-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

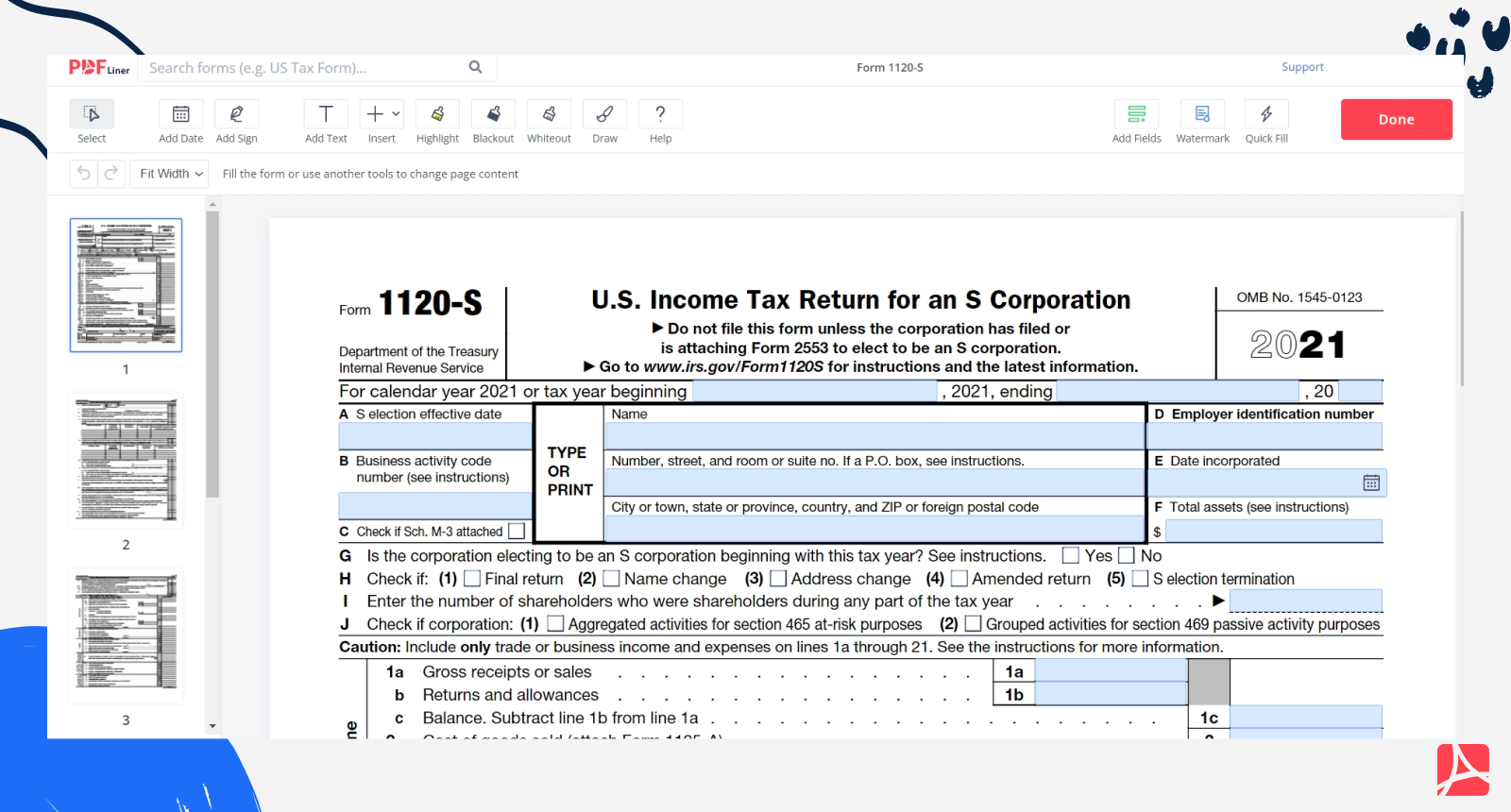

1120-S Instructions to Fill Out the Form Correctly

Form 1120-S is a tax return document for S corporations. It is used for reporting income, losses, and dividends. If the company filed Form 2553 and was elected as an S corporation, it should fill out the 1120-S Form. Here you will find a comprehensive guide on how to fill out this document in the right way. Nowadays, you can do it online and use an e-signature too.

What Is Form 1120-S

As noted before, the form 1120-S is designed for S-type corporations. The companies should fill out this form and send it to the IRS by the 1120-S filing deadline. The document should include the income and losses. This information will be used to count the owner’s personal income tax rate. S corporations don’t pay the corporate taxes; that’s why they should file the 1120-S tax form.

You should file the 1120-S form to report the percentage of the corporation, which is owned by the shareholders. It helps the IRS to indicate the tax payment and refunds for them. If you are in the initial stage and want to know how to get Form 1120-S, follow the guide on the PDFLiner website.

How to Fill Out Form 1120-S

This form consists of five pages and six schedules. Follow this step-by-step guide to file this document correctly.

Step 1: Indicate the corporation data

When proceeding to fill out the 1120-S form, you should write the tax period first. Then put your corporation name and address into the specific fields. This schedule also includes the S election effective date, business activity code number, employer identification number, and some other fields. You should answer four questions about the election or changes during this year.

Step 2: Fill out the income and other

The income field contains several points. Here you should indicate the gains and losses. At the end of this section, there is the line for the total income. It is counted, including all gains and losses throughout the year (it's lines 3 to 5 in the document).

The next section with 13 different points is for deductions. After you fill them out, you should add lines 7 through 19. The 20th field requires the total deductions amount. You have to indicate the ordinary business income too.

Besides income and deductions, there is a section for tax and payments. It is needed for defining the Amount owed and overpayment. To fill out these sections, you might require other Forms that are indicated in some lines.

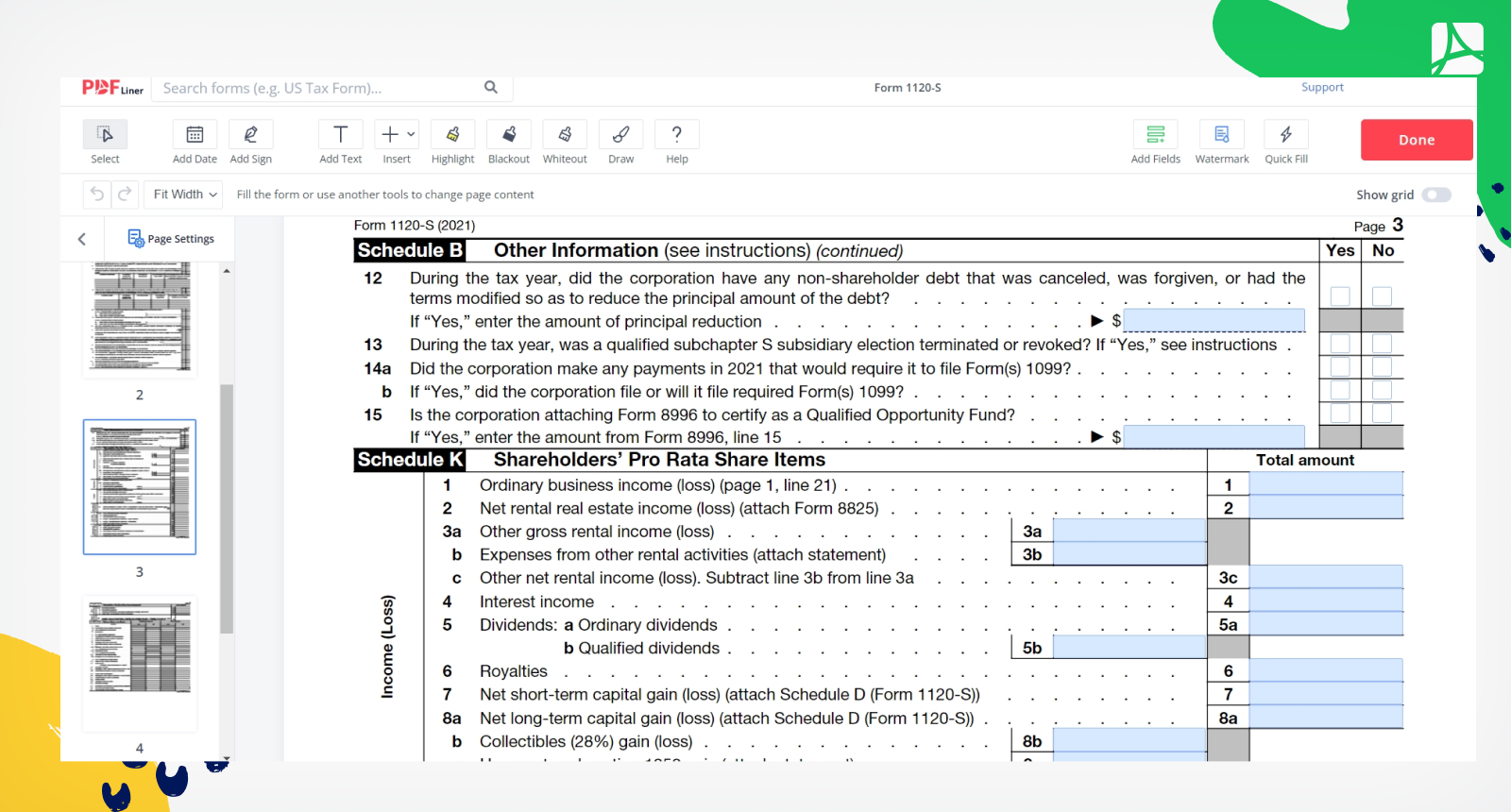

Step 3: Write Schedule B

This schedule includes the questions, which you will answer mostly yes or no. One of them might require you to attach Form 8990 if your corporation needs to file it. Also, if your company provided publicly offered debt instruments, you might have to file Form 8281. You can conveniently fill out all the forms in the versatile PDFLiner editor.

Step 4: Continue with Schedule K

In Schedule K, you should fill in the information about the shareholder’s share items. It includes income, losses, credits, deductions, and some other additional fields. You might need to attach other forms for some categories, which are indicated in the form. Fill out the income reconciliation at the end of this section.

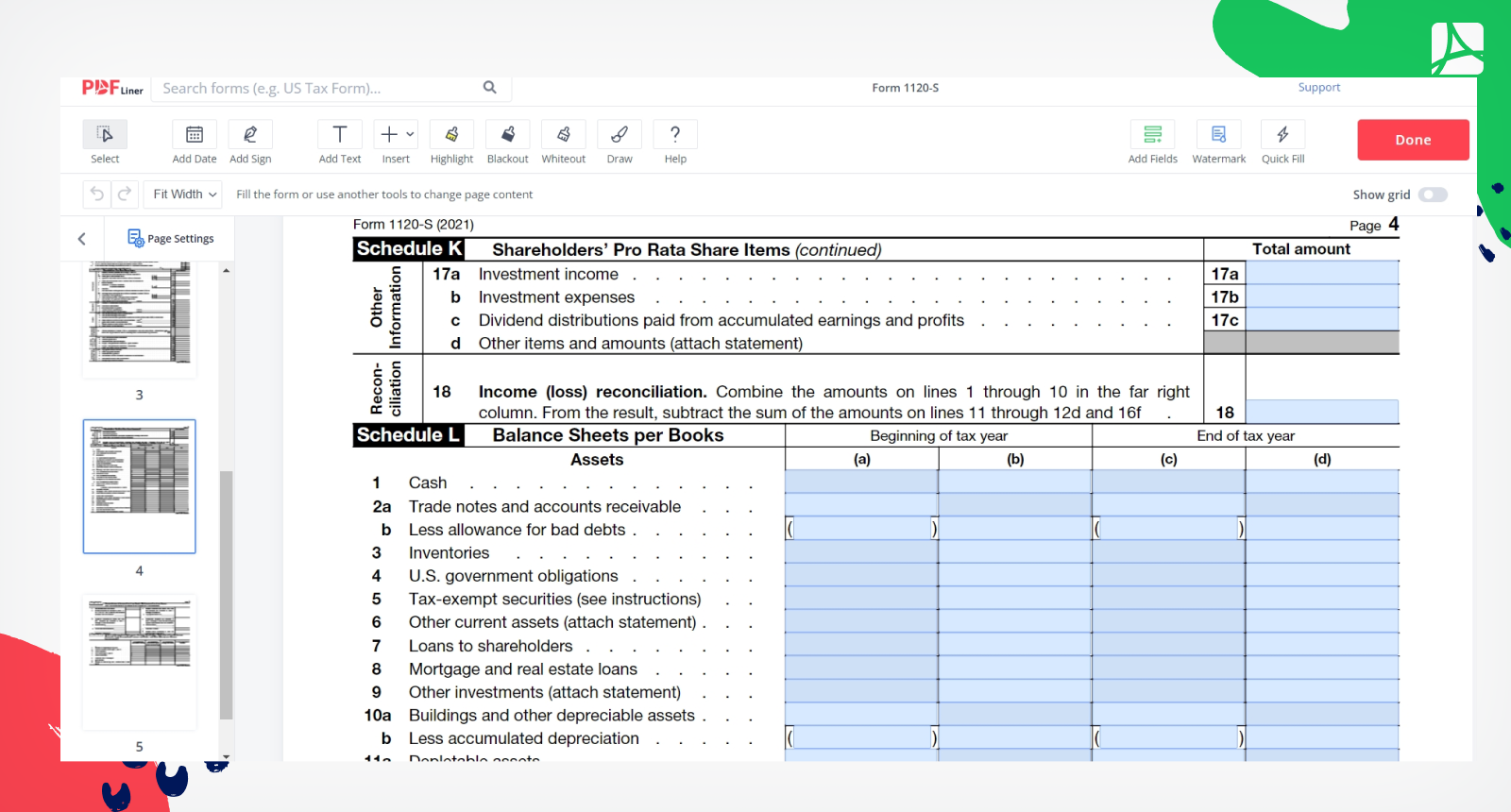

Step 5: Schedule L

The schedule L is named Balance Sheets per Books. It consists of the fields Assets and Liabilities and Shareholder’s Equity. In the first one, you have to count the total assets from the beginning of the tax year till the end. If you have the assets or investments that are not indicated in these sections, you should attach the statement about them.

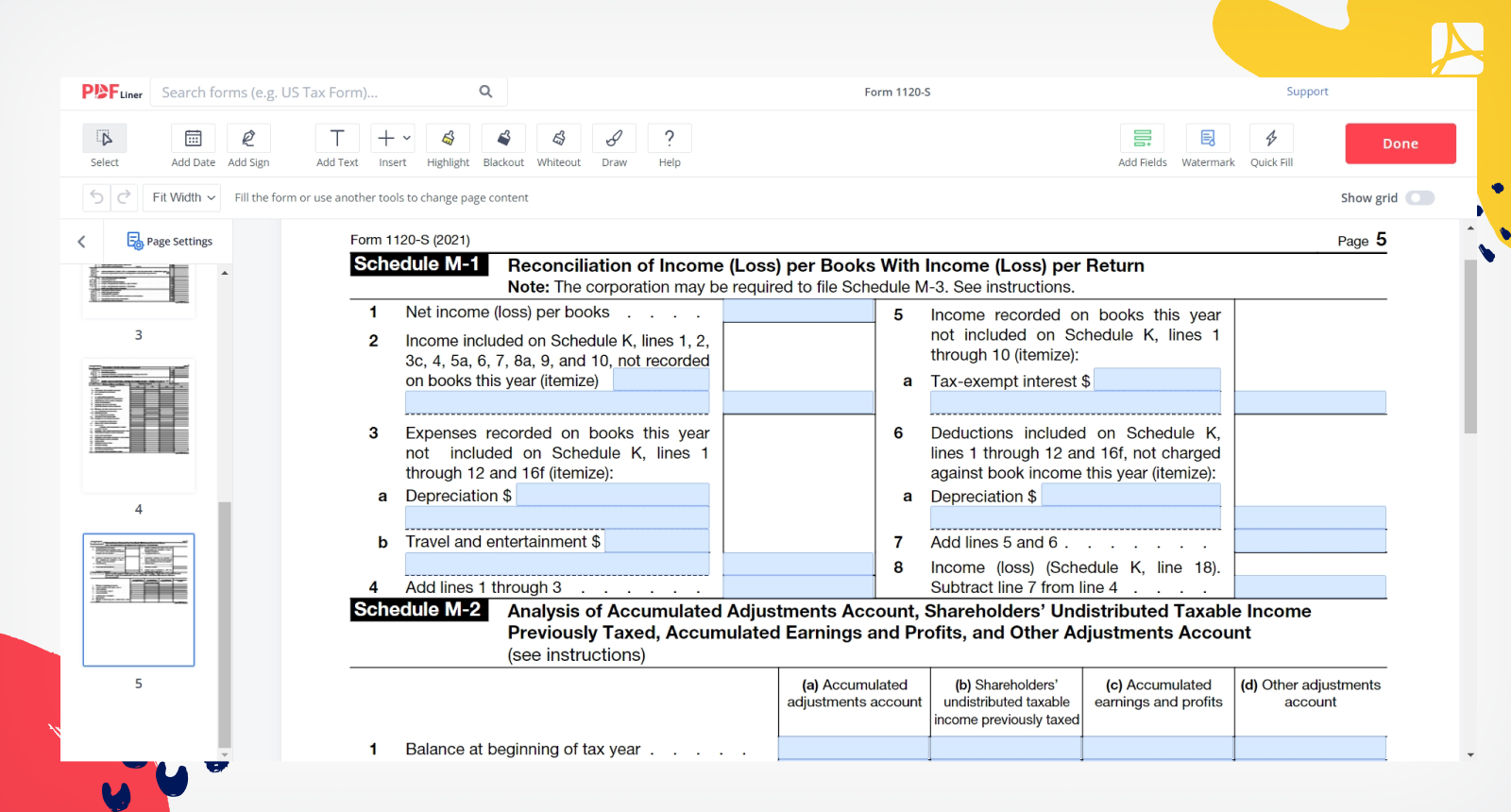

Step 6: Finish with Schedules M-1 and M-2

Schedule M-1 is intended for the reconciliation of book income with income per return. Here you need some information from Schedule K. Schedule M-2 is the analysis of all totals that you filled out in the 1120-S Form. The one for shareholders is counted separately.

Step 7: Sign the document

The last thing to do is to sign the Form itself. It’s better to complete it when all other sections are already filled and checked, and you are sure that there are no mistakes in the document. You can sign the 1120-S Form as well as the tax forms 1120 at the bottom of the first page.

How to Sign Form 1120-S

You can sign the Form with an old method by printing it out. However, the e-signature feature is available on PDFLiner. You just need to click on the signature field in the form and choose the way you want to create a signature. There are four methods to do this. You can draw a signature, upload it from your computer, or capture it with a web camera. Also, you may save the created signatures in your PDFLiner account. If you want to discover more about the e-signing feature of this document, check out the article about how to sign Form 1120-S on PDFLiner.

How Form 1120-S Has Changed

The IRS has changed the 1120-S Form in 2020. It has the same purpose as the previous version, but some new sections appeared because of the changes caused by Covid-19. For example, the form now includes the employee retention credit. New items G and H require the shareholder’s number of shares and loans from the shareholders. If your corporation made some charitable cash contributions, it should be indicated in the document too. More comprehensive 1120-S instructions are placed on the official IRS website.

FAQ

Check out these answers if you need additional info about the 1120-S form. You can start to work with it on the PDFLiner website in two clicks.

Can I file my own 1120-S?

You can download the 1120-S form from the IRS site or fill it out on PDFLiner. After you finish working with it, you should file it to the 1120-S mailing address that is indicated in the form.

What is ordinary business income on Form 1120-S?

This is the income that includes the total income and deductions without the references to shareholders. It should be filled out on the first page of Form 1120-S, and you will see the instructions there on how to count it.

Where do I report tax-exempt income on the 1120-S?

You should report this income in Schedule K. However, do not include it when you fill out lines 1a to 5. You should indicate it in line 16b.

Which sources of income are considered passive income per the 1120-S?

If you have the passive investment during the tax year, you can indicate it as a net excess passive income. However, there are some additional details, so you should check the expanded IRS 1120-S instructions on the IRS website.

.png)