-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

Estimated Tax Payments Addresses: Info for Filling Form 1040-ES

As well as filing your tax returns on time, the IRS also requires you to pay on time. Otherwise, you run the risk of a serious delay penalty. To prevent it from happening, you need to know the 1040-ES IRS payment address relevant to your state. In this article, you will find all the info you need to know on where to send the IRS payments and forms.

Mailing Address for Estimated Tax Payments

Form 1040-ES applies to all freelancers and self-employed people who should complete paperwork and pay taxes themselves. The specific IRS payment mailing address depends on your location, not on your profession or position. According to the current calendar year information, the tax office divides all states into three groups and gives each one a separate address.

So, you should send your payments to P.O. Box 931 100, Louisville, KY 40 293−1100 if you are in the following regions: Arkansas, Delaware, Connecticut, District of Columbia, Indiana, Illinois, Iowa, Kentucky, Maryland, Maine, Massachusetts, Missouri, Minnesota, New Jersey, New Hampshire, New York, Pennsylvania, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, and Wisconsin.

The second group includes Alabama, Georgia, Florida, Louisiana, North and South Carolinas, Mississippi, Texas, and Tennessee. The mailing address for 1040-ES for listed states is P.O. Box 1300, Charlotte, NC 28 201−1300.

At the third P.O. Box 802 502, Cincinnati, OH 45 280−2502 address should be sent payments of taxpayers in Arizona, Alaska, Colorado, California, Hawaii, Idaho, Michigan, Kansas, Montana, Nevada, Nebraska, New Mexico, Oregon, Ohio, North and South Dakotas, Washington, Utah, and Wyoming.

Several groups of citizens might have questions about where to mail federal estimated tax payments exactly. If you live in another territory possessed by the United States at the time of payment, use an APO or FPO address, are dual-status alien, file 2555 or 4563 Forms, you should use the P.O. Box 1303, Charlotte, NC 28 201−1303, USA.

In all cases, regardless of your address for the IRS estimated tax payments, the recipient should be the Internal Revenue Service.

How to Mail Form with PDFLiner

Now that you know where to send 1040-ES, it’s time to fill out and prepare the form for submission.

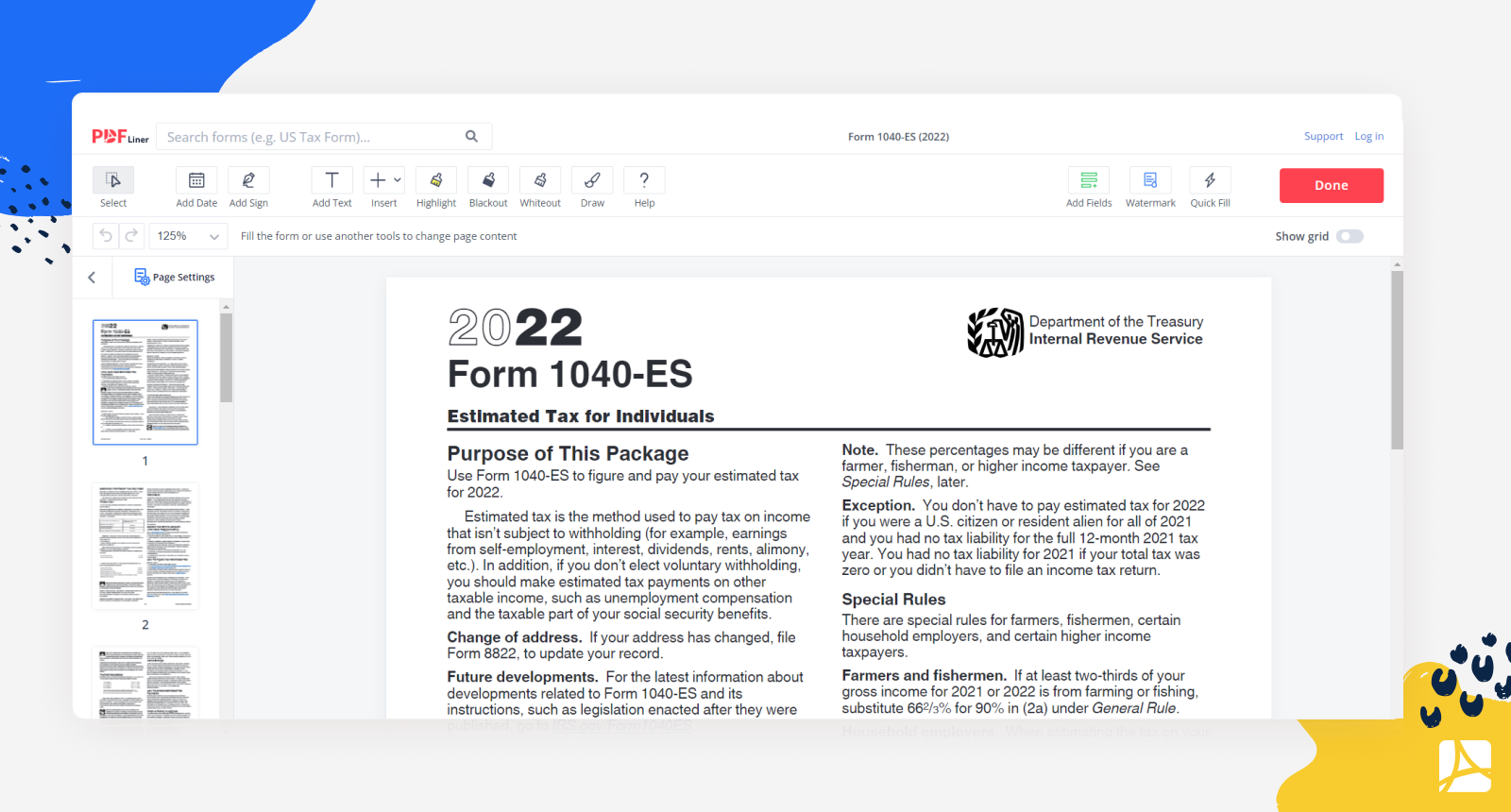

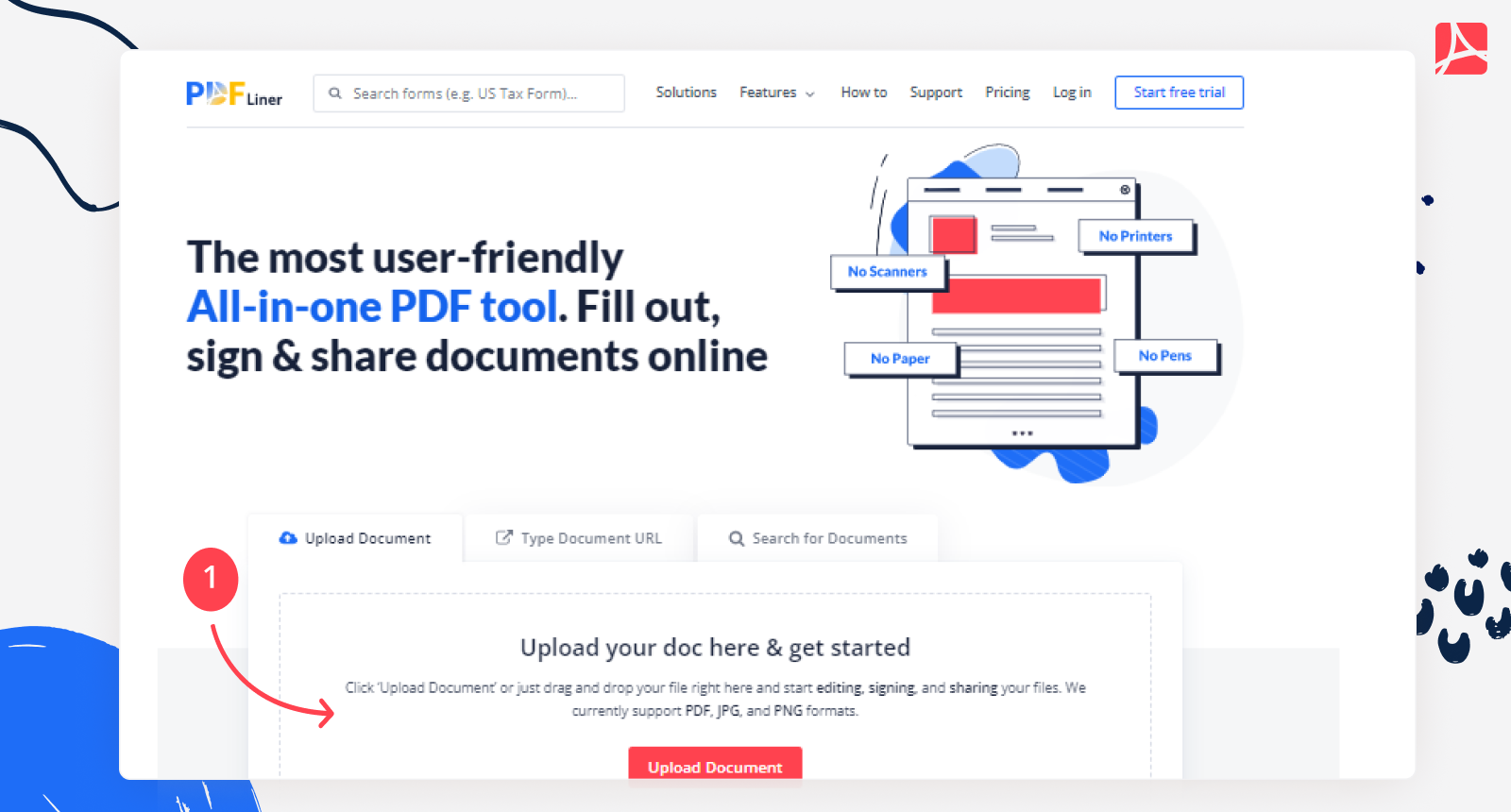

Step 1: Open the PDFLiner website and upload your file, or pick a fillable document from our library.

Step 2: After the editor is fully loaded, you can modify this and any other files as follows:

- Fill in text fields;

- Add or remove text parts;

- Highlight or hideout important fragments;

- Add images and pictures by hand;

- Date and sign.

.png)

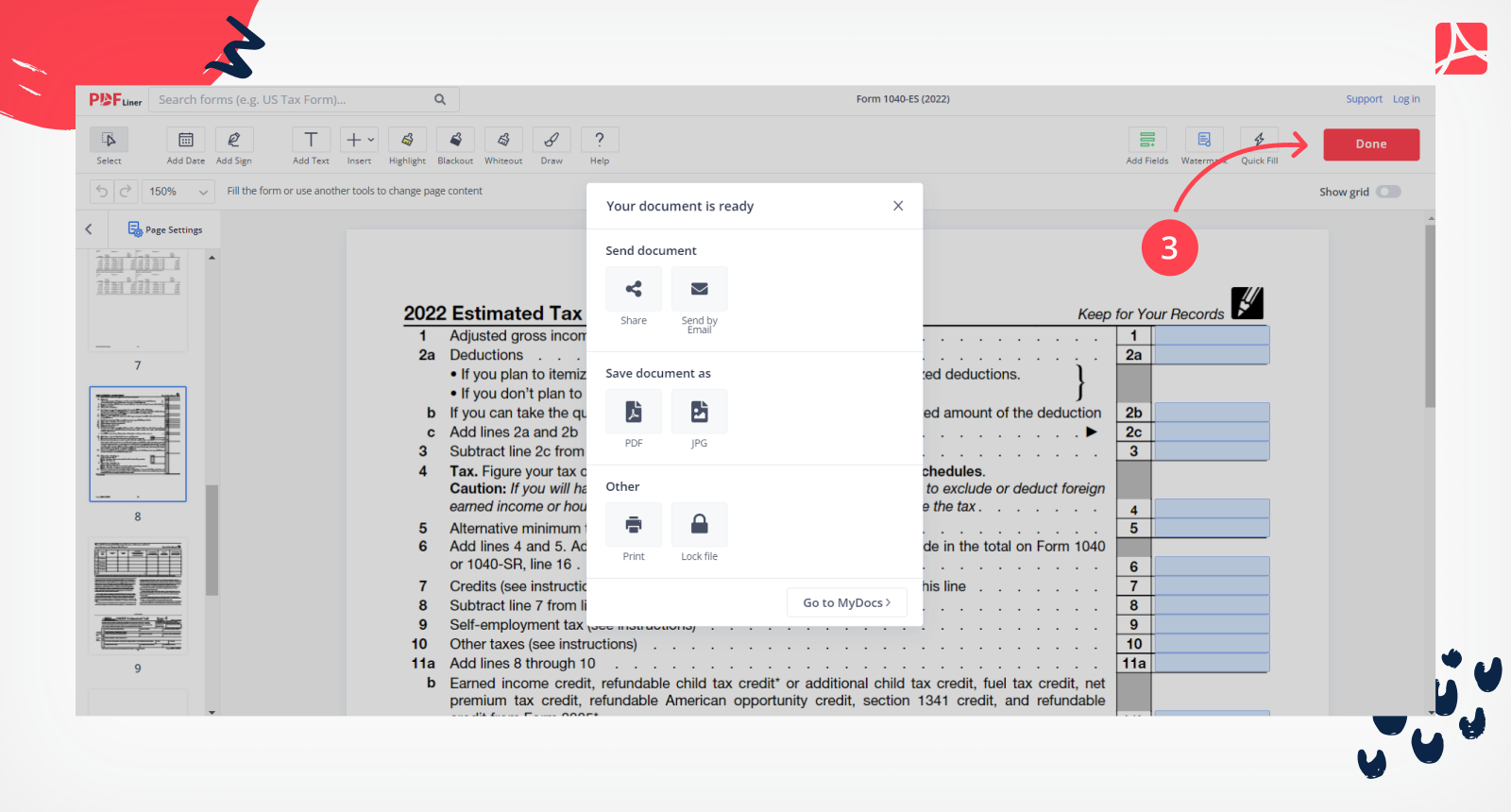

Step 3: When finished, click the "Done" button and print the form. Check which 1040-ES payment address is right for you and send the document to the tax office.

What Else Can I Do with PDFLiner?

The PDFLiner editor has extensive tools necessary for working with text files, primarily with fillable tax forms. Using our platform, you can fill out, edit, annotate documents, and share them. If necessary, you can insert additional text fields, make special notes, hide or highlight text parts, add pictures, photos, and even hand-drawn doodles, put the sign and date.

The finished document can be sent by email, saved to your device or in the cloud storage, printed, or converted to another format. You can also share the file with colleagues using a link and password-protect it so that no one can change it.

FAQ

Should I send estimated tax payments certified mail?

It is optional, but it is recommended by many experts. So you can track the delivery of the mail and get a notification when it is delivered and received by the agency.

How do I pay the IRS by mail?

When you know where to mail estimated tax payments, you can send a money order or check. Make sure your papers are payable to the U.S. Treasury.

How do I know if my taxes were received by mail?

If you use the correct address to mail estimated federal tax payments, you may get a written confirmation when your funds are received. It could be done if they were sent via priority mail or certified return receipt.

Fill Out Tax Forms At No Time with PDFLiner

Start filing your taxes electronically today and save loads of time!

.png)