-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

Form 14411, Systemic Advocacy Issue Submission

Get your Form 14411, Systemic Advocacy Issue Submission in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

A Comprehensive Guide to Filling Out IRS Form 14411

In an effort to address and solve systemic issues within the Internal Revenue Service (IRS), Form 14411 stands as a critical document for taxpayers and professionals alike. This 1-page document, also known as the Systemic Advocacy Issue Submission form, enables individuals to report problems that are not isolated but affect multiple taxpayers and involve IRS policies or procedures. Given its significance, it’s crucial for filers to understand the correct approach to filling out this form to ensure their concerns are adequately voiced.

How to Fill Out IRS Form 14411

- Completing the IRS Form 14411 requires attention to detail and a clear understanding of the issue at hand. Here’s how you can fill out the form systematically:

- Download the 14411 Form PDF: Your first step should be obtaining the form, which is available as a fillable form 14411 on the official IRS website or platforms like pdfFiller. Ensure you have the latest version for the current tax year.

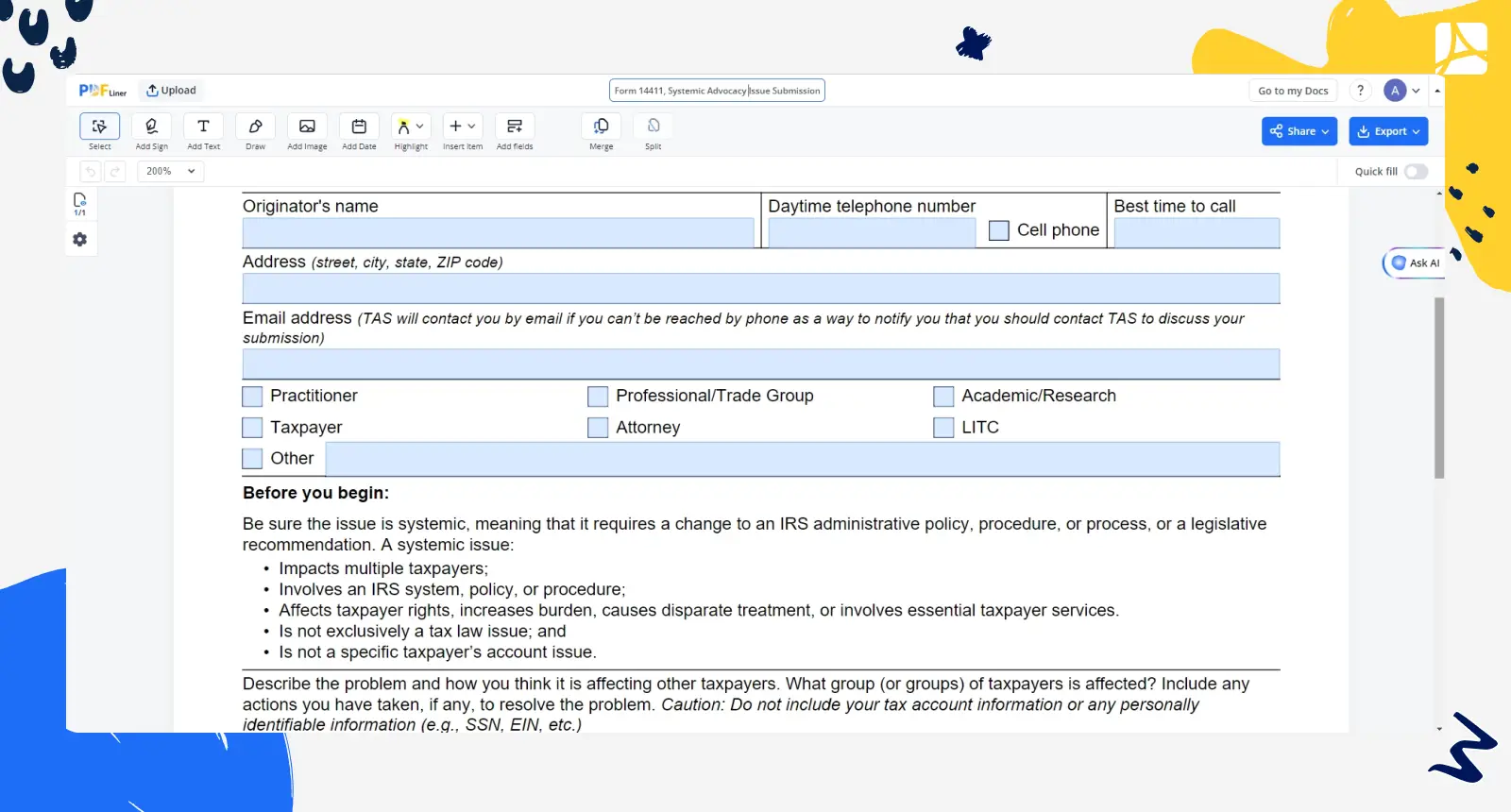

- Fill in Your Contact Information: Start by providing your name, daytime telephone number, cell phone, and the best time for the IRS to call you. Also, include your address and email address, as TAS might use these to reach out if necessary.

- Select Your Role: Identify whether you’re submitting this form as a taxpayer, attorney, practitioner, professional/trade group, academic/research entity, LITC (Low Income Taxpayer Clinic), or other. This helps TAS understand the perspective from which you're reporting the issue.

- Describe the Systemic Issue: In the specified section, clearly articulate the problem you’ve identified, including how it affects other taxpayers and the specific IRS system, policy, or procedure involved. Avoid including any personal tax account information. Focus on explaining the nature of the systemic problem and any steps you’ve taken to resolve it.

- Submit the Form: Once completed, the form can be submitted by fax, email, or through the web as specified by the IRS. Ensure you use the correct contact details for the submission method you choose.

Where and How to Submit Your Form

After completing your fillable form 14411, it’s essential to know where to submit it. You have a couple of options: sending it by fax, emailing, or using the IRS’s web submission portal. Choose the method that’s most convenient for you, but make sure to keep a copy for your records.

The Importance of Accurate Submission

IRS Form 14411 is a potent tool for voicing systemic concerns directly to the authorities capable of instigating change. Remember, each accurately filled-out tax form 14411 contributes towards identifying and rectifying systemic issues that can lead to a more efficient and equitable tax system for all.

Fillable online Form 14411, Systemic Advocacy Issue Submission