-

Templates

Tax FormsFillable tax forms simplify and speed up your tax filing process and aid with recordkeeping.Explore all templatesReal EstateReal estate templates for all cases, from sale to rentals, save you a lot of time and effort.Explore all templatesInsuranceInsurance templates make it easier for agents to manage policies and claims.Explore all templatesLegalLegal templates provide a structured foundation for creating legally binding documents.Explore all templatesMedicalMedical forms help you keep patient documentation organized and secure.Explore all templatesBill of SaleBill of Sale templates streamline the transfer of ownership with clarity and protection.Explore all templatesContractsVarious contract templates ensure efficient and clear legal transactions.Explore all templatesEducationEducational forms and templates enhance the learning experience and student management.Explore all templates

-

Features

FeaturesThe all-in-one document management system has all the features you need to safely and efficiently handle your PDFs. Dive in, learn how to use all the tools, and become a PDF pro.Explore all featuresShare PDF Check out the featureWith the help of PDFliner you can share your PDF files by email or via the link as soon as you have edited, filled, or signed them online.Sign PDF Check out the featurePDFLiner gives the opportunity to sign documents online, save them, send at once by email or print. Register now, upload your document and e-sign it onlineFill Out PDF Check out the featurePDFLiner provides different tools for filling in PDF forms. All you need is to register, upload the necessary document and start filling it out.Draw on a PDF Check out the featureDraw lines, circles, and other drawings on PDF using tools of PDFLiner online. Streamline your document editing process, speeding up your productivity

- Solutions

- Features

- Blog

- Support

- Pricing

- Log in

- Sign Up

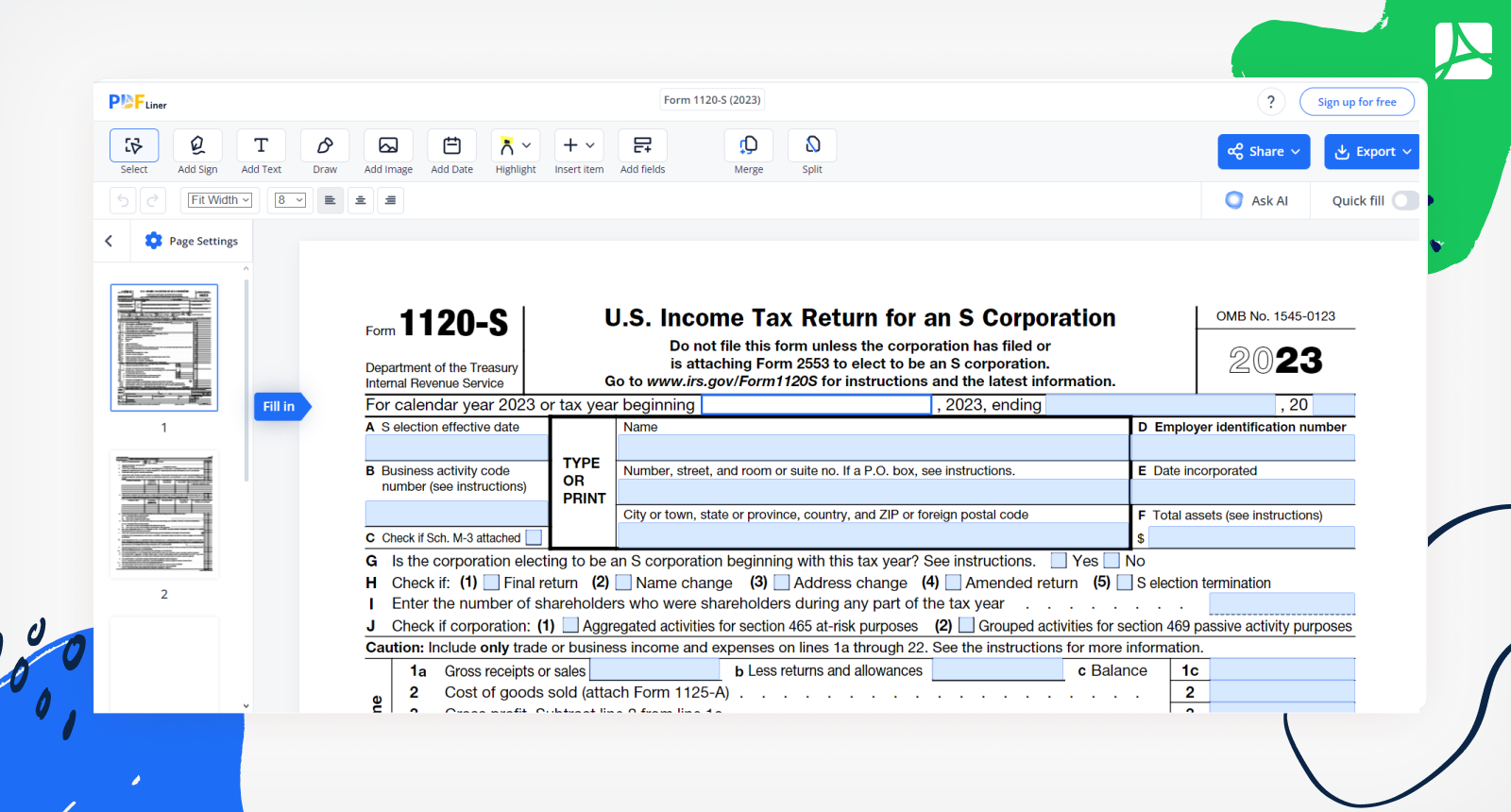

Form 1120-S (2023)

Get your Form 1120-S (2023) in 3 easy steps

-

01 Fill and edit template

-

02 Sign it online

-

03 Export or print immediately

What is IRS Form 1120S?

IRS 1120S is the form created by the Internal Revenue Service for S corporations as an income tax return yearly report. S corporations are business structures that were made the way their owners can avoid double taxation. Each shareholder of such companies must fill out income tax return documents on their own and pay taxes for this business as well.

What I need the IRS 1120 S for?

You need IRS 1120S form if you are an owner of S corporation type business and you have to report on:

- Company’s income;

- Business gains during the year;

- Losses that business may face;

- Deductions;

- Credits the company is involved in.

The fillable IRS 1120S form is handy when it comes to the yearly report over taxes the business has to pay to the US. The form must be accompanied by B, K, and L forms. They are required for the IRS report. However, the number of attached documents may vary depending on the requirements of the IRS.

Filling out Tax Return Form 1120-S

You have to send the IRS 1120S form to IRS until the 15th day of the 3rd month of the year. Yet, you can extend the deadline depending on the circumstances. The form requires your complete attention. You have to provide the information on the company’s income, tax, payments, deductions, etc. There are 5 pages in the form.

Organizations that work with tax forms 1120S

Department of the Treasury Internal Revenue Service.

Related to IRS 1120 S Form Documents

- Fillable Form 1120

- IRS Form 1120 F

- Fillable Schedule K-1 (Form 1120-S)

- Fillable 1120-W

- 1040 NR tax forms

1120-S Form Resources

How to Fill Out 1120S?

- Click the Fill Out Form button to open the fillable form;

- Start with the 1st page: company’s name and address, phone, income, deductions, tax, and payments;

- 2nd page offers you to provide Other information, including accounting methods;

- On the 3rd page you can find Shareholder’s Pro Rata Share Items with Foreign transactions, income, credits and deductions specifications;

- Page 4 continues the table from page 3, and adds Balance Sheets per Books lines;

- The 5th page is about Reconciliation of Income per Books With Income per Return and Analysis of Account.

Form Versions

2020

Form 1120-S for 2020 tax year

2021

Form 1120-S for 2021 tax year

2022

Form 1120-S for 2022 tax year

FAQ: 1120-S Form Popular Questions

-

How to amend form 1120-S?

To amend a filed Form 1120-S, you should check box H on page 1 and file a corrected Form 1120-S. You should also attach:

- Explanation for every change that you would like to make.

- Statement that identifies the line number of each amended item.

- Corrected amount or treatment of the item.

-

How is form 1120 different from form 1120-S?

The difference is pretty simple. Form 1120 - Corporation Income Tax Return should be filed by C Corps to report federal taxes. Form 1120-S should be used by S Corps.

-

When are 1120 forms due?

The 1120 tax forms deadline is usually on April 15 or April 18 as it was this year. Nevertheless, corporations with a fiscal tax year that ends on June 30 should file the form by March 15.

-

Where can I find 1120 forms?

You can find the forms 1120 and 1120-S on the official IRS website or here on PDFLiner. Simply enter the name of the form in search bar and click a blue button next to the form that you'd like to fill.

Fillable online Form 1120-S (2023)