-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

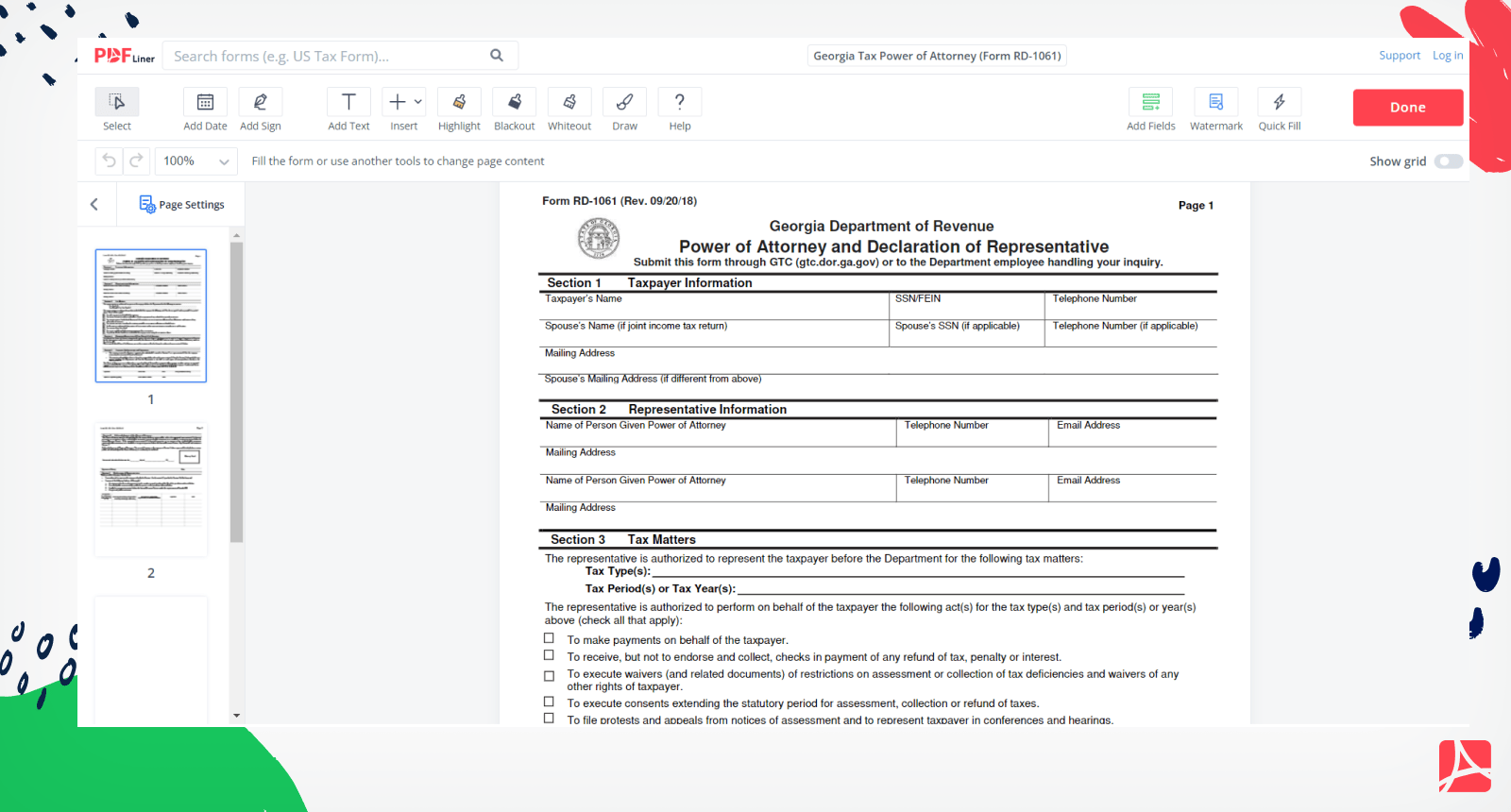

Georgia Tax Power of Attorney (Form RD-1061)

Get your Georgia Tax Power of Attorney (Form RD-1061) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What Is a Georgia Tax Power of Attorney?

A Georgia Tax Power of Attorney (Form RD-1061) is a legal document that allows a person or entity to appoint an agent or representative to act on their behalf regarding tax matters with the Georgia Department of Revenue. This form grants authority to the agent to access confidential tax information, communicate with the department, sign and file tax returns, and make payments or receive refunds.

How To Fill Out the Georgia Tax Power of Attorney (Form RD-1061) Online

Filling out the Georgia power of attorney form Rd 1061 online on the PDFliner website is a simple and easy process. Follow the Georgia form RD 1061 instructions below:

- Access the PDFliner website and search for the Georgia form rd 1061.

- Click on the form and start filling it out online. You can save your progress at any time and come back to it later.

- Provide the taxpayer's name, address, Social Security Number (SSN), and daytime phone number.

- Enter the agent's name, address, SSN, and daytime phone number.

- Specify the tax matters for which the agent is authorized to act. You can choose all tax matters, specific tax periods, or limited tax matters.

- Sign and date the form. If the taxpayer is a business entity, an authorized representative must sign and date the form.

- Submit the completed form online, print it out, or download it in PDF format.

What Should the Georgia Power of Attorney Tax Form Include

The Georgia Tax Power of Attorney (Form RD-1061) should include the following information:

- The taxpayer's full name, address, SSN, and daytime phone number.

- The agent's full name, address, SSN, and daytime phone number.

- The tax matters for which the agent is authorized to act, such as filing returns, making payments, and receiving refunds.

- The tax periods or years for which the agent is authorized to act.

- The duration of a power of attorney, which can be for a specific period or until revoked.

- The signatures and dates of both the taxpayer and the agent or the authorized representative of a business entity.

When to Request the Georgia Power of Attorney Tax Form

You may need to request the Rd-1061 form in the following situations:

- If you want someone else to handle your Georgia tax matters on your behalf, such as filing your tax returns, making payments, or responding to any notices or audits from the Georgia Department of Revenue.

- If you are unable to handle your tax matters personally, perhaps due to illness, disability, or absence from the state.

- If you are a business owner or representative, and you want someone else to handle your business's tax matters, such as filing sales tax returns or responding to audits.

- If you are an executor, administrator, or trustee of an estate or trust, and you need to handle the estate or trust's tax matters.

- If you are an attorney, accountant, or another professional who needs to represent a client in Georgia tax matters.

- In any of these situations, you can use Form RD-1061 to designate someone else as your representative before the Georgia Department of Revenue. This form authorizes your representative to act on your behalf and access your tax information.

Where to File Form RD-1061?

You can file Form RD-1061, the Georgia Tax Power of Attorney, in one of the following ways:

- Georgia Tax Center: You can file the form electronically through the Georgia Tax Center (GTC) system. You will need to create an account on GTC to file online.

- Online: You may visit the PDFliner website and fill out this form for free.

- Mail: You can mail the completed form to the Georgia Department of Revenue at the address provided on the form. Make sure to include any required attachments, such as a copy of your driver's license or other identification.

- Fax: You can fax the completed form to the Georgia Department of Revenue at the number provided on the form. Again, make sure to include any required attachments.

Fillable online Georgia Tax Power of Attorney (Form RD-1061)