30 from line 29.

If you are claiming car or track expenses also fill out Part 4 and for all other expenses that weren't listed you can use part 5.

How to File Schedule C

Once you’re done with filling it out, you can download the form and save it to your device or cloud storage. Again, it’s best to use PDFLiner for that. Then:

- Go to the official IRS website.

- Choose how you want to file the form. In your case, it’s Business & Self-Employed.

- Then choose Sole Proprietorship under Business Types.

- Form 1040 will be the first on the list — read its info in case you need to specify any details.

If you would like to file by mail, find your mailing address, print all the tax forms needed for the tax return and mail them.

E-filing is preferable as it allows the IRS to respond and process your form quicker. If you stick to old-fashioned postal mailing, it may take weeks to admit your form due to possible staff problems.

Schedule C Extra Tips

In this section, there are some tips that will help you fill out Schedule C more effectively.

1. Multiple forms

In case you have a few freelance venues or side gigs, you need to file more Schedule C forms. For example, if you work as a freelance sound engineer and also install acoustic equipment for weddings and birthday parties, you have to file two separate Schedule C’s.

2. Home office

If you work from home, you can use this Schedule to deduct “home office” expenses. The IRS sets a flat-rate deduction of $5 per square foot of your home office. So, measure the footage of your home space that is dedicated to your work. The maximum limit allowed is 300 square feet.

It’s also recommended to keep a close track of all your expenses related to your home office. Especially utility bills — your work may require a lot of electricity, and so forth.

3. Save more tax money

You can include other tax deductions in this form. These relate to:

- Medical and dental insurance.

- Work-related education: courses, degrees, and skills development.

- Pension savings.

- Business insurance — especially if you run a single-person LLC.

- Credit card interest.

- Office supplies.

- Internet connection and phone bills.

Even expenses related to Covid-19 can be deducted.

FAQ

Now, a few popular questions about the IRS Schedule С 1040.

What are other expenses on Schedule C?

Miscellaneous expenses imply bank fees, membership costs, investing in your professional education, buying gasoline for your truck, etc.

How much of your cell phone bill can you deduct?

You can deduct about 30% percent of your phone bill.

How do I prove my Schedule C income?

It depends on various factors. Your clients should file the 1099-MISC form to report how much money they paid for your services/goods, etc. See the IRS tips for more info.

Can I file Schedule C online?

Yes, as well as any other tax form.

What are tax schedules?

A tax schedule is a specific tax form, which you must file according to your income situation. This is why as a sole proprietor, you should file 1040 Schedule C.

.png)