-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesAI-Enhanced Document Solutions for Contractor-Client Success and IRS ComplianceExplore all featuresAI Summarizer Check out the featureAI PDF summarizer makes your document workflow even faster. Ask AI to summarize PDF, assist you with tax forms, complete assignments, and more using just one tool.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

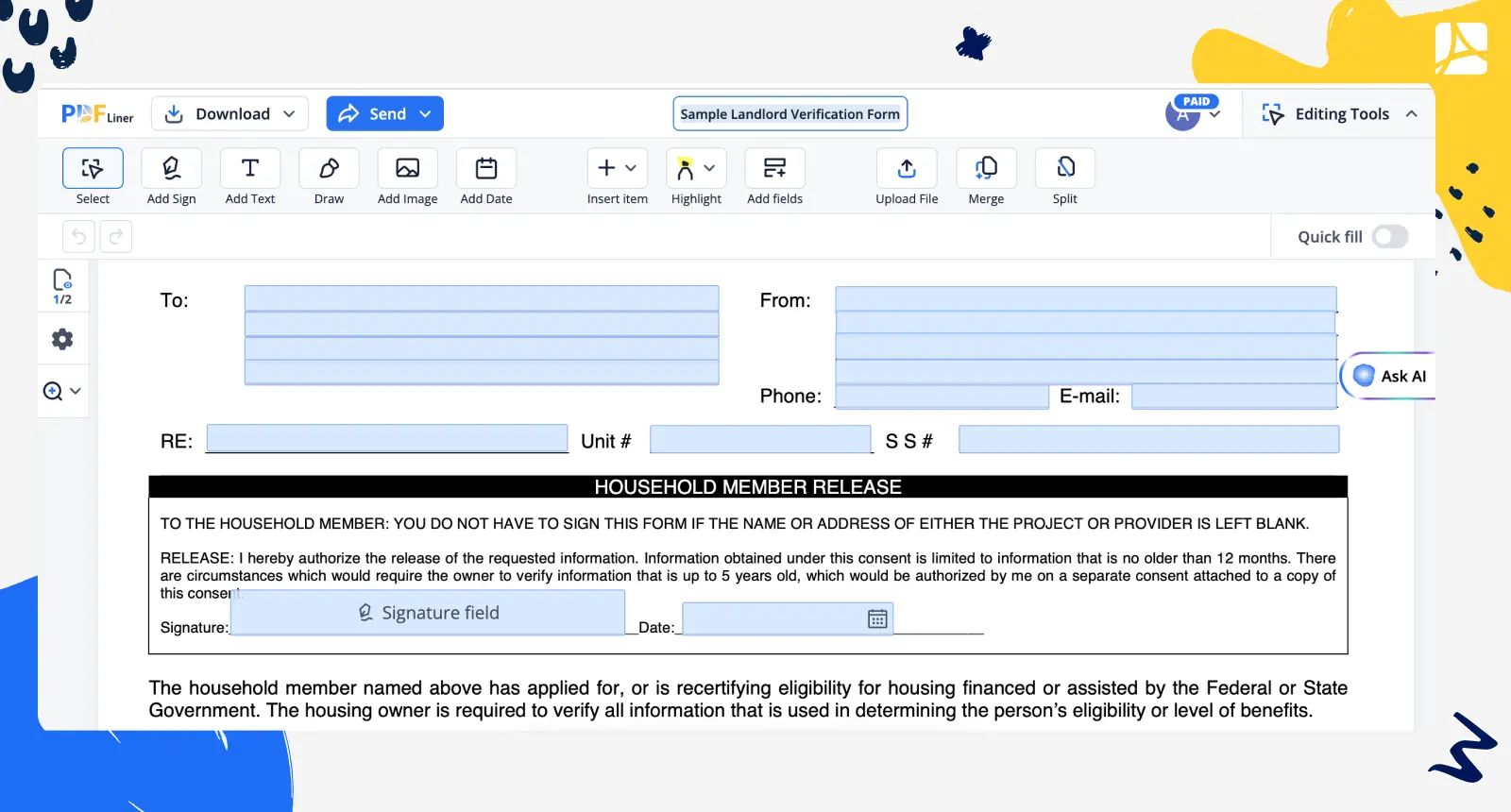

Sample Landlord Verification Form

Get your Sample Landlord Verification Form in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

Understanding and Completing Your Massachusetts Commercial Lease Agreement

When entering the world of commercial real estate in Massachusetts, one of the crucial steps for landlords and tenants is the proper completion of a commercial lease agreement Massachusetts. This legal agreement specifies the conditions for leasing the commercial space and establishes the obligations of each party involved. Grasping the intricacies and importance of correctly filling out this contract is essential in preventing legal issues and guaranteeing a relationship that is advantageous for both the property owner and the renter.

Understanding the Massachusetts Commercial Lease Agreement

The Massachusetts commercial lease agreement is customized to fit the specific needs of commercial rentals, differing significantly from residential leases. It encompasses details such as the amount of rent, the duration of the lease, the specific use of the premises, and various clauses related to expenses and maintenance obligations. For both parties, grasping the implications of these clauses and how they influence each stakeholder is paramount.

Why a Standard Commercial Lease Agreement in Massachusetts is Essential

The standard commercial lease agreement in Massachusetts serves as a safeguard for both parties involved. It legally enforces the terms agreed upon, providing a layer of security and predictability to the commercial leasing transaction. The agreement helps in clearly defining the expectations and requirements from both sides, reducing potential conflicts and misunderstandings during the leasing period.

Types of Commercial Lease Agreements in Massachusetts

Depending on the arrangements and negotiations between the landlord and the tenant, a Massachusetts commercial lease can be classified into several types, such as Gross, Modified Gross, or Triple Net (NNN). Each type details the financial responsibilities differently when it comes to utility costs, insurance, real estate taxes, and maintenance. For instance, a 'Gross Lease' typically encompasses all these expenses within the monthly rent, making it crucial for tenants to understand the type of lease they are entering into.

Step-by-Step Guide to Filling Out the Standard Commercial Lease Agreement Massachusetts

- Identify the Parties: Start by filling in the details of both the landlord and the tenant, including names and addresses.

- Describe the Premises: Specify the location and type of the commercial space being leased, along with its square footage.

- Lease Term and Use: Clearly state the commencement and expiration dates of the lease and describe the permitted use of the premises.

- Financial Terms: Fill in the monthly base rent amount and specify the due date for rental payments. Don’t forget to indicate any provisions for rent increases, such as adjustments according to the Consumer Price Index (CPI) or fixed percentage increases over time.

- Additional Provisions: Decide on the lease type (e.g., Gross, Modified Gross, Triple Net) and specify respective obligations regarding utilities, maintenance, taxes, and insurance. Ensure both parties initial each section to confirm their agreement.

By systematically addressing each segment of the agreement, you ensure all pertinent details are covered, making the commercial lease agreement in Massachusetts a comprehensive contract tailored to specific leasing arrangements.

Fillable online Sample Landlord Verification Form