-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

31 1099 Forms

-

Form 1099-K (2021)

What is Form 1099-K?

A 1099-k IRS form is a way for the IRS to track income that comes through credit card and third-party network transactions. The form is used to report certain payment transactions to improve voluntary tax compliance.

Form 1099-K (2021)

What is Form 1099-K?

A 1099-k IRS form is a way for the IRS to track income that comes through credit card and third-party network transactions. The form is used to report certain payment transactions to improve voluntary tax compliance.

-

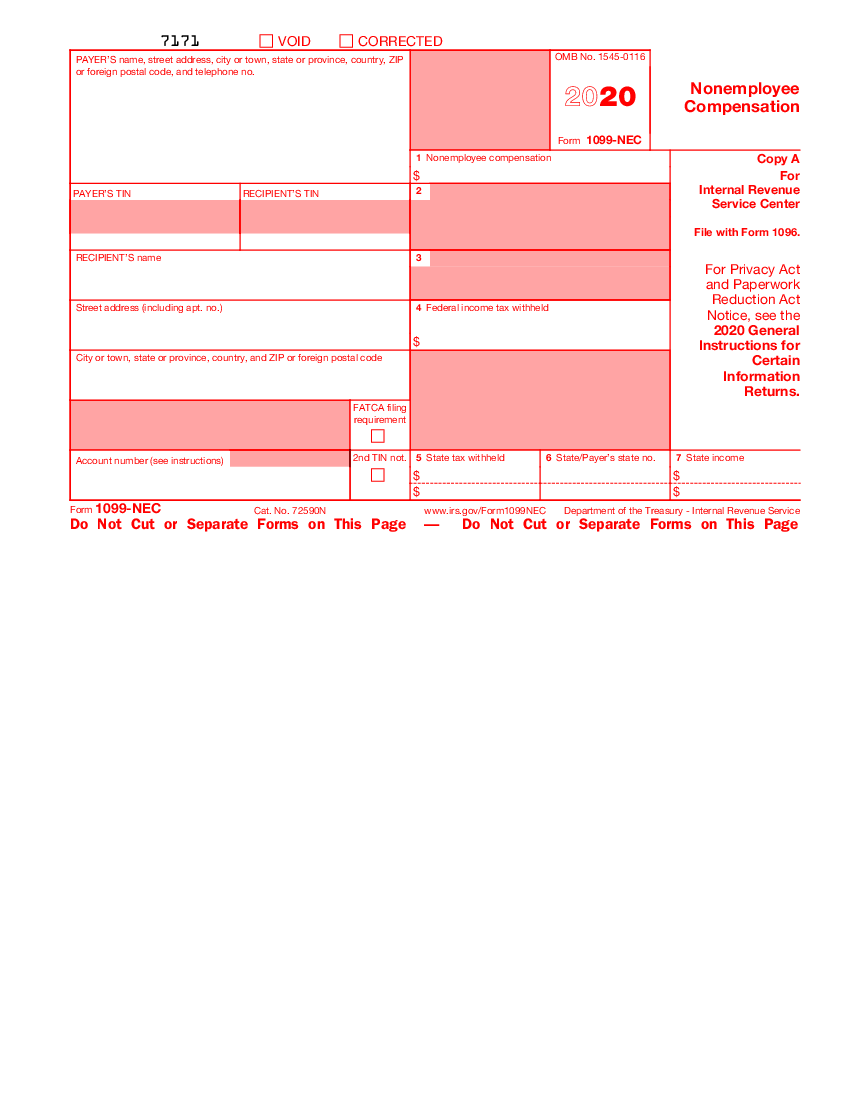

Form 1099-NEC (2020)

Overview of 2020 Form 1099 NEC

The Form 1099-NEC was brought back into use by the IRS for the tax year 2020 to separate non-employee compensation from the Form 1099-MISC. The blank 1099 NEC form 2020 printable is dedicated to reporting payments totaling $

Form 1099-NEC (2020)

Overview of 2020 Form 1099 NEC

The Form 1099-NEC was brought back into use by the IRS for the tax year 2020 to separate non-employee compensation from the Form 1099-MISC. The blank 1099 NEC form 2020 printable is dedicated to reporting payments totaling $

-

Form 1097-BTC

What Is IRS Form 1097 BTC (Bond Tax Credit)

IRS Form 1097 BTC reports the amount of bond tax credit a taxpayer is eligible to receive when they purchase qualified tax-exempt bonds. This credit reduces the amount of taxes owed on the bond income.

Form 1097-BTC

What Is IRS Form 1097 BTC (Bond Tax Credit)

IRS Form 1097 BTC reports the amount of bond tax credit a taxpayer is eligible to receive when they purchase qualified tax-exempt bonds. This credit reduces the amount of taxes owed on the bond income.

-

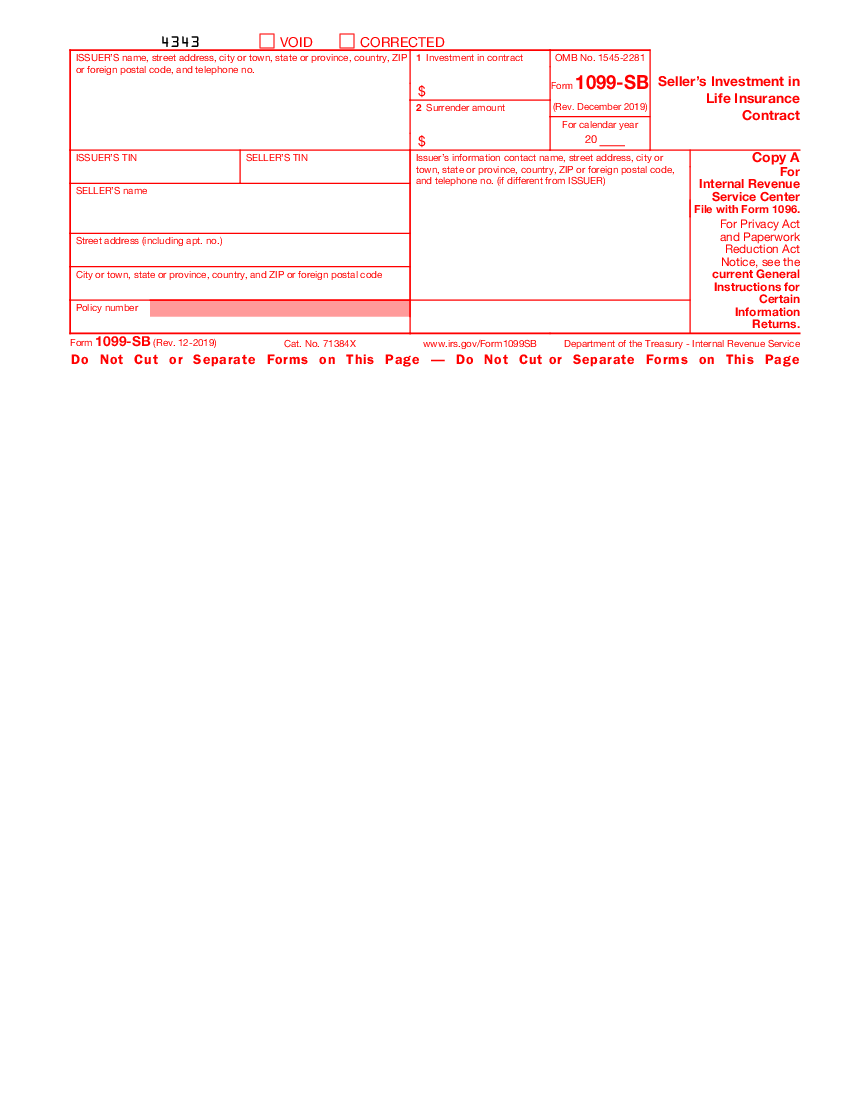

Form 1099-SB

What Is SB 1099 Form

The SB 1099 form is an important tax document issued by insurers under Section 6050Y of the Internal Revenue Code. It primarily deals with sellers' investments in life insurance contracts. This form reports the se

Form 1099-SB

What Is SB 1099 Form

The SB 1099 form is an important tax document issued by insurers under Section 6050Y of the Internal Revenue Code. It primarily deals with sellers' investments in life insurance contracts. This form reports the se

-

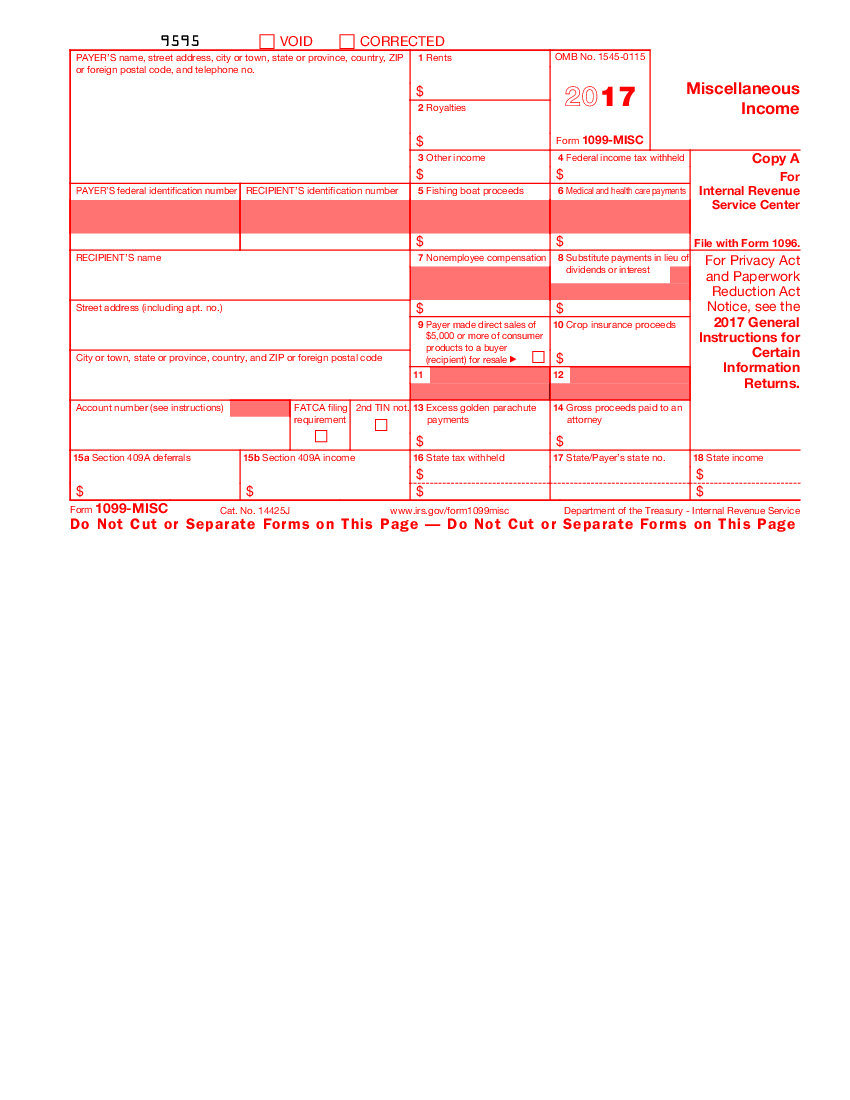

Form 1099-MISC (2017)

What is the 1099-MISC Form?

A 1099-MISC Form is a federal form that is filled by independent contractors to report about the number of received taxable payments from businesses and persons. This form is called to minimize underreporting of self-employed w

Form 1099-MISC (2017)

What is the 1099-MISC Form?

A 1099-MISC Form is a federal form that is filled by independent contractors to report about the number of received taxable payments from businesses and persons. This form is called to minimize underreporting of self-employed w

-

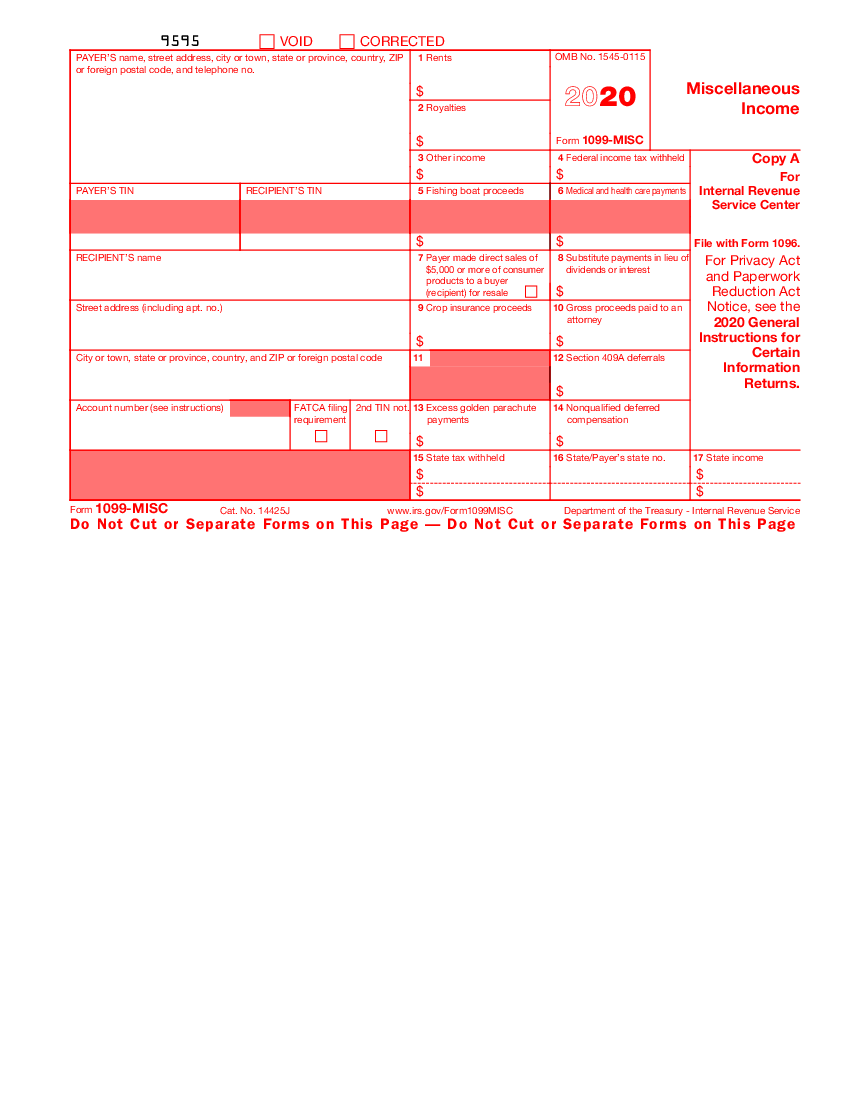

1099-MISC Form (2020)

What is 1099-MISC 2020 form?

The 1099-MISC form for 2020 is one of the types of forms that were created for US citizens to report about the incomes and expenses. It is necessary to define the level of taxes the individuals have to pay.

Wh

1099-MISC Form (2020)

What is 1099-MISC 2020 form?

The 1099-MISC form for 2020 is one of the types of forms that were created for US citizens to report about the incomes and expenses. It is necessary to define the level of taxes the individuals have to pay.

Wh

-

Form 1099-MISC (2021)

Form 1099-MISC (2021)

✓ Easily fill out and sign forms

✓ Download blank or editable online

Current Version

fillable Form 1099-MISC

Form 1099-MISC (2021)

Form 1099-MISC (2021)

✓ Easily fill out and sign forms

✓ Download blank or editable online

Current Version

fillable Form 1099-MISC

FAQ

-

What is the deadline for 1099 forms to be mailed?

Send the document to the recipient by January 31, 2022. Do it in a timely manner if you’re aimed at that ultimate blissful end-of-the-tax-season peace of mind.

-

Where can I get tax 1099 forms for independent contractors?

PDFLiner is the best place where all printable 1099 Form types are up for grabs absolutely free of charge. Beautifully pre-made and perfectly customizable, the templates we offer can be modified right here within our platform to suit your most sophisticated needs. Explore our service’s multiple features and see for yourself that they’ll easily streamline your document management possibilities while boosting your productivity in the mightiest way.

-

What forms does a 1099 employee fill out?

There’s a treasure trove of forms that employees need to fill out. Whether you’re looking for employee templates or 1099 independent contractor forms, PDFLiner is the answer. Do your best to save all information return forms you receive. Consult your tax preparer if you have any further questions on the topic.