-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

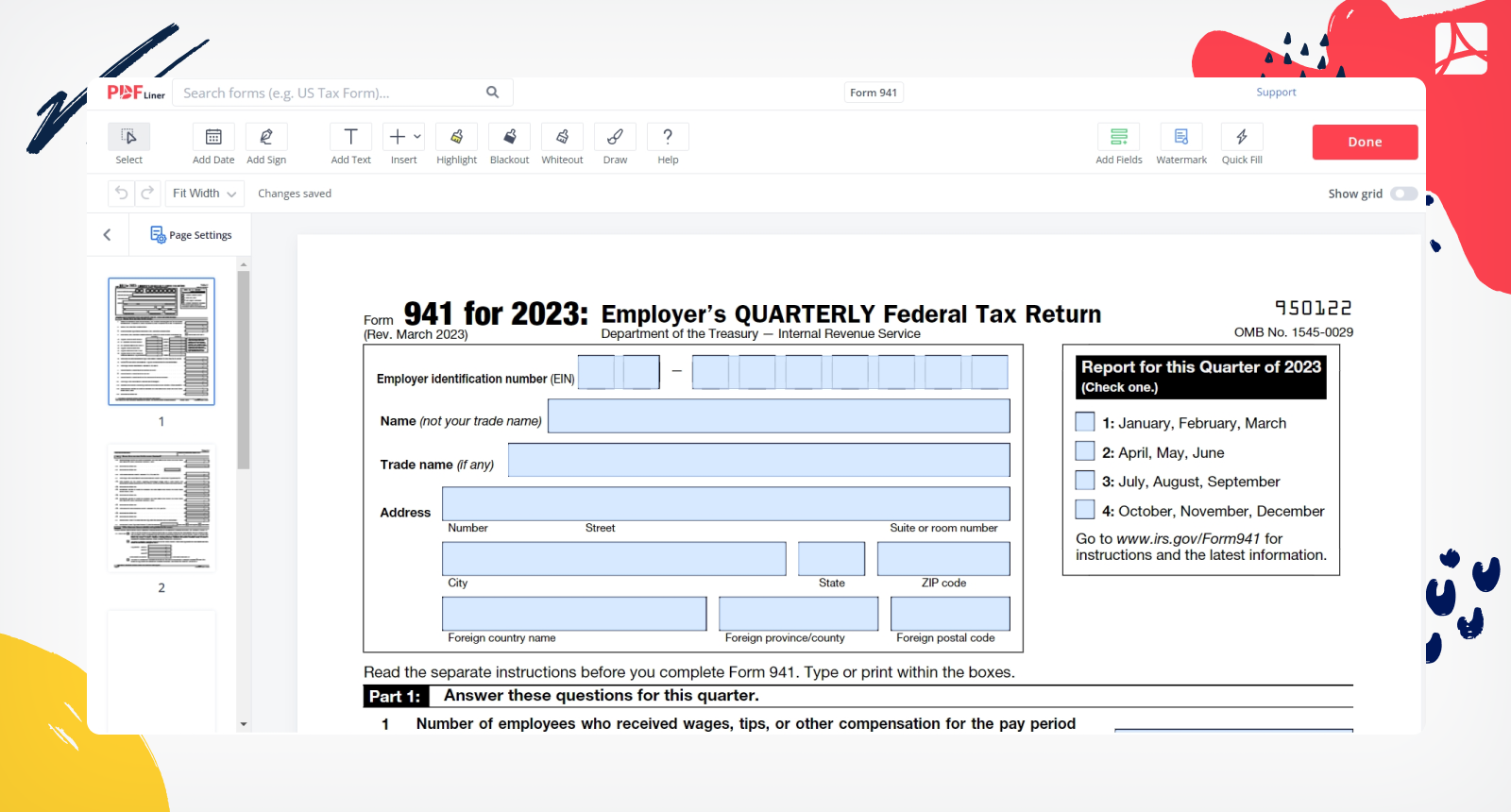

How to Get Form 941: What It Is and Who Needs It

When we talk about tax forms, one of the most commonly used ones is surely IRS form 941. This type of form is intended for reporting Social Security, income, and Medicare taxes that are withheld by employers from the paychecks of employees. If you wonder how to get form 941, you can learn more about this form and ways to download it for your personal use in this article.

How to Get Form 941

Form 941, otherwise referred to as Employer's Quarterly Tax Form is applicable to any employers and business owners who pay wages to their employees. Its purpose is to notify the IRS about any taxes withdrawn from the employee’s account and owed to the revenue service. It is important to note that this form needs to be filled out and mailed each quarter to the address that corresponds to your state.

You have an opportunity to download a copy of Form 941 from the IRS site or the PDFLiner platform. With the help of PDFLiner, you can edit the document using all the available online tools and thus correctly prepare the tax form for submission.

If you have no idea how to amend form 941 or even begin filling it out, here at PDFLiner we have a guide on how to fill out Form 941 with all the necessary recommendations that make this process much easier. You can follow our form 941 instructions step by step and be confident that you have done everything correctly.

FAQ

The following popular questions about the details of getting the 941 form and answers to them might make the process easier for you.

What is a 941 form?

To put it simply, it is a type of tax form that has to be filled out by the business owners if they have employees. As employers are responsible for withholding federal income tax from employees’ paychecks, this tax form is used for reporting tax withholding sums for Medicare and Social Security.

Where to mail form 941?

The address where you have to mail payroll form 941 is different depending on the state in which your business operates. It is possible to find out the exact address on the official IRS website.

When is form 941 due?

The form has to be submitted four times a year and usually by the last day of the quarter month. For instance, it is necessary to file form 941 by April 30 for the first quarter, which is January through March.

Who needs to file form 941?

Without considering exceptions, all business owners who have employees should file this form.

How often is form 941 filed?

The form is filled out four times a year, which is once for each quarter.

Fill Your Forms Online Quickly and Easily

Start e-filing your taxes today and save a significant amount of time!

.png)